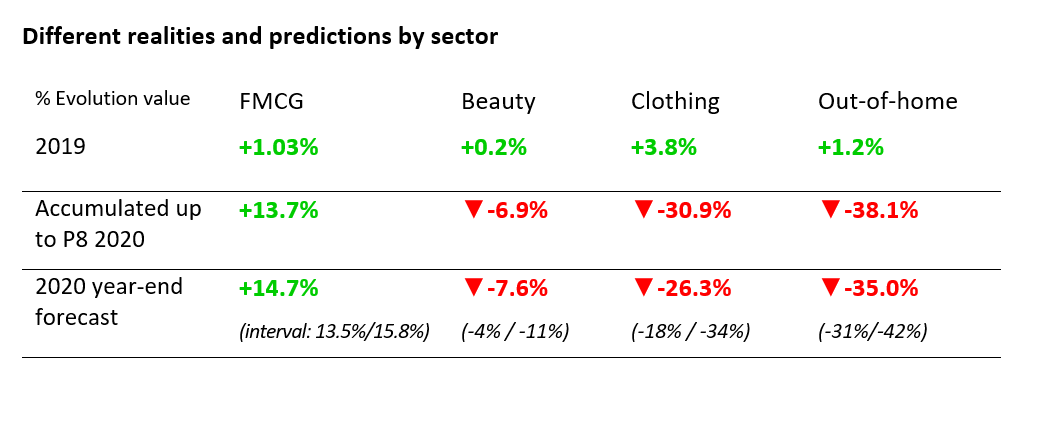

FMCG is continuing to record double-digit growth so far this year in Spain, with an increase of 13.7% compared to the same period in 2019. This is all the more significant compared to the growth of 1.03% in 2019 vs 2018.

During the latest outbreak, economic activities involving food, technology and the environment are proving to be the most resilient and some have even become stronger as a result of the situation.

At the other end of the spectrum, the out-of-home, beauty and clothing sectors will have to wait until 2021 before growth surpasses 2019 levels. So what are our forecasts for the year ahead?

Year-end forecasts for 2020 and 2021

FMCG will end the year with 14.7% annual growth, one percentage point higher than the rest of the year. This is down to people buying more due to the fear factor, partial confinements, the continuance of remote working and the arrival of Christmas campaigns.

The out-of-home and clothing sectors saw respective drops of 38.1% and 30.6% in the year to mid-August, compared to 2019. These figures could see an increase by the end of the year. Although the potential of new coronavirus outbreaks may slightly shrink the results for the beauty sector, this does not rule out a year-end closure of -4%, which would indicate some recovery.

Within FMCG, the beverages sector is predicted to come out on top at the year end, while the fresh food category will continue to demonstrate a positive trend, as will packaged food. Indications are that pharmacy products will maintain their high growth.

Brand type is seen to be a common factor related to growth. Forecasts indicate that manufacturer brands will close at the same levels as FMCG (+14.7%), which is higher than retailer own-brands (+14.3%) although they have narrowed the gap.

Retailer trends are predicted to remain consistent for the rest of the year, with the online channel and regional supermarkets set to come out as the biggest winners.

Kantar’s forecasts also signal a return to normality for the contributions of families, which have returned to 2019 levels, with the exception of those for senior citizens.

The questions of how and why we consume have been other key aspects of 2020. Compared to the previous year, a 10% increase in consumption at home is predicted, which above all will benefit main meals.

Next year we’ll also be talking about a growth of around 9.4% compared to 2019, and this will be a year that will show a pseudo-normality between the level year of 2019 and the exceptional year of 2020.