Worldpanel ComTech team has predicted five key consumer technology trends to watch in 2024. These include an upsurge in consumer confidence, a flood of AI-fuelled software innovations, a rise in the popularity of refurbished devices, fierce competition from new players, and a continued yet slow uptake of foldable phones.

The trends have been identified based on a detailed analysis of consumer behaviour in six technology categories across 20 global markets. This understanding has enabled Worldpanel to predict how attitudes and behaviour will change in the coming year, and the impact that this will have on the industry.

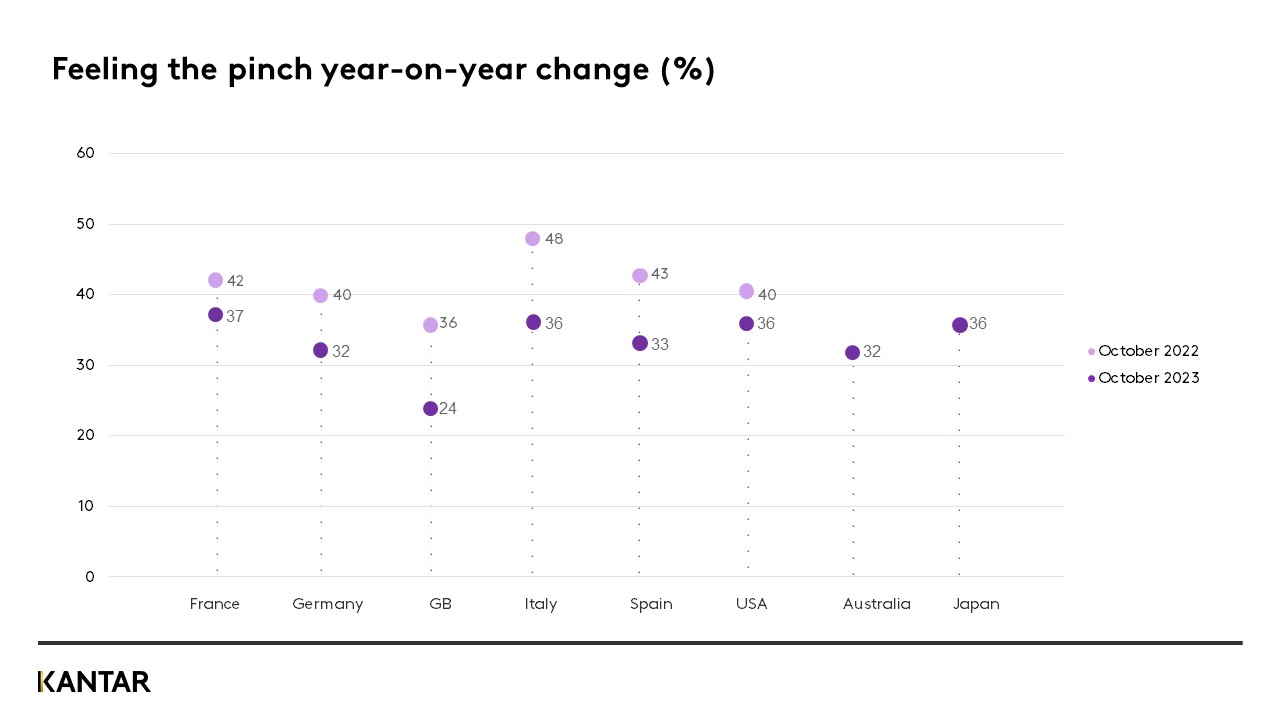

1. Consumers' inflation concern will fall as higher costs are normalised

Inflation-battered shoppers will begin to experience respite from rising rates, inflation will fall, interest rates will level off. However, consumers will not readily shrug off high interest rates, reduced household savings and rising credit-card defaults. Consumer spending will likely remain flat/down on the previous year.

A smaller proportion of the global population are ‘Feeling the Pinch’ – the individuals hit hardest by the effects of inflation. Consumers who are less impacted by inflationary pressures conduct less research before buying their phone, in part due to stronger personal finances, which lowers perceived risk when making a purchase. The research that they do differs greatly compared to their financially constrained counterparts. This indicates that as inflationary pressures normalise, we should expect to see an upheaval in the way that consumers purchase their phones.

2. AI will accelerate software innovation

AI breakthroughs will fuel the development of a raft of new device features, and consumer tech manufacturers will talk much more about their software capabilities. As hardware innovation stutters, ‘halo’ software features, powered by AI, will be developed and implemented to drive sales.

For many years, Apple has successfully marketed its unique operating system features – think FaceTime, ApplePay and iMessage – drawing consumers into its hardware. Its competitors have followed suit. Google Pixel has embedded AI capabilities into its devices with impressive results – particularly photo editing capabilities that allow users to erase, move, and swap items in a picture.

Consumers are responding positively: Apple and Google Pixel buyers seek ‘unique operating features’ in their devices to a much higher extent than the market average (+170/+136 over-index).

3. Consumers will buy more refurbished phones

Refurbished and used phones will jump in popularity in 2024 as consumers look for ways to reduce spending and exhibit more sustainable behaviours. Ownership volumes have increased +70% over the past two years. 14% of Smartphones sold over the 2024 Christmas period will be refurbished/used across the European 5 markets.

This will drive the trade-in market, with retailers and manufacturers competing to offer consumers greater value for their old devices to incentivise sales. Apple and Samsung will bolster their direct refurbished offering, aiming to steal share from third-party retailers Back Market, eBay, and Amazon which currently hold the majority share.

The smartphone industry made healthy progress on sustainability in 2023. Apple ditched the Lightning Cable for USB-C. Google committed to seven years of software updates in its latest Pixel 8 series. Samsung used recycled materials in twelve components of its S23.

Manufacturers’ climate promise deadlines will inch nearer in 2024. Apple and Google pledge net zero emissions by 2030, Samsung 2050. More recycled materials will be used – Samsung currently uses recycled fishing nets and PET bottles in its plastic, Apple’s iPhone 15 range uses 100% recycled cobalt in its batteries. Under governmental pressure, the ease of repairing a phone will improve. While consumers don’t currently prioritise these areas – with only 1% seeking them as a feature – this will increase in the coming year.

4. Samsung and Apple will face fierce rivalry

Samsung and Apple will remain the largest smartphone companies, but they will face increased competition from the likes of Huawei, Xiaomi, Google, and Transsion (a Chinese manufacturer with strong growth in Africa).

Consumers in Mainland China, the world’s largest smartphone market, are turning to domestic brand Huawei, driven by its P60 range. Huawei’s share of total sales in the third quarter of 2023 increased by +6% points compared with the same period last year. Apple’s sales are so far unaffected by the uplift, with Android losing share. Google Pixel will continue its strong performance, fuelled by its 8 series and a mid-year launch of the Pixel 8A, a cheaper version of the flagship device. Japan, Australia and the UK are its current top performing markets.

5. Foldable phone adoption will continue to creep upward

In 2023 foldable smartphones still comprise just 1% of total smartphones owned, and we don’t expect this to jump in 2024. Of the foldable owners who upgraded their phone in the last 12 months, 55% chose to move back to a conventional smartphone. Retention will improve as consumers upgrade from better devices.

Apple remains a notable omission from the foldable market and is unlikely to launch next year given its foray into spatial computing with the Vision Pro (a new headset that will retail at $3,499). An Apple foldable phone would certainly give the category a much-needed boost in the arm.

Kantar’s Worldpanel ComTech panel continuously tracks consumer behaviour across the technology industry monthly, in 20 markets. Reach out to our experts to understand how data lead insights can help drive growth.