In the crowded markets of Europe, where every street corner seems to have its own flavour, you can see the eating habits of a continent as clear as a chalkboard sign outside a cafe. A Brit reaches for an on-the-go snack; a Spaniard sits down for a lunch that’s less a meal and more a leisurely affair, course after course. Each moment says something different about the people who live it. And yet, these habits are not carved in stone. They’re shifting, morphing, evolving — like the world around them.

For brands in the food and beverage game, these differences can sometimes feel like a riddle and a gift wrapped in the same package. Crack the code, and you’ve got a key to the pantry. Miss the mark, and you’re just another product lost in the supermarket aisle. In a world of such fluid habits, brands that are meaningfully different and present at the right moments have a real opportunity to stand out.

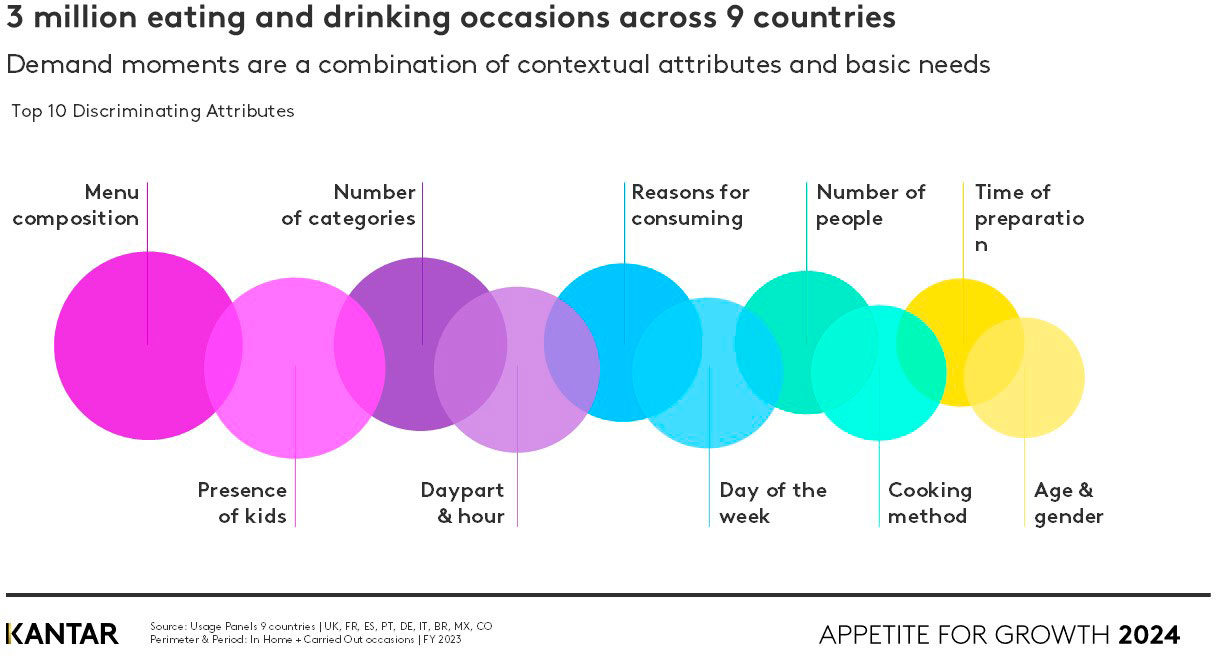

But it’s not just Europe. All over the globe, these changes are brewing. And we’ve set out to understand them in the biggest study of its kind. We call them ‘Demand Moments’ — those little ticks of the clock when someone reaches for a snack, a sip, a something. Over three years, we analysed 3 million food and drink occasions across nine countries, distilling them into 14 “moments of truth”.

What’s behind these choices? What makes someone grab a quick bite, or sit down for a feast? And, most importantly, how is all this changing as we speak?

We’ve gone deep into the kitchens, cafes, fast food joints, and home-cooked meals across three continents. We’re looking at those moments, trying to grasp what drives them. Understanding these moments isn’t just about food — it’s about understanding ourselves.

It’s a model that examines the contextual, functional, and emotional aspects of consumption and captures crucial regional differences that make all the difference.

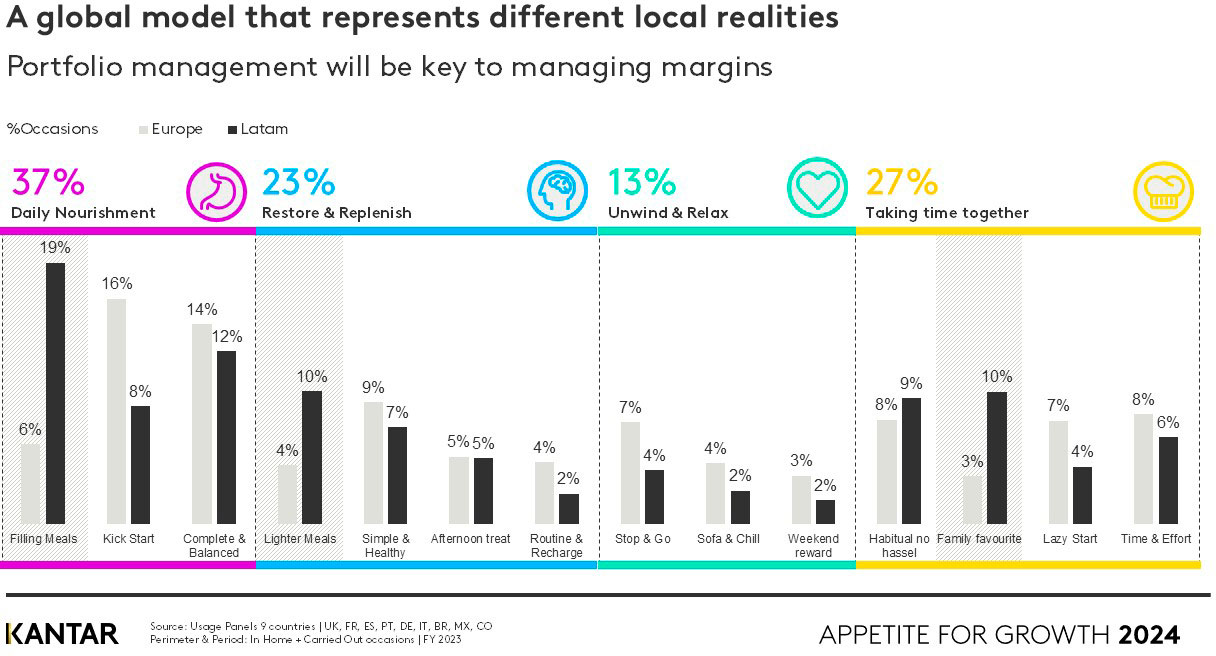

Key regional differences

Germany and the UK: snacking strongholds

Germany and the United Kingdom are where snacking has taken hold, transformed from a minor habit into a full-blown behaviour. In the UK, snacks comprise 28% of all eating occasions, outpacing breakfast at 27%. Germany isn’t far behind, with snacks accounting for 25%. This isn’t some passing trend; it’s a fundamental shift in how people structure their meals. Our Demand Moments model pinpoints this change, especially through moments like “Stop & Go,” “Sofa & Chill,” and “Weekend Reward” in the UK, and “Habitual No Hassles” in Germany.

In Germany, practicality rules. The “Habitual No Hassles” moment is all about meals that are simple, efficient, and require minimal fuss. Think Abendbrot — bread, cheese, cold cuts. It’s straightforward, no-nonsense, and fits seamlessly into the day. For brands, this means offering products that slot into these routines without adding complexity.

In the UK, snacking is more than convenience; it’s woven into the fabric of daily life. “Stop & Go,” “Sofa & Chill,” and “Weekend Reward” reflect a lifestyle where snacking fits comfortably alongside leisure and comfort. Brands that understand this and can provide indulgent yet convenient snacks will find themselves well-positioned in this market.

Mediterranean countries: meals as social rituals

Now, step south to the Mediterranean-facing countries — Spain, Italy, France — where meals are social rituals. Here, food is layered with meaning, from the starters to the desserts, each course playing its part in a structured, multi-course experience. Our Demand Moments model captures this through higher indexing Demand Moments such as “Family Favourites” and “Time and Effort” in France, and “Complete and Balanced” and “Simple and Healthy” in Italy and Spain.

In France, meals are about pleasure and tradition. “Family Favourites” and “Time and Effort” moments are about gourmet dining, where meals are carefully prepared, often multi-course, and always enjoyed in the company of family or friends. Brands looking to enter this market must respect these values, offering products that enhance the dining experience without cutting corners on quality.

In Italy and Spain, it’s about balance and simplicity. The “Complete and Balanced” and “Simple and Healthy” moments reflect a diet rich in fruits, vegetables, grains, and lean proteins. These meals are often minimally processed and naturally nutritious. Brands aiming for success here should focus on products that align with the Mediterranean ethos of healthy, wholesome eating, highlighting natural ingredients and a balanced approach.

Latin America: a commitment to tradition

Shift across the Atlantic to Latin America, where food is the glue that holds family and community life together. Tradition reigns supreme, especially in Brazil, where 85% of eating occasions are either main meals or breakfast, with snacking taking a backseat. The Demand Moments model illuminates how these preferences shape consumption, particularly through “Filling Meals” in Mexico and “Kick Start” and “Lighter Meals” in Brazil.

In Mexico, the “Filling Meals” moment is all about hearty, communal meals shared with loved ones. These meals are about connection and celebration. Brands that want to make inroads here should focus on products that fit seamlessly into these communal settings, complementing traditional Mexican dishes while adding a touch of convenience or enhancing flavour.

In Brazil, it’s all about starting the day strong. The “Kick Start” moment prioritises a hearty breakfast, while the “Lighter Meals” moment in the evening reflects a preference for quick, easy options. Brands can tap into these habits by offering products that provide a nutritious breakfast while also catering to the demand for simpler, low-effort meals later in the day, ensuring they are present at the key moments that matter.

A global framework with local precision

The Demand Moments model is a precise tool for understanding the subtleties of how people eat, drink, and snack across different regions. While global trends like the rise of snacking are significant, the real opportunities lie in the local nuances.

The diversity in consumption habits is an opportunity — a chance to differentiate for success.

Implications for brands

Understanding these regional nuances allows brands to tailor their strategies effectively:

- In snack-heavy markets like Germany and the UK, brands can focus on developing innovative snack options that cater to local tastes.

- In south-west Europe, promoting ready-made meals that save time without compromising on taste can resonate well with consumers.

- In Latin America, products that emphasise communal aspects and traditional flavours can be particularly appealing.