- Total VoD category monthly spending rose to an average of $50 per household in Q4, up 16% from the previous year, due to the price hikes implemented by every major service in the last 12 months.

- Prime Video won the highest number of new subscriptions for Q4, aided by festive seasonality, as an increasing number of consumers utilised the Amazon Prime delivery service.

- Paramount+ climbed to become the second most popular service for new subscribers in Q4, with Black Friday promotions pulling consumers in.

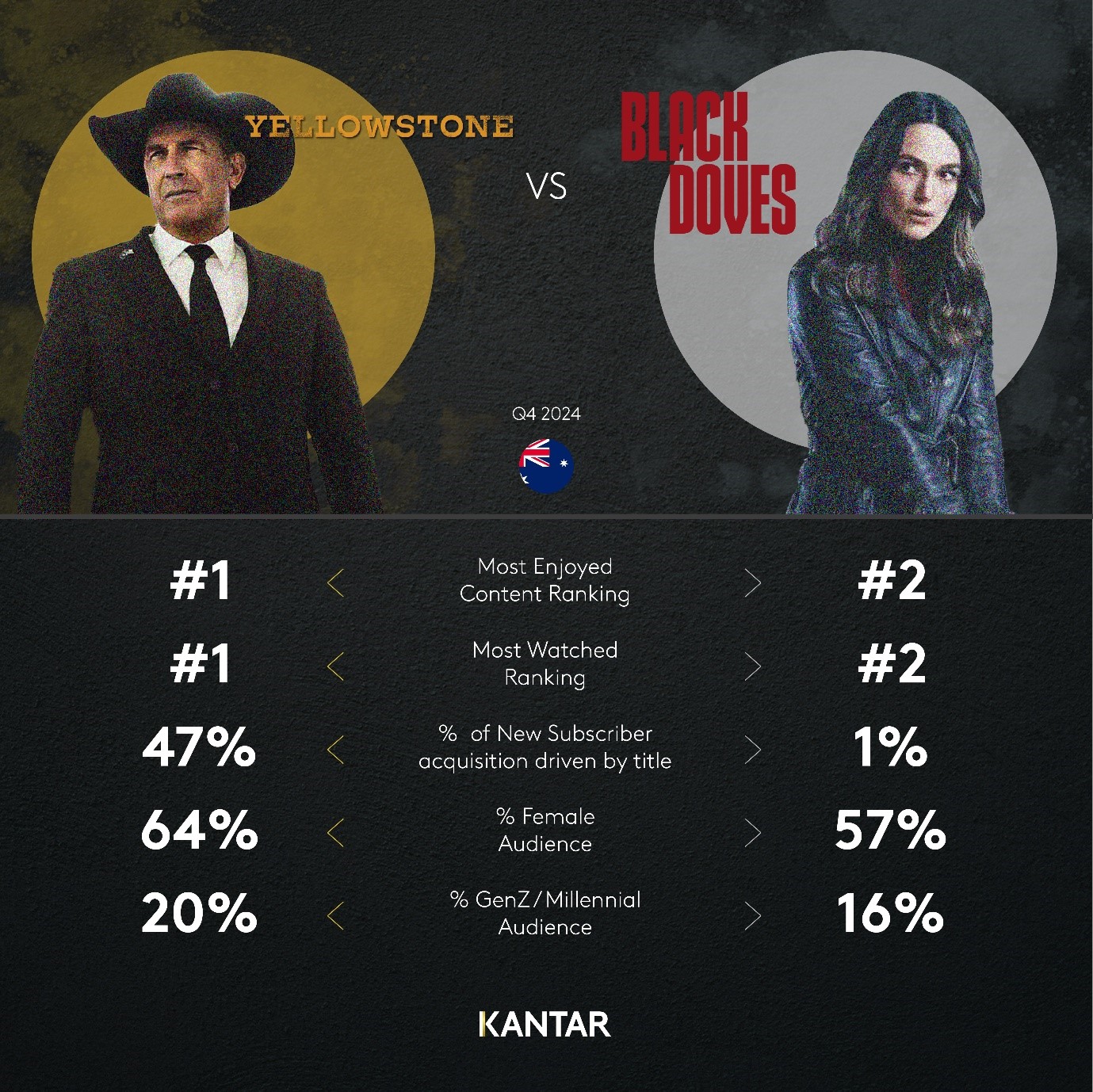

- Stan’s Yellowstone was the most enjoyed and viewed title in Q4 after new episodes aired in November and December. Netflix’s Christmas spy thriller Black Doves took the second spot for the most enjoyed and viewed title.

- Binge grew its total subscribers quarter-on-quarter, rising to fourth place in share of new subscriptions ahead of DAZN’s acquisition of Foxtel later this year. Foxtel’s Kayo was weaker for new subscriptions in Q4; however it has performed well over the longer term, growing total subscribers by +16% year-on-year.

- The total VoD market remains solid, with just over three quarters of Australian households holding at least one subscription – staying flat quarter-on-quarter, but up +2ppts year-on-year.

- However, those subscribing to a premium ad-free (SVoD) service has declined, down -3ppts year-on-year to 68%, as consumers shift to ad-supported (AVoD) options, which have now been adopted by 28% of households.

- Free Ad-Supported Streaming Television (FAST) continues to grow, with a net increase of 500k households year-on-year and penetration reaching 11% of all households.

VoD category spend grows, as subscription prices continue to creep up

The average monthly spend for an Aussie household on VoD subscriptions has blown out to $50 for Q4, up from $43 the previous year. This comes as every major service imposed some form of price rise on customers in 2024, following several increases in 2023. Providers are looking to cover increasing production and operational costs to turn around loss-making businesses, with only a handful having been able to generate a profit in recent years.

There is also a need for services to make their relatively new ad-supported plans look attractive against premium options. Taking Netflix as an example, its recent premium plan bump from $22.99 a month to $25.99 a month in May 2024 makes the cost of this option three times that of a Standard with ads plan ($7.99/month). Even a Standard ad-free plan commands an additional $11, making the ad-supported option a more attractive proposition to consumers, who have had to endure long term cost-of-living pressures.

Despite a shift to lower cost AVoD plans, household VoD spend has continued to balloon as the average number of services held has inched up to 3.2 from 3.0 last year. This, coupled with a growing population, has resulted in the total number of subscriptions held rising by 1.5 million year-on-year, to 25.2 million. Total VoD category spend for October to December 2024 equated to $1.2 billion, up nearly $0.2 billion on Q4 2023, suggesting the gamble of raising prices has paid off for most services.

Yellowstone returns to top the content charts in a welcome boost for Stan

In Q4 Yellowstone finally returned with Season 5 Part 2, after a ‘midseason break’ of almost two years, partly due to the Hollywood strikes in 2023. Undeterred by the long wait, fans held out for the final six episodes, streaming in droves to make it the most viewed and enjoyed title of Q4. Yellowstone’s audience tends to be older, comprised primarily of ages north of 45, with 65+ year olds making up the largest proportion, a demographic typically underrepresented among streamers. Yellowstone’s popularity among over 65s has helped Stan unlock growth among the demographic, growing subscribers by +24% year-on-year for the age group.

The Yellowstone premiere helped Stan attract new customers from various demographics in Q4, driving nearly half of all new Stan subscribers who signed up for specific content. This helped propel Stan to 11% of ad-free SVoD new subscriptions, second only to Disney+. However, the lack of an ad-supported plan means Stan is potentially missing out on the 24% of total new subscriptions that Aussies took out in Q4 on a cheaper plan with ads. And with Stan’s churn stubborn at around 14% for the past few quarters, subscriber numbers have fallen flat, with total share tapering off to 23% of VoD households, down from 24% the previous year.

Despite the success of Yellowstone, NPS for Stan remained flat quarter-on-quarter at 12ppts, with net satisfaction with perceived value for money sitting -2ppts below average at 19ppts and down compared to the previous year. This may be attributed to its cheapest plan coming in at $12 per month – meanwhile most competitors offer a sub $10 ad-supported option. With the upcoming launch of ads on Stan Sport in 2025, this could pave the way for the eventual addition of an ad tier on the main service in the not-too-distant future.

Ahead of Foxtel sale, Kayo and Binge hold their own in competitive streaming market

2025 will bring major upheaval for Kayo and Binge, as DAZN’s acquisition of Foxtel finalises and HBO brings its Max service to Australian shores, having previously licenced content exclusively to Foxtel.

Kayo had a weaker Q4, as its new subscriber share declined year-on-year. This was no doubt impacted by full cricket streaming rights being available on BVoD for the first time via 7Plus, which grew weekly viewership to 28% of all households – an increase of 250k compared to the previous year. However, Kayo’s strong customer acquisition over the course of 2024 resulted in its share rising to 17% from 15% in 2023 among households with at least one VoD service. Its local rivals Optus Sport and Stan Sport trail well behind, with shares of 8% and 5% respectively. However, Kayo’s dominance of sports rights could be chipped away at, with Disney potentially shifting ESPN content away from Kayo to its own Disney+ service, having added ESPN+ as a bundle option to the app for its US subscribers in December last year.

Foxtel’s other main streaming service, Binge, enjoyed greater success in adding new subscribers during Q4, with its share rising +3ppts to 10% of new subscriptions in the quarter. Binge’s growth can be attributed to an above average proportion of new subscribers having been offered a promotion (such as the Black Friday $2/month Basic with ads deal) and a growing proportion being handed a 7-day free trial. Such offers no doubt aided conversion, with 27% stating value for money as a driver to signing up, rising to 36% among AVoD subscribers, 11ppts higher than the average. Specific content remains the top subscription driver for Binge at 37% of all new customers, above its key competitors. However, a factor that will pose a risk to Binge ahead of HBO Max’s launch is that the number one title signed up for across the last eight quarters has been an HBO production, with House of the Dragon top for the last three quarters.

Access the interactive data visualisation tool for more information and contact our experts.