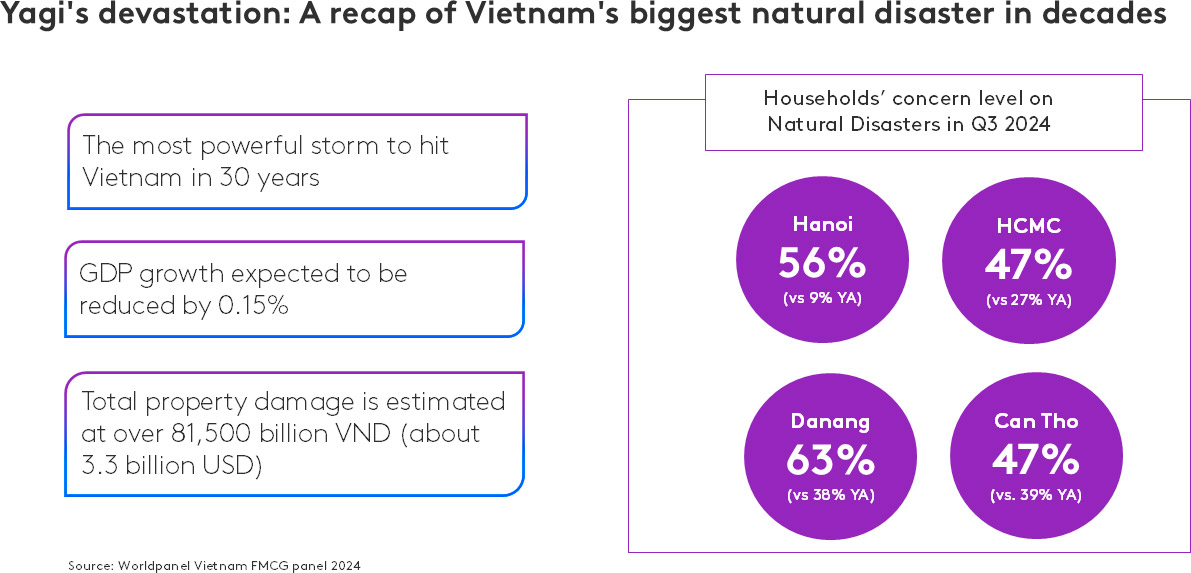

Typhoon Yagi, one of the most powerful storms to hit Asia in recent years, made landfall in northern Vietnam on 7 September 2024, resulting in extensive damage. The disaster – which is projected to reduce Vietnam's 2024 GDP growth by 0.15 percentage points – not only disrupted various FMCG sectors, but also impacted northern Vietnamese consumers’ purchase behaviour.

The uncertainty caused by the typhoon has led to a short-term shift in consumer priorities and FMCG spending patterns. The event also poses prolonged implications for the Vietnamese New Year (Tet) season at the end of January, and throughout 2025.

Heightened concerns about natural disasters

Worldpanel’s quarterly consumer confidence survey reveals that climate and natural disasters were a top two concern for Vietnamese consumers in Q3 of 2024, with nearly half of all households across Vietnam’s four key cities expressing worries. Hanoi witnessed the most dramatic increase, with the proportion of the population feeling concerned surging from a mere 9% in Q3 2023 to a striking 56% in Q3 2024.

Coupled with rising food prices, this heightened uncertainty may influence consumer spending priorities and behaviour. While the immediate impact of the typhoon will be temporary, the recovery process for northern Vietnam, which is less accustomed to such severe natural disasters, may be more prolonged. This could lead to budget constraints for certain categories and prioritisation of recovery in the coming year.

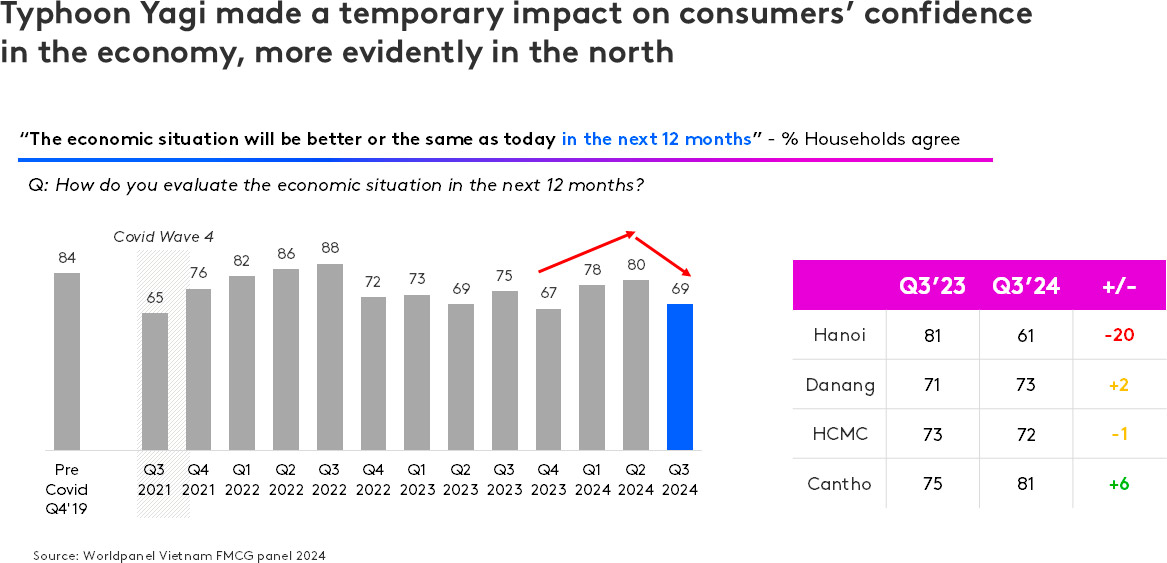

Data from Worldpanel also reveals that the typhoon undermined consumer confidence in the country’s economic prospects, with 69% feeling positive in Q3 of 2024, down from 80% in Q2.

Impact on FMCG and intention to spend

As we saw with the pandemic, crises often trigger a surge in demand for essential FMCG items as consumers stock up. However, a closer look at post-typhoon purchasing behaviour in northern Vietnam reveals some nuances.

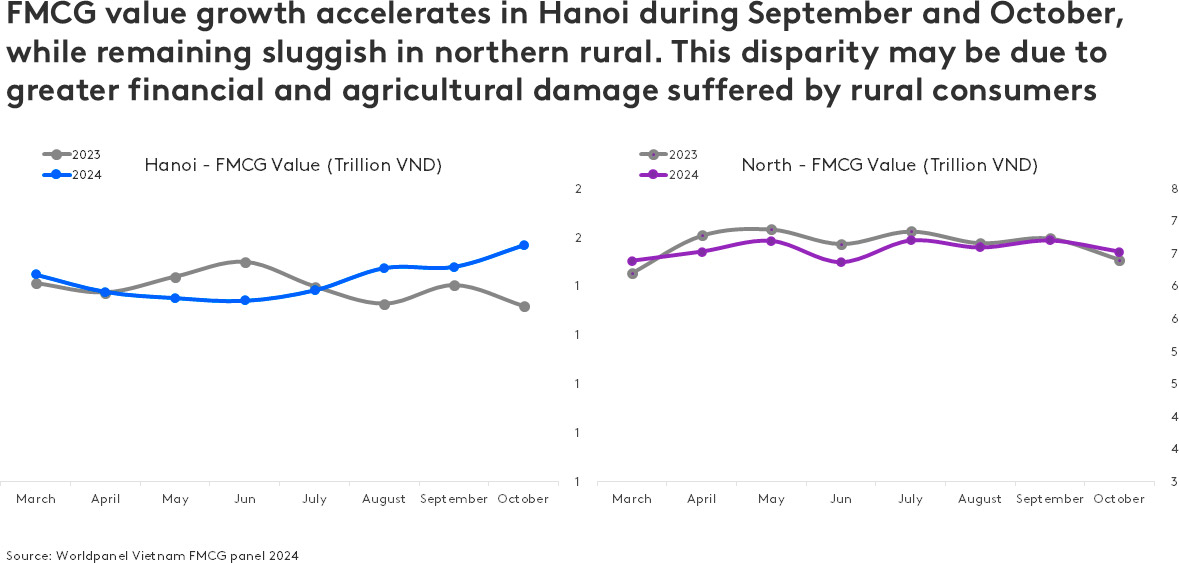

In the immediate aftermath, demand surged in Hanoi – likely driven by a combination of stockpiling behaviour and preparations for potential flooding. In contrast, rural areas suffered more significant economic and agricultural damage, which led to reduced purchasing power and a shift in consumer priorities – and therefore less pronounced growth in FMCG spend. Packaged foods and certain beverage categories were prioritised over personal care and home care products during September.

Rural households may also have been more reliant on donations from relief efforts, prioritising essential items like food, water, and medicine, while reducing discretionary spending on non-essential FMCG items.

Worldpanel reconnected with several panellists residing in the typhoon's direct path. While urban residents in Hanoi reported a slight increase in stockpiling behaviour and minimal impact on household income, the situation was significantly different for rural households. They reported substantial losses to their livelihoods and assets, directly impacting their disposable income. Due to these losses and reliance on relief efforts, their FMCG spending either remained the same or declined. This suggests that these households’ priorities in 2025 will be to rebuild livelihoods and recover financially, which may impact future FMCG spending in the rural north.

The mid- to long-term consequences of the typhoon on rural FMCG consumption could be significant, with an impact on livelihoods and infrastructure that is heavier and more prolonged than in the urban centre. This may lead to ongoing economic challenges, affecting consumer spending power and preferences.

Navigating the post-typhoon landscape

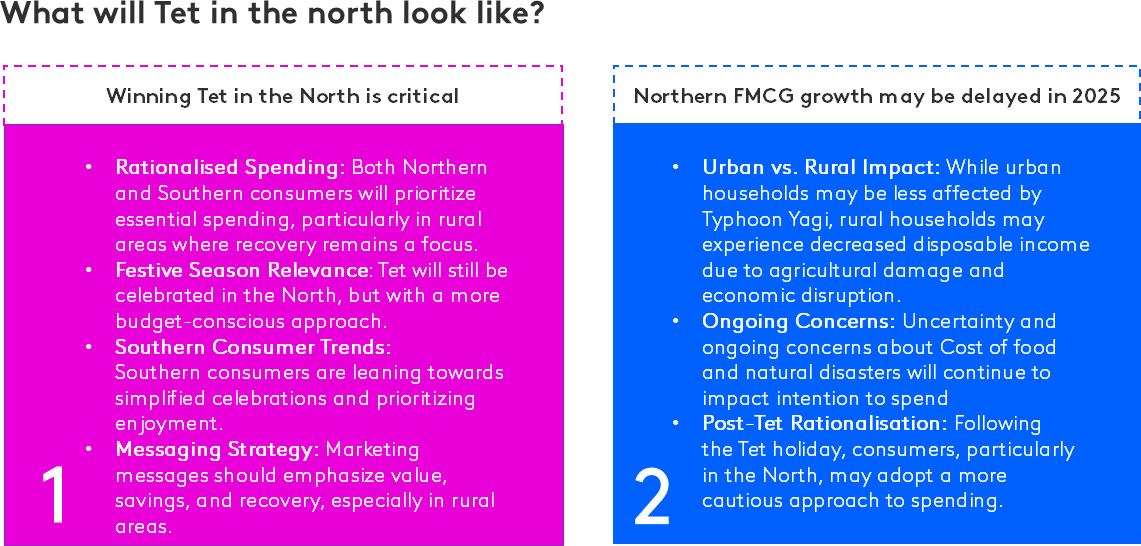

Tet 2025 remains a crucial period for FMCG brands and certain categories, often contributing up to a quarter or even a third of their annual sales. Worldpanel’s festive studies have shown that the season is particularly important in the north, where traditional celebrations hold deep significance.

While all Vietnamese consumers will prioritise essential spending, their approaches to rationalisation may vary.

Winning Tet in the north is critical for brands

While economic factors may influence spending patterns, the cultural importance of Tet ensures its continued importance in the north. Shoppers are more likely to rationalise their purchases in months outside of the holiday season.

The decrease in disposable income experienced by many households will impact their ability to spend on Tet preparations. The economic uncertainty caused by the typhoon could make consumers more cautious, likely resulting in subdued or moderate growth in Tet 2025 compared with last year. Again, consumers in the rural north may prioritise rebuilding their homes and livelihoods, leading to a shift in budget allocation.

Potential delay in FMCG growth

Ongoing concerns about the cost of food and natural disasters will continue to impact Vietnamese shoppers’ intention to spend.

Tet remains relevant in the north, which is why rationalised spending will not be as evident there, in comparison to the south where consumers enjoy a more relaxed and simplified holiday. However, in the quarters following Tet, consumers – particularly in the north – may adopt a more cautious approach to spending, stalling the growth of FMCG.

Worldpanel Vietnam’s household purchase panel enables us to uncover consumer attitudes and perspectives, and link them to actual shopping behaviour. Contact our experts today to learn how we can help you supercharge your brand strategy in 2025.