That 2020 was a watershed in time is a view that is unlikely to be contested. The pandemic has affected (and changed) almost every aspect of life – the economy, education, healthcare, work, relationships, purchase and consumption. Do marketers have the tools to understand what those changes mean?

Who could have foreseen that more than a year after the outbreak in Wuhan, 70% of people around the globe would still feel that coronavirus concerns them ‘hugely’ or that 1 in 3 people in ‘leading’ countries (high vaccination rate and stable/declining case rate) would still feel worried about falling sick despite taking care of themselves?

This anxiety about the general situation extends to consumer sentiment and behaviour too. Take shopping and purchases, for instance – more people (70%) are paying attention to prices in stores, malls, and supermarkets (compared to 64% at the same time last year), and 58% (+10%) pay more attention to products on sale. Online grocery shopping saw a boost and more than 1 in 3 people now prefer to shop online for their groceries. Localism, expressed as product origins or shopping at stores close to home, has continued to be important.

We see changes in lifestyle too – ‘healthy eating’ was a Top 2 priority last year, but has dropped a couple of places in priority a year on. Even in people’s comfort with different activities, we see that comfort with going back to essentials (going to the hairdresser) or everyday pleasures (going to a restaurant/pub) is higher than comfort with destination outings (cinema/theatre or foreign travel).

Each of these changes has implications for strategic (planning the innovation pipeline, pricing, or brand building) as well as tactical investments (promotional activities).

Windows of opportunity

Marketers have recognised the magnitude of this behavioural change as well as its enduring impact. 90% of marketers surveyed by Kantar expect these changes to persist post the crisis and 64% expect to revisit their long-term strategic priorities.

But the pandemic is not the only momentous event affecting consumer behaviour. Other socio-politico-cultural movements (BLM, the climate crisis) are jolting people out of their automatic ways of being and causing them to reflect on what they are doing. We call these moments ‘twitch moments’ – moments when assumptions are reviewed, and habits can be broken. Not all ‘twitch moments’ need to be as momentous. Some can be ‘marketing twitches’ (your online store delivers a substitute brand, or your favourite beverage brand has been discontinued) or ‘personal twitches’ (you are moving out of your parents’ home and need to decide on categories that Mum and Dad used to decide on). These mega, marketing, or personal twitches are windows of opportunity for brands that act fast to spot emerging changes in motivations and behaviour.

The challenge is that, at the very time that there is a heightened need for fast insights into these rapid and widespread changes in consumer motivations and behaviour, there are also new constraints on in-person research in most parts of the world. Going into people’s homes or inviting them for a discussion are difficult to execute, even in countries with fewer pandemic-related restrictions.

Fast human-centric insights at scale

New technologies can now uncover early, in depth insight into current behaviour; how people shop, what underpins their decisions in the moment, what changes are at play, and the opportunities or threat this holds.

Kantar’s Conversational AI solution combines qualitative expertise and AI to facilitate intelligent conversations that allow brands to access textured human insights early, quickly and at scale. Chatbots are not new (not even to the world of market research) but few have used the power of qualitative expertise across the design and execution stages. Fewer still use qualitative thinking and analytical frameworks to develop and frame the insights from data collected via Chatbots.

What we’ve learned about AI-powered Chatbots

We’ve learned a lot about the use of Chatbots, and how to understand changing consumer behaviours quickly and efficiently, across the world. Five principles underpin the success of our hybrid qual-quant solution:

1. An invitation to play:

Developing the right persona for the Bot is crucial to participation. Our Bots have a casual and engaging personality, supported by a Bot name and avatar that are selected to resonate with the local category and cultural context. This persona inspires the bot’s tone throughout the research experience. This in the familiar context of a messenger platform, encourages deeper engagement, faster data collection, and more authentic responses from participants. In this way, we step away from formal survey language to craft a Bot engagement that is closer to the warm-up routine in a focus group discussion – personal, purposeful and promising a memorable experience. Other variables that boost participation are nuanced targeting, expertly designed social media recruitment and localised incentives.

2. Respect the context:

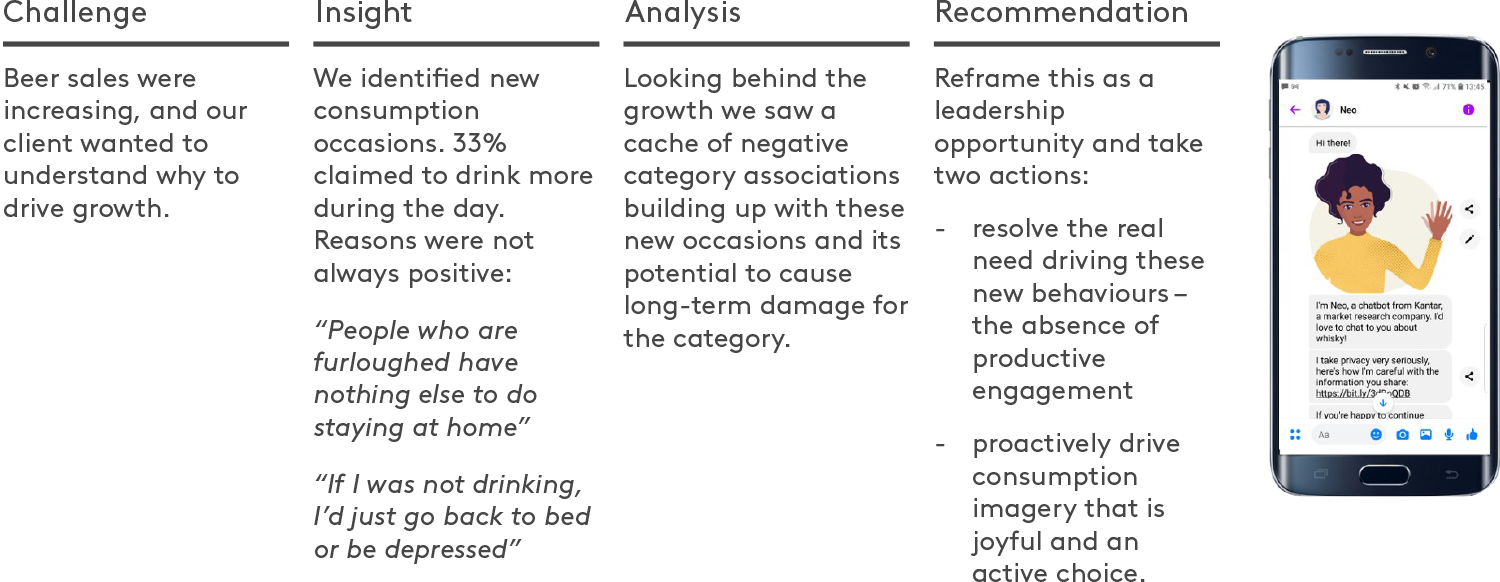

Our Bots meet people where they are, in a context that is intimate and familiar, on messenger platforms like Facebook Messenger or WeChat, where people are used to sharing stories about their lives and themselves. In this way we tap into existing behaviour in the always-on, mobile-first culture, engaging with people on their terms. This gives us access to those who may otherwise be reluctant respondents such as Centennials or younger Millennials. It gives us permission to talk about topics that people may otherwise shy away from (e.g. daytime drinking). But to fully realise the potential of this access and not take advantage of the permission to engage, we need to stay true to the nature of the environment, which lends itself to short bursts of interaction, limited to 7-10 min conversations.

3. Think conversation, not research:

Much of our Bot development involves imbibing qualitative research philosophy into designing the Chatbot interaction. We make the questions interesting and thought-provoking. We leverage AI to ensure each conversation is adaptive, with the Bot playing back the participant’s own words to them at key points, which makes it feel more like a real conversation and instils a sense of rapport and trust. AI enables in-context dynamic intelligent probing to really get to the heart of people’s stories about their category experiences, behaviours, and habits. We strive to codify some of the key elements of a typical qualitative interaction – empathy, creativity, curiosity – and embed these in the conversation, even supported with emojis, the quintessential hallmark of messenger interactions.

A simple example of a qual-inspired question: Imagine you were writing a social blog and had to describe the ideal experience with this brand.

An authentic and vivid story about whisky

4. Fast insights should also be big insights:

Asking interesting questions to lots of people and dashboarding the responses is not Qualitative at scale. Being able to contextualise this rich data in the wider socio-cultural context, bringing in specialist expertise (e.g. the implications for retail strategy) and linking to other data sources (e.g. brand tracking or creative evaluation data) is what makes the insight fast and BIG.

Uncovering reasons for growth in the beer category

5.The might of Qualitative IP:

The Chatbot scene is crowded, with a Chatbot for everything – sales, customer service, and now market research. For market research Bots to be meaningfully different, we need to infuse relevant Qualitative models into the analysis process. For example, our Behaviour Change model helps marketers to understand decision processes in any category and identify the new habits that will stick. It looks at existing or new habits through the lens of five motivational currencies (Time, Connection, Money, Vitality, Safety) and three ability currencies (Practical ease, Cognitive ease, Cultural fit). This ensures recommendations from a Chatbot study either strengthen a currency or bridge a currency deficit.

In a whisky study, the data revealed that around one in four people were buying whisky for gifting and the gifting stories indicated a deeply emotional moment of category connection, accentuated by the times we live in. Connection is a huge need and gifting helps fill that deficit. However, we also know that the switch to online shopping and the closure of specialised alcobev retail stores has created a cognitive load in the whisky shopping process. Category novices are struggling to make meaningful choices from the sea of brands in the category. Our recommendation in this context is to tap into the connection currency in the online path to purchase and simplify decision-making through messaging suited to the gifting occasion rather than standard category discourse around product craftsmanship.

Capture meaningful stories

The age-old adage about reaping what you sow is especially true in the case of market research – ask intelligent, stimulating questions and your Chatbot can throw up deeply meaningful and insightful stories about category experiences. With feedback from over 400 people the potential for the inspiration for innovation or creative development and more is huge.

People, culture, societies are changing at a mind-boggling pace and businesses that are fast on their feet will have a competitive advantage in this emerging business-scape. The intimate, precise, and all-seeing power of Conversational AI allows us access to new places, and spaces, and new forms of data. This tells us so much more than we ever knew about people, decision-making, and the human condition.