Mainland China’s FMCG sector achieved modest value growth of 1% during the first nine months of 2023, driven by a 1.2% increase in volume sales. This was primarily led by rising consumer interest in products that promise health, value, and exclusivity.

Focusing in on the third quarter, we can see how performance has changed year on year. In Q3 of 2022 value growth reached 6%, following the easing of the COVID-19 lockdowns. This set a high benchmark for 2023, which the industry was not quite able to reach, with a slight decrease of 0.9%.

Clear signs of hope

In the first four weeks of Q4 of this year, FMCG spend increased by a noteworthy 5%, aided by a resurgence in consumer demand due to heightened holiday spending. This suggests we can expect the overall expansion of the FMCG market to continue.

Furthermore, while the Chinese FMCG growth appears to be moderate, this does not necessarily signify a decrease in overall spending. Instead, shoppers may be reallocating expenditure towards sectors such as dining out and travel, reflecting a post-pandemic shift in priorities.

Healthy products, good value, and exclusive dominate

Over the past few years, there has been a noticeable shift in consumer preferences towards products that are healthy, offer value for money, and are exclusive. This change in behaviour has had a significant impact on the FMCG market. The average selling price in certain categories such as chocolate, facial tissue, and hair conditioner has become premiumised, indicating that Chinese consumers are increasingly willing to pay more for greater quality and a better experience.

In the food and beverage sector, consumers aregravitating towards healthier options such as organic, natural, and functional foods. They are looking for nutritional benefits, clean labelling, and sustainable sourcing. Value-for-money options, such as private label brands and price promotions, have also gained in popularity as consumers seek to make the most of their purchasing power.

Home care continues to grow while other categories stabilise

In the first nine months of 2023, Mainland China's FMCG market exhibited a nuanced picture across the four major sectors: home care, beverage, personal care, and packaged food.

Home care sustained its momentum with value growth of 8.8% compared to the same period in 2022. This effect was driven by robust consumer stockpiling behaviour and continued health and hygiene concerns, particularly within essential categories such as toilet paper and tissue.

The growth trajectory in the packaged foods sector decelerated, as demand returned to pre-pandemic levels. The beverage segment remained stable, with higher volumes balanced out by a focus on affordability. Consumers exhibited a clear preference for value-driven choices, prompting a shift towards more economical products. Within the personal care segment, growth was moderated by a lower average selling price, reflecting this trend.

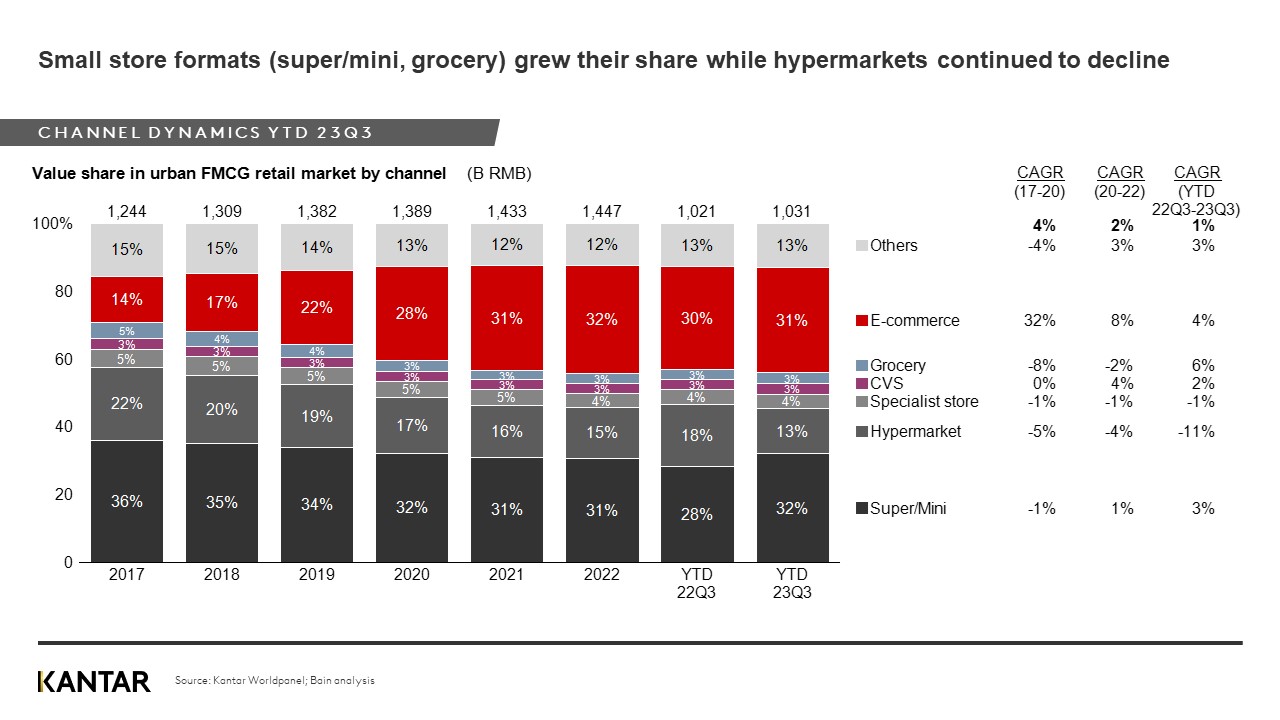

Smaller formats thrive, while O2O continues to soar

The shift towards smaller store formats, such as super/mini and grocery stores, continued, with spend rising 3% and 6% respectively between Q3 of 2022 and Q3 of 2023. E-commerce outperformed the overall market with a 4% year-on-year growth over the same period. One notable highlight was the emergence of social media platforms, including Kuaishou and Douyin, which have captured an additional 6% of the total market share since Q3 of 2022.

Hypermarkets, on the other hand, experienced a decline in market share as some players decided to close their stores across the country. Club warehouses showed a significant value increase of 58% in Q3 of 2023 year-to-date, which can be attributed to a growing number of buyers and increased shopping frequency.

Specialised discount stores are rapidly gaining traction, reflecting a more rational approach by consumers towards daily expenditure. This emerging trend suggests that competition in the retail market will intensify going forward, as these stores continue to attract price-conscious shoppers.

Online-to-offline (O2O) channels continued to grow in Q3, with value growth of 11% compared with Q3 of 2022. Consumers are responding favourably to the convenience and speed they offer.

Despite the challenges, Chinese Mainland's FMCG market consistently demonstrates long-term resilience and capacity for growth. Overall, brands and retailers must remain agile in adapting to the ever-changing market environment to maintain competitiveness and market share. This will involve continuous monitoring of changes in consumer trends, flexible adjustment of pricing and channel strategies, and more efficient investment in marketing and product innovation.

Get in touch with our experts and learn more about the latest Mainland China Shopper Report 2023.