Kantar’s Entertainment on Demand study in Spain uncovers the following behaviours within the Video on Demand (VoD) market between September to December 2022:

- In Q4, the number of households accessing at least one video streaming service in Spain was down -224k from the previous quarter, representing 12.2million or 65% of households

- VoD-enabled households, accessed on average 3.3 different video streaming services, with Prime Video & Netflix being the most popular combination, held by 11% of households

- 2.1% of Spanish households took out a new SVoD service in the last 3 months, with Amazon Prime Video accounting for 62% of all new subscribers

- Netflix also saw a small increase in new subscriber numbers, following the launch of its ‘Basic with Ads’ price tier

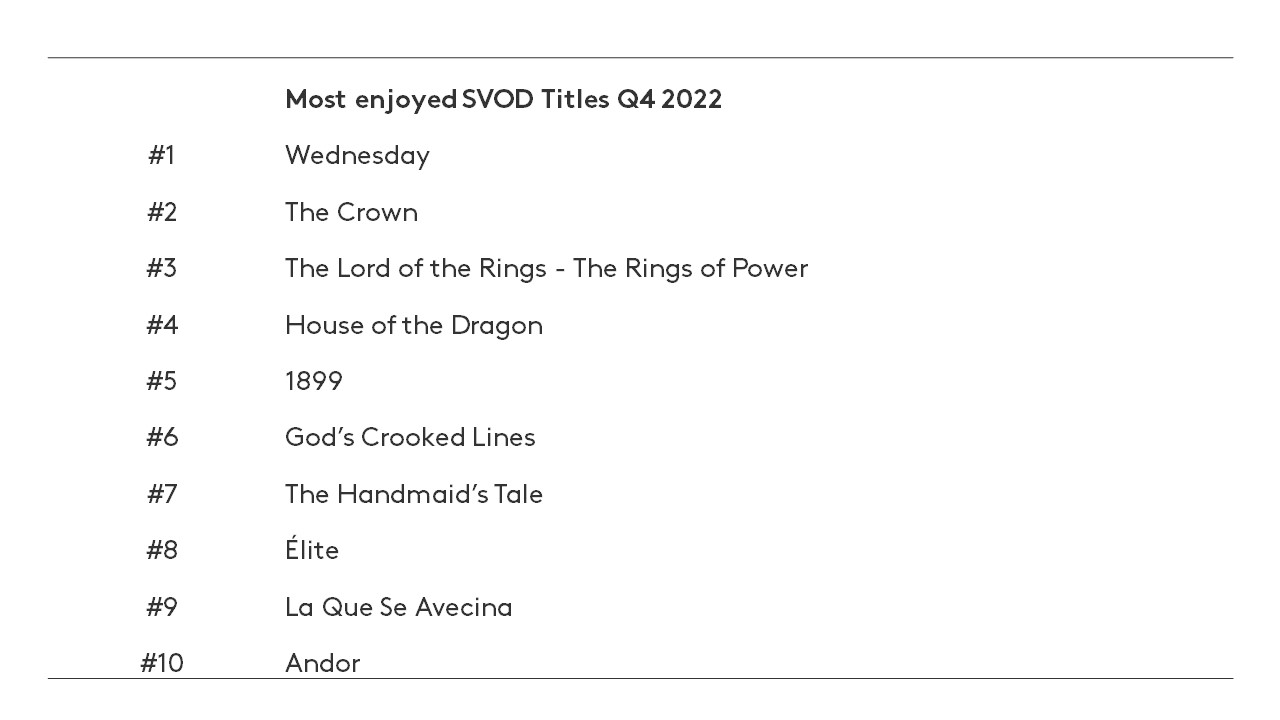

- Wednesday on Netflix was the most enjoyed SVOD title in Q4’22, closely followed by The Crown on Netflix & Lord of the Rings: The Rings of Power on Prime Video

- The proportion of consumers planning to cancel one or more SVoD services in the next quarter fell to 17%, indicating a solid first quarter for the sector overall

Prime Video tops the table

Amazon Prime Video secured 61.5% of all new video subscriptions in the final quarter of the year. Big budget series Lord of the Rings: The Rings of Power continued to drive new subscribers to the platform, whilst The Boys and local Spanish series, La Que Se Avecina also performed strongly.

Consumers in Spain see Amazon Prime Video as increasingly good value for money, a metric that has become even more important over the last 6 months, against the backdrop of rising inflation. Competitors haven’t fared quite so well with Netflix, holding only a 10.4% share of new SVoD subscriptions. Just over one in 10 new Amazon Prime Video subscribers switched directly from a competitor in Q4, with HBO Max and Disney+ among the most impacted services.

Netflix's new Ad-Supported service popular with new subscribers

To great anticipation, Netflix released its ad-supported tier in Spain in November, part of a strategy to turn around subscriber losses and bolster profit at the American giant. The new tier, ‘Netflix Basic with ads’, reduced the entry price from €7.99 to €5.49.

Mayte González, Media & Shopper Sector Director at Kantar Worldpanel comments, “The market is in constant flux. Following Netflix's incorporation of a more affordable offer including advertising, we will see how the restriction of sharing will impact this platform in the first months of 2023.”

Early data from Kantar's EoD study reveals the new plan has been popular with new subscribers, with four in ten choosing the ad-supported service. However, whilst uptake of the new tier was high amongst those who did take out a new Netflix subscription, overall subscriber acquisition did not see a significant increase in Spain with Netflix claiming only 10% of new SVoD subscriptions.

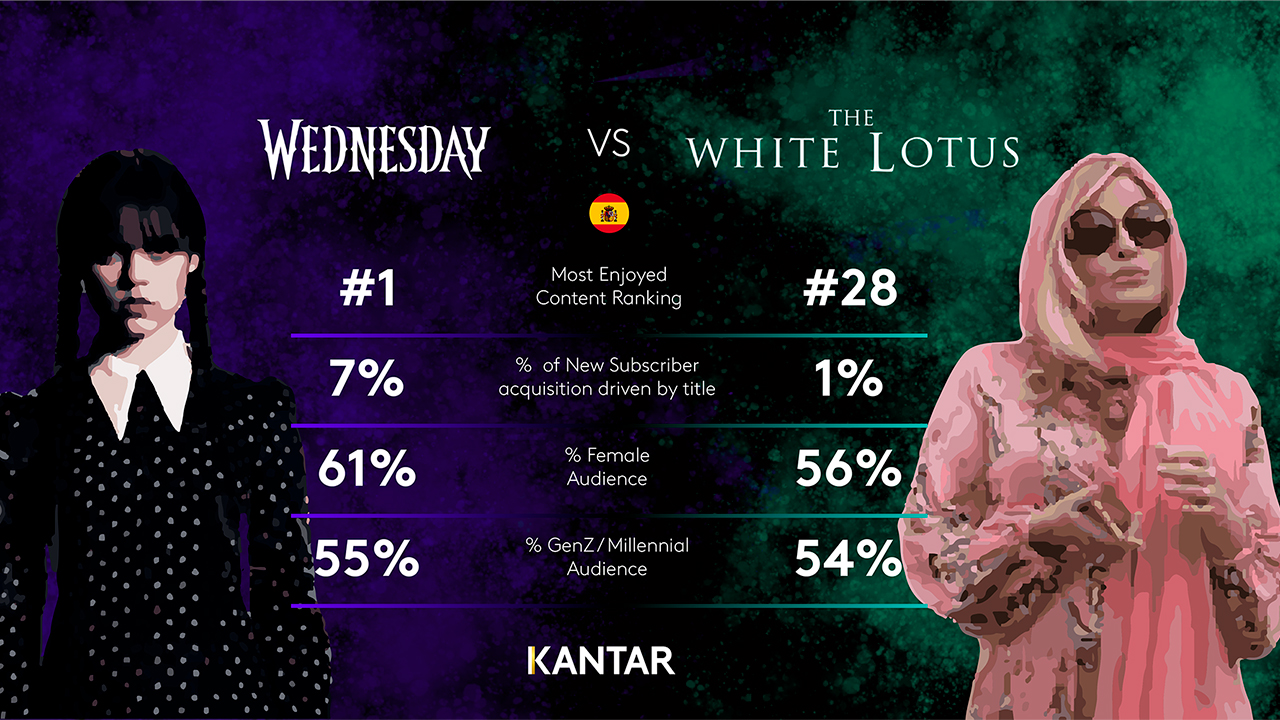

Adams family spin-off ‘Wednesday’ dominates

Wednesday, an Adams family spin-off starring Jenna Ortega & Catherine Zeta Jones, dominated on Netflix during the final quarter of the year, with 10% of all VoD subscribers citing it as their most enjoyed title.

However, it was La Casa De Papel that remained the top title in driving new subscribers to Netflix, followed by Stranger Things, with Wednesday coming in third.

Disney+ gains momentum with subscribers

Disney+ and HBO Max continue to fight it out for 3rd place in subscriber numbers in Spain, but it is Disney+ which is gaining momentum in SVoD households. Among households that already hold multiple video streaming subscriptions, Disney+ was ranked the #1 most important service by 20% of subscribers, up from 18% last quarter.

Meanwhile, for HBO Max 15% of households with multiple subscriptions rank HBO as their #1 most important service, down from 17% in Q3 when top hit, House of the Dragon was released. HBO’s reliance on House of Dragon is clear, with 43% of new subscribers in the quarter citing the title as the reason they signed up, followed by The Handmaids Tale at 10%. In contrast, Disney+ tends to have a much longer, more differentiated number of titles attracting new subscribers, with The Mandalorian, Andor and Disenchanted taking the top three spots in Q4 2022.

Movistar+ coming under pressure to compete with streaming giants

Movistar+ continued to lose subscribers in Q4 2022, with the Spanish service struggling to attract new consumers to the platform. In Q4 2022, Movistar+ accounted for less than 1% of total new video streaming subscribers and in the Pay TV sector both Vodafone and Orange saw share gains at Movistar+ expense. Subscriber departures from Movistar+ are strongly driven by price considerations, far more so that for their SVoD competitors. 40% of churned Movistar+ subscribers cited the need to save money and further 25% refused to accept price rises. Overall, the customer experience of Movistar+ is positive with a strong Net Promotor Score and high satisfaction rating in sports, quality of shows, and the Movistar+ interface, however, this is not yet enough to reverse concerns around value for money.

Access the interactive data visualisation for more information.