The ways people choose to pay for things can vary widely based on factors like country, economic stability and also by generation. These factors are growing in influence and shaping the ways global consumers interact with their money. From credit card choices to digital payment preferences, each generation exhibits unique habits and priorities, a result of new technologies in finance, historical habits, and personal choices.

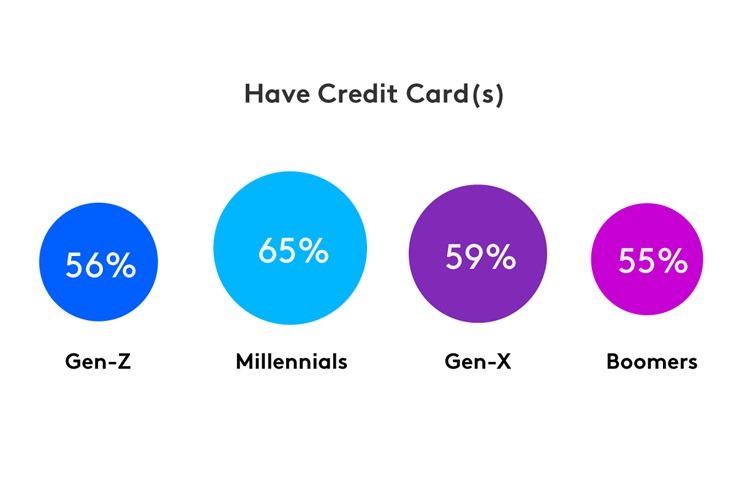

Millennials stand out as the generation most likely to embrace credit cards than other generations. 65% of this generation report they have a credit card, the most of all generations of consumers.

Millennials are also most likely to have a card affiliated with an airline (14%) and retailer cards (25%). This affinity for specialised credit cards suggests a desire for tailored benefits and loyalty perks – specific to habits and personal behaviour trends. A generation known for prioritizing experiences, over “things,” Millennials strategically leverage credit cards to maximise travel rewards and exclusive retail discounts, seamlessly blending lifestyle aspirations with financial strategy.

When it comes to reward redemption, cash back is the most popular choice for all. Younger generations, however, are more likely to choose cash back than other generation.

Gen-Z (40%) and Millennials (41%) surpass Gen-X (34%) and Boomers (26%) who choose this instant reward option. Rather than accumulating points or focusing on discounts, Gen-Z and Millennials are more likely to prioritise tangible, immediate benefits that contribute to their overall financial well-being.

Likely aligned with their personal financial goals, younger generations are most likely to view credit cards as a means to build credit or improve their credit score and history. 33% of Gen Z and 37% of Millennials reported this factor as primarily influential for their use of credit cards. Faced with rising interest rates and low housing inventory, these generations of consumers likely recognise the importance of establishing and maintaining a positive credit history from an early age.

When it comes to motivations behind credit card usage, Gen-X (40%) and Boomers (36%) place a premium on discounts and rewards. This contrasts with Gen-Z (39%) and Millennials (43%), who are more motivated by the prospect of earning points. The shift towards points suggests a desire for flexible, redeemable rewards, aligning with the dynamic and experiential lifestyles of younger consumers.

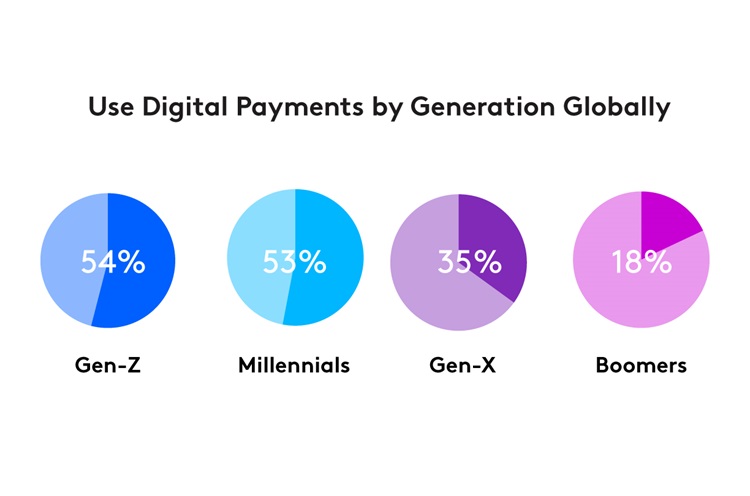

Digital payment types like Apple Pay or Google Wallet have gained significant traction, particularly among young consumers. Over half of Gen-Z (54%) and Millennials (53%) have used these payment types. As younger consumers are typically the first to adopt new technologies, Gen-Z and Millennials recognise the convenience of contactless transactions, easily available from their phones or watches. Conversely, only 35% of Gen-X and a mere 18% of Boomers opt for digital payment methods, highlighting the generational gap in the adoption of these modern payment technologies.

However, the adoption of digital payments is not without concerns. 43% of Boomers expressed the highest level of apprehension about the security of mobile payment sources, emphasising the need for more robust security measures in the digital payment space before adoption. In contrast, Gen-Z, exhibited a higher level of trust, with only 32% expressing concerns about the security of digital payment types.

To read more about how digital payments are adopted across global markets, read Tapping into Modern Payments: The Expanding Digital Payment Market here.

Respondents were sourced from the Kantar Profiles Audience Network.

Credit Cards Most Popular Among Millennials

Millennials stand out as the generation most likely to embrace credit cards than other generations. 65% of this generation report they have a credit card, the most of all generations of consumers.

Millennials are also most likely to have a card affiliated with an airline (14%) and retailer cards (25%). This affinity for specialised credit cards suggests a desire for tailored benefits and loyalty perks – specific to habits and personal behaviour trends. A generation known for prioritizing experiences, over “things,” Millennials strategically leverage credit cards to maximise travel rewards and exclusive retail discounts, seamlessly blending lifestyle aspirations with financial strategy.

Younger Generations Favor Cash Back Rewards

When it comes to reward redemption, cash back is the most popular choice for all. Younger generations, however, are more likely to choose cash back than other generation.

Gen-Z (40%) and Millennials (41%) surpass Gen-X (34%) and Boomers (26%) who choose this instant reward option. Rather than accumulating points or focusing on discounts, Gen-Z and Millennials are more likely to prioritise tangible, immediate benefits that contribute to their overall financial well-being.

Credit Cards Benefits Vary by Generation

Likely aligned with their personal financial goals, younger generations are most likely to view credit cards as a means to build credit or improve their credit score and history. 33% of Gen Z and 37% of Millennials reported this factor as primarily influential for their use of credit cards. Faced with rising interest rates and low housing inventory, these generations of consumers likely recognise the importance of establishing and maintaining a positive credit history from an early age.When it comes to motivations behind credit card usage, Gen-X (40%) and Boomers (36%) place a premium on discounts and rewards. This contrasts with Gen-Z (39%) and Millennials (43%), who are more motivated by the prospect of earning points. The shift towards points suggests a desire for flexible, redeemable rewards, aligning with the dynamic and experiential lifestyles of younger consumers.

Younger Generations Adopt Digital Payments

Digital payment types like Apple Pay or Google Wallet have gained significant traction, particularly among young consumers. Over half of Gen-Z (54%) and Millennials (53%) have used these payment types. As younger consumers are typically the first to adopt new technologies, Gen-Z and Millennials recognise the convenience of contactless transactions, easily available from their phones or watches. Conversely, only 35% of Gen-X and a mere 18% of Boomers opt for digital payment methods, highlighting the generational gap in the adoption of these modern payment technologies.

However, the adoption of digital payments is not without concerns. 43% of Boomers expressed the highest level of apprehension about the security of mobile payment sources, emphasising the need for more robust security measures in the digital payment space before adoption. In contrast, Gen-Z, exhibited a higher level of trust, with only 32% expressing concerns about the security of digital payment types.

To read more about how digital payments are adopted across global markets, read Tapping into Modern Payments: The Expanding Digital Payment Market here.

Get more answers

For more findings from this study, access the complete Connecting with the Digital Payments Community

Find additional insights into how global consumers are paying for goods and services.

About this study

This research was conducted online among 10,001 consumers across ten global markets: Australia, Brazil, Mainland China, France, Germany, Singapore, Spain, South Africa, US and UK. Between 23 December, 2023 and 12 January, 2024. All interviews were conducted as online self-completion and collected based on controlled quotas evenly distributed between generations and gender by country.Respondents were sourced from the Kantar Profiles Audience Network.