The carbon footprint of the logistics and postal industry is large and well documented. It is an energy intensive industry closely linked to economic activity; responsible for moving goods and communication around to facilitate trade. And the last mile in particular, offers sustainability challenges in the sudden dispersal of routes and potentially bespoke nature of each delivery event. It is said to account for 53% of shipping costs and it makes a significant contribution to the industry’s carbon footprint. Innovation in this area is essential.

Looking across the industry, many companies are recognising the importance of climate change. Our proprietary Kantar BrandZ dataset tells us that sustainability is more important to brand equity in the logistics sector than it is in other sectors and its influence has been growing over time. However, we also have evidence that, while actins are being taken, few companies are owning this space in a way that could drive growth for them and their brands.

Sustainability business models offer significant benefits

For businesses that get it right – that understand their responsibilities, act and are seen to act – there are huge financial benefits. For 25 years, Kantar’s BrandZ database has tracked 20,000 brands across 522 categories and in 51 markets worldwide. Its brand valuations have been verified time and again against the financial outcomes of brands and the companies that own them. As a resource, it gives unrivalled insight into how brands build, maintain and lose value.

Our latest analysis shows that those brands which achieved high scores in Kantar BrandZ consumer perceptions of sustainability and also performed well in an independent audit of their sustainability performance grew substantially, even outstripping the average growth of Kantar BrandZ’s 100 most valuable brands in 2022 (See chart above).

In a sense, performance on sustainability is becoming table stakes for business – especially as regulation in this area is implemented around the world. But more than that, there is a huge opportunity here that should be grasped. Nowhere is this truer than in the logistics industry.

Exploring the value-action gap: why facts don’t change our minds?

As always, the basis of that value growth comes from consumers – the key question: where are they choosing to spend their dollars? Kantar’s Sustainability Sector Index 2022 found that 97% of consumers are prepared to make changes to their lifestyle to live more sustainably. Some do, but many others struggle to put these aspirations into action. For instance, 68% believe sustainable products come at a premium and 65% say that the increased costs of living prevent them making the more sustainable choices they would like to make. Cutting these numbers by social grade and income shows clearly and unsurprisingly that those with some financial flexibility are more likely to choose these sustainable options; those with less, find it harder.

The point here is not that consumers are not telling the truth; it is that both values and action are part of the equation. This is the famous value-action gap. This tension between how consumers would ideally act and how they actually do act reveals barriers, whether mental, physical or financial, that stop them. In this gap, there are significant benefits to be reaped for those brands that remove frictions and help consumers act in the way they would like to. For the logistics industry, this would mean offering sustainable delivery options at a competitive price.

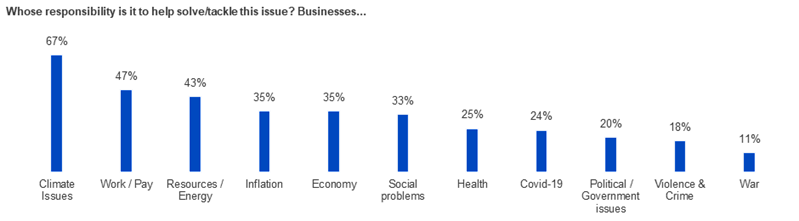

Indeed, climate issues are seen as an area that consumers the world over identify as a key responsibility for business - and by a large margin! Over two-thirds (67%) believe businesses should take action on the climate, while the next issues on the list for business – pay and working conditions – comes in at a much lower 47%.

The influence of sustainability on brand equity in the logistics industry

One of the biggest with a positive profile is Lotte Logistics, the leader in South Korea. The company has a full scale ESG program and has a great reputation for treating employees and their partners well. DHL in Europe is also well regarded and has a particular focus on its environmental responsibility – aiming to reduce its carbon footprint and “striving for clean operations and climate protection”.

In recent years, some of the largest delivery companies have developed well-integrated and impactful ESG programmes and industry bodies such as UPU and IPC have been active in promoting the ambitions and achievements of the industry:

- For IPC member posts, collective yearly CO2 emissions werereduced by 34% in 2021 compared to 2008

- Between 2012 and 2021, posts have doubled the share of alternative fuel vehicles (from 12% to 24% of the postal fleet). Electric vehicles account for 17% of the postal fleet.

- By 2021, 34% of the energy used in postal buildings comes from renewable sources. By 2030, posts aim to reach 75%.

- The carbon savings offered by a well-functioning PUDO/Open-locker network

- Replacing old sorting infrastructure with newer, more efficient models

- The generation by many companies of clean energy on site to run their operations.

The list goes on as the industry has already made huge investments in this space. Given this focus, someone from within the industry might be forgiven for being amazed that only 13% of brands have developed their sustainability credentials in the minds of the consumer - surely it must be higher! So, what explains the low penetration with the public?

Sustainability swords and shields in the logistics industry

At Kantar, we use a “swords and shields” framework to classify sustainability business investments. At a category level, this framework helps our clients understand what actions are necessary (a hygiene factor, or a ‘shield’ where failure carries risk) and which are genuine “big bets” around sustainability that can be used to differentiate their brand in their category and drive a competitive advantage – these are the brand’s ‘swords’.

Although further research is needed, one trend that may be classed as a shield is becoming clearer – the electrification of delivery fleets. It remains an incredibly important step; indeed, without it, brands will not be seen to meet fundamental consumer requirements. Strides must continue to be made in this area, not least as regulation on combustion engines across Europe will come into force over the next decade or so, but also as it is predicted to offer operational savings over the long-term. However, as every major brand (at least in the UK) is purchasing alternative fuel and electric vehicles, this action alone will not give them the winning edge over their competitors in consumers’ minds.

Even so, we see that sustainable investments made by carriers in the UK (as one national example among the countries we monitor) are being acknowledged by consumers. Most brands that we track have seen their sustainability index increase since we started measurement in 2017 although none is breaking away from the pack.

The biggest winner here is DHL with an increase of 36. Closely following are dpd, FedEx and UPS who all saw 30 points of improvement. Royal Mail, with a superior brand salience and “feet-on-the-street” delivery model has the highest sustainability index, although it dropped slightly between 2020 and 2023.

To summarise, Kantar’s BrandZ data confirms the growing relevance of sustainability within the logistics industry. This trend should not be ignored, and brands should continue to look to leaders and innovators in this area to see what can be achieved, while thoroughly critiquing their own business model for opportunities to innovate. Regulation is coming to force sustainable initiatives, but more than this, consumers expect action and will reward businesses that make it possible for them to meet their own sustainability aspirations.

Furthermore, the data underlines that the actions of players across the logistics industry are being noticed, but that no major players are currently owning this space in a way that could drive brand differentiation for them. Each company should be asking themselves: “can we go faster with our sustainable strategy and implementation?” If so, they may be able to cement their sustainability credentials with consumers and reap the benefits this will bring

Kantar’s offer in this area

Kantar’s Sustainable Transformation Practice brings together expertise and assets from across Kantar to support organisations, both commercial and public, in the definition activation and measurement of sustainability strategies. We are dedicated to leveraging our human understanding expertise to identify how to move citizens and consumers on the journey from Value to Action.

If you would like to discuss any of the ideas in this report, please contact: postandlogistics@kantar.com