Globally, 2023 marked the second-highest FMCG value growth in more than a decade, with total spend increasing by 8.6% over the year. In Asia, the picture was somewhat different. The watchword was ‘stability’, with annual growth of 3.7%, compared with 3.4% the previous year. Spending per household remained flat at US$828, an increase of 1%.

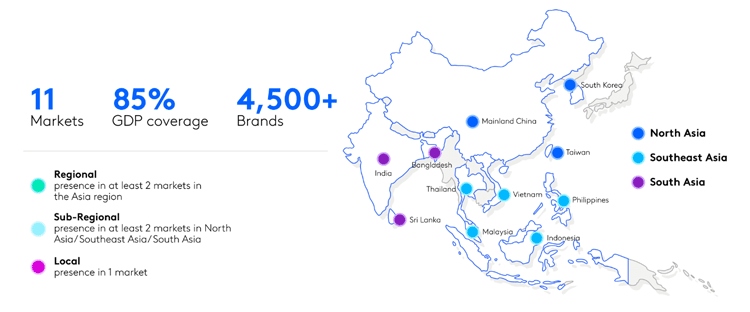

These are the headline discoveries unveiled in the 2024 edition of Kantar Worldpanel’s Asia Brand Footprint report. This comprehensive analysis covers 11 Asian markets, representing 85% of the region’s GDP, and more than 4,500 brands.

The most chosen FMCG brands in Asia

Brand Footprint examines the 232 billion brand choices made by Asian shoppers in 2023, using Kantar Worldpanel’s unique Consumer Reach Point (CRP) methodology. This combines data on population, penetration, and consumer choices (frequency) to determine the most chosen brands.

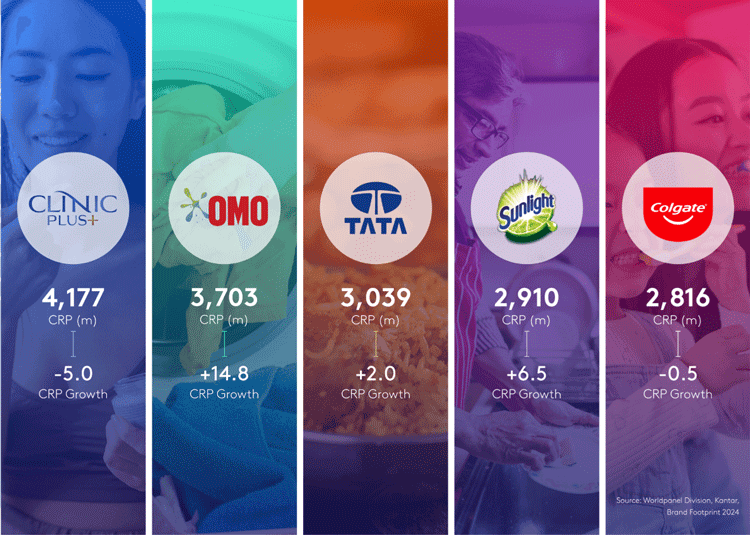

The top 5 most chosen brands in 2024 are:

Decoding Asian shoppers’ brand choices

Focusing on the number of brand choices made across Asia, we see an increase in total CRPs of 3.6% over the last year – almost exactly matching FMCG value growth (3.7%). South Asia has primarily driven this uplift.

Regarding the size of brands, 43% of CRPs are from small (with penetration between 1-10%) and medium (penetration 10-30%) brands. A notable 87% of growing brands are small and medium-sized. Asian consumers favour local brands, which account for a 77.6% share of the region’s total CRPs, especially in North Asia (81.6%) and South Asia (81.4%).

Decoding brand success

The Brand Footprint study has identified the key drivers of brand growth in Asia, and how top brands are successfully leveraging these to stay competitive and ahead in the market.

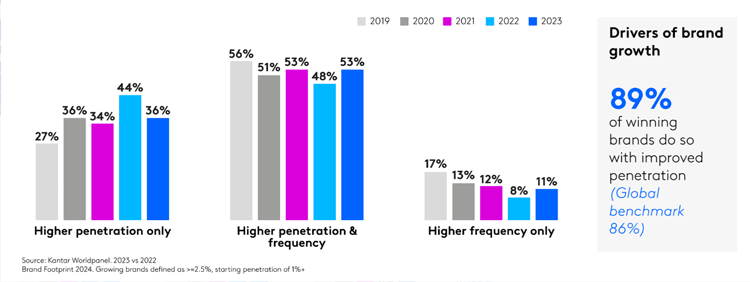

A remarkable 89% of all brands that grew in the last year did so by gaining penetration. In 2023, more than half (53%) of the brands that increased their CRPs in Asia combined greater penetration with increased purchase frequency. Improving penetration alone was successful for 36%, while only 11% grew by upping frequency.

The highest performing brands in the Brand Footprint ranking demonstrate the importance of understanding consumer behaviour and optimising their strategies. To learn from them, and set a course for success in the coming year ahead, brands must:

• Set realistic penetration growth targets, based on their size.

• Position themselves effectively as markets continue to polarise, to Predispose More People to buy.

• Optimise their omnichannel strategy to Be More Present.

• Develop a deep understanding of consumption occasions in order to Find New Space.