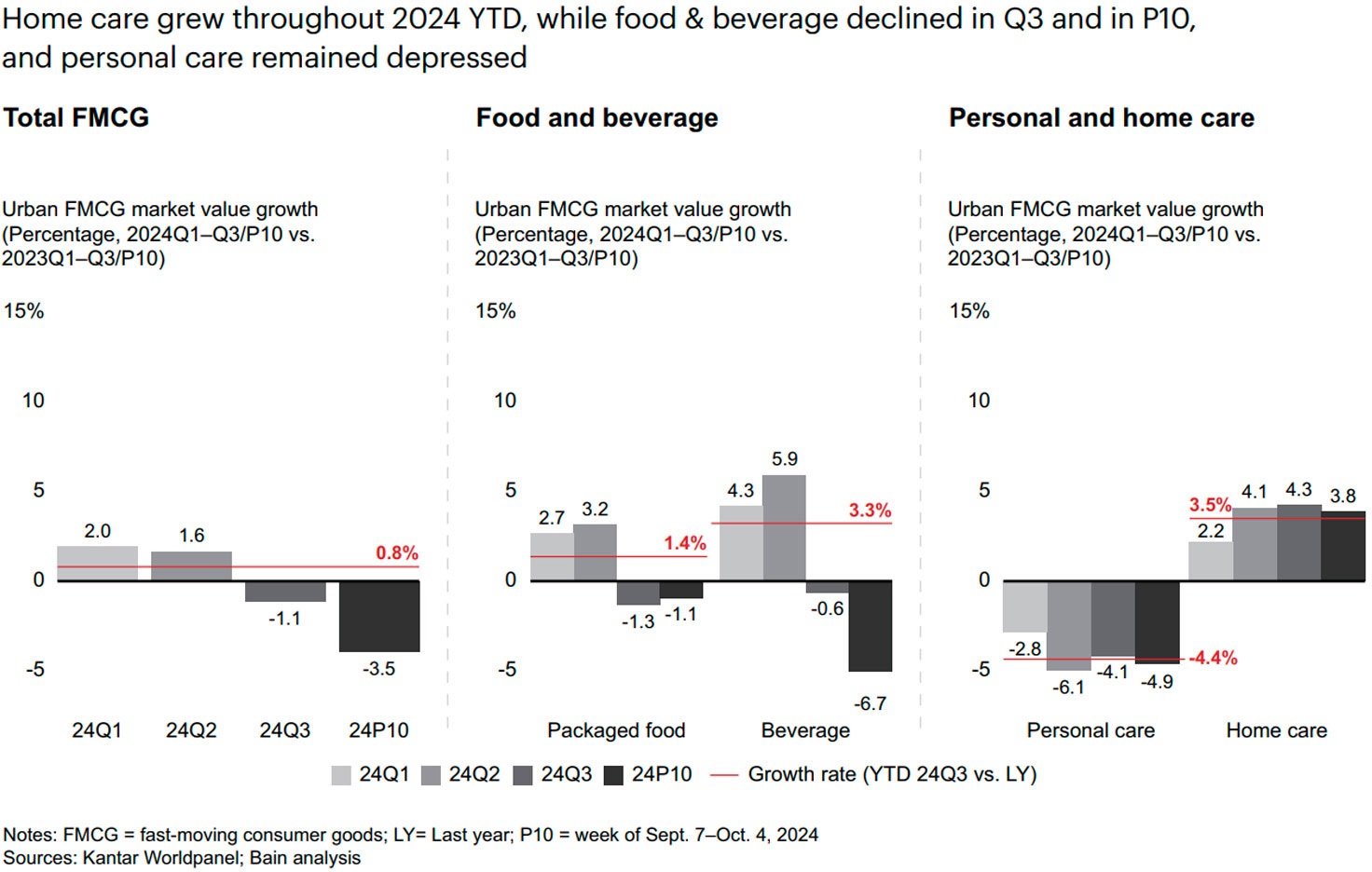

FMCG growth in Mainland China decelerated over the first three quarters of 2024, as a 4.6% increase in volume coupled with a decline of 3.6% in average selling prices (ASP). Value growth of 2.0% in Q1 and 1.6% in Q2, followed by a 1.1% drop in Q3 – with a 3.5% decline in September alone – averaged out at 0.8%.

This deflationary trend was first identified in 2021, and reached its height in Q3 of this year, driven by intensifying market competition and the escalating demand for value for money.

FMCG’s performance lagged behind that of total retail sales, partly due to Mainland China’s pro-consumption policies which were targeted at durable goods. Consumers also continuously reallocated spend towards service sectors such as dining and travel, with sales in these areas increasing 6.7% during the first three quarters of 2024.

Home care alone records consistent growth

Within the four major FMCG sectors, home care led growth with a value increase of 3.5% in compared to the same period last year, closely followed by beverages at 3.3%. Packaged food experienced moderate growth of 1.4%, while personal care saw a decline of 4.4%.

Home care was the only segment that maintained growth across the full three quarters, as it experienced the lowest deflation in ASP and the strongest increase in volume. This was supported by a rise in both penetration and frequency, due to heightened health and hygiene needs as well as a growing desire for improved quality of life at home.

The personal care sector faced accelerated ASP deflation at -9.6%, compared to -3.3% during the same period in 2023. This persisted throughout the year, driven by consumers' cost-consciousness, competitive pressure from duty-free channels and online platforms’ aggressive promotions, and domestic brands offering value-for-money alternatives.

Online penetration shows muted growth

Propelled in part by the expansion of discount chains and club warehouse formats, offline channels achieved a growth rate of 1.8% in the first three quarters of the year. They also experienced lower price deflation at -3%, compared with -6% for online channels.

Mainland China’s channel landscape is characterised by smaller formats such as super/mini and grocery stores, which are gaining share, while discounters are outpacing non-discounters. Club warehouses saw notable growth of 17% – although this was a slowdown from the 58% increase during the same period in 2023. These channels are benefiting from Mainland China’s expanding middle class, which seeks premium quality and innovative products that offer good value.

E-commerce penetration remained stable, with categories that traditionally do well online – such as skincare, beauty, and infant formula – growing at between 0% and 2%. Overall, there was a slight penetration decline of 0.6%, the first time the channel has lost market share. Robust volume growth of 6% was offset by a similar-sized decline in ASP resulting from heavy promotions. Douyin continued to grow at 35%, although this was slower than the 65% seen in 2023, and has now overtaken JD as the second-largest e-commerce platform in Mainland China.

The ‘leaky bucket’

As the behaviour of Chinese shoppers evolves, market leadership continues to be determined by a brand’s ability to boost and maintain household penetration. The big challenge is that while consumers still love brands, many will continue to switch from one to another.

In September, the Chinese government launched more measures to stimulate consumption. Although it will take time for these to take full effect, they are likely to progressively build consumer confidence, which will translate into higher consumption.

To succeed in 2025, Mainland China’s FMCG players need to:

- Re-examine their portfolio, and keep innovating

- Maximise availability, both online and offline – capitalising on the full potential of omnichannel.

- Embrace out-of-home opportunities.

- Implement marketing campaigns aimed at recruiting consumers.

- Manage costs in the persistent deflationary environment.

If you would like to read the complete China Shopper Report from Kantar Worldpanel and Bain & Company, please contact our experts.