Although each Latin American country presents different realities and challenges, FMCG consumption across the region as a whole showed healthy signs of recovery in the second quarter of this year. Purchasing volume grew 6.3% in Brazil, 2.2% in Mexico and 2% in Peru, for example, compared to the same period in 2022.

Meanwhile, the volume decline that Colombia, Chile and Argentina had been suffering eased – with falls of -2.2%, -1.5% and -0.8%, respectively – marking a change of course. Only Bolivia, Central America and Ecuador continued to experience the effects of medium and long-term challenges, with sharper drops in consumption of -2.5%, -3.4% and -4.9%.

Another positive indicator of recovery in the region is the return of purchasing frequency to its pre-pandemic level, for the first time since COVID.

Fragmented spend means less loyalty

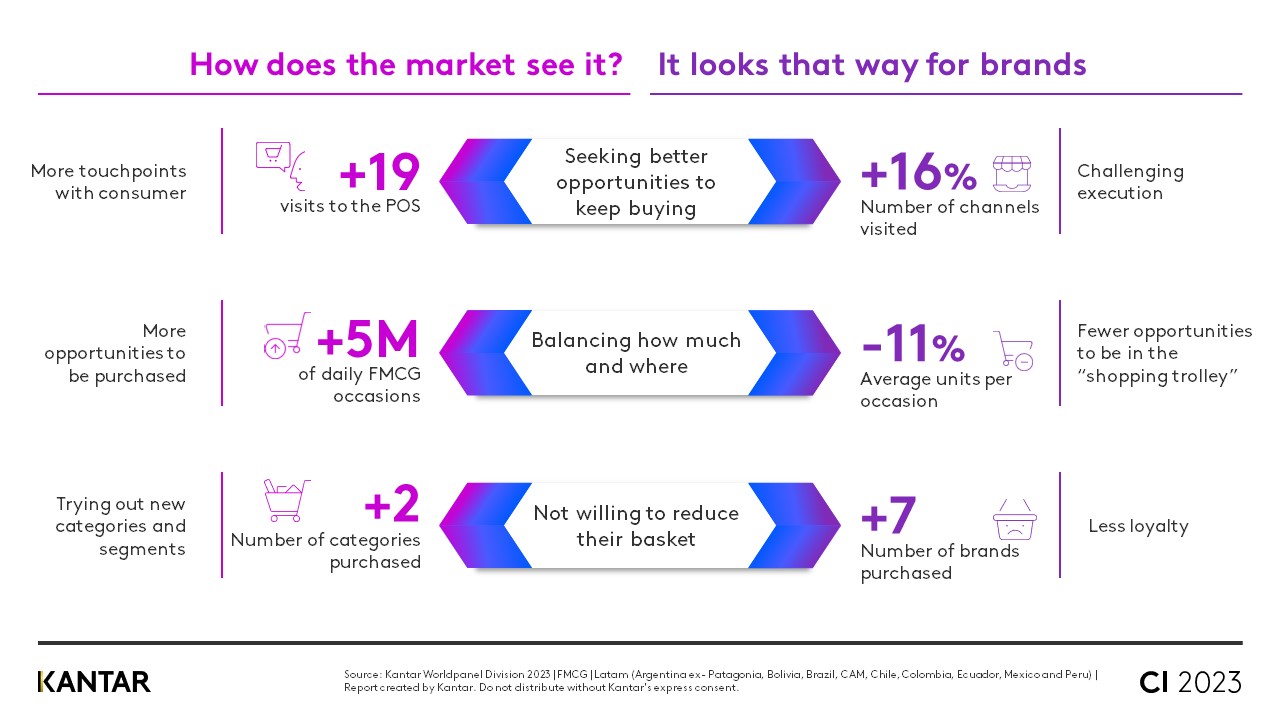

On the other hand, Latin Americans continue to endure a decrease in their purchasing power. This means that they can't afford to spend a large amount per occasion, and instead are fragmenting their spending across more channels and brands to get better deals.

Proof of this behaviour is that, in the last two years, shoppers have only increased the number of categories they purchase by two, but at the same time have expanded their brand repertoire by seven.

New FMCG habits and preferences

Covering more consumption occasions, by ensuring the brand is relevant in as many moments as possible, is essential nowadays to succeed. Beverages is the winner here, when it comes to in-home occasions: although consumption moments were down in the second quarter of this year, these remain 24% above pandemic levels.

Latin Americans are seeking indulgence, with soft drinks being the products they choose most often to satisfy this need. There is also an increasingly intense demand for healthy items. At this point, plant-based drinks, as well as isotonic and energy drinks, are attracting more buyers and more frequent consumption.

Worldpanel’s Consumer Insights Latam Q2 2023 study tracks Latin American buyer behaviour, bringing a 360-degree view of mass consumer goods in the region. Contact us to learn more about your segment and brand and watch our latest Consumer Insighs video here.