More global shopping baskets are being filled with mega-brand names, with 20 of the top 25 brands showing growth in how often they were chosen by consumers in 2019. Overall though, local brands had a stronger 2019 than global brands. These are two key findings from Kantar’s 2020 Brand Footprint ranking, a global measure of how often brands are chosen across the world.

The annual ranking, which focuses on the long term performance of brands, includes a special analysis on how the biggest brands are faring during the current pandemic, with early signs showing that they are winning in relative terms.

Key findings include:

A shift in favour to the top 25 global FMCG brands

- 424 billion brand choices were made throughout the year, representing a 2.6% increase in CRPs (Consumer Reach Points) compared to 2018.

- Global brands grew CRPs by 2% in 2019 compared to zero% growth in 2018, but this wasn’t enough to beat out local brands which grew CRPs by 3.1% around the world.

- Global brands now account for one in three (34.1%) brand choices around the world, while local/regional brands account for two in three (65.9%) of the brands placed in shopping baskets.

- The biggest global brands responded best to the challenge posed by local brands in the past few years, showing their most successful growth rate than in any previous Brand Footprint. 20 of the top 25 (80%) ranked brands achieved growth in 2019, compared to 48% in 2018.

- The top 50 Global brands accounted for 15.5% of all brand choices made in 2019 and accounted for 24% of the growth in items purchased.

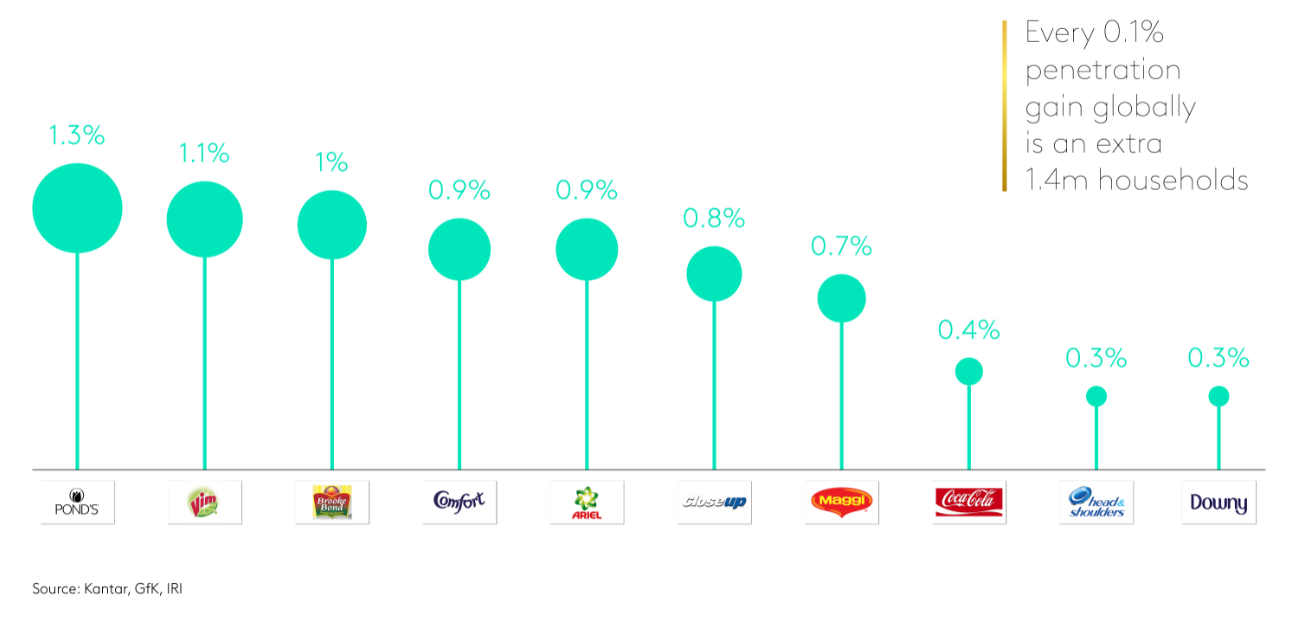

- Three top 50 brands (Pond’s, Vim and Brooke Bond) achieved a global penetration gain of 1% or more – meaning an additional 14 million new customers each. Every 0.1% penetration gain globally is an extra 1.4m shoppers

Top 10 most chosen brands globally

|

2019 Rank |

Change vs. 2018 |

Brand |

CRP (m) |

CRP Growth |

Penetration |

Consumer Choice |

|

1 |

= |

Coca-Cola |

6,094 |

0.4% |

42.1% |

12.3 |

|

2 |

= |

Colgate |

4,157 |

7% |

59.7% |

5.9 |

|

3 |

= |

Maggi |

3,117 |

12% |

32.3% |

8.2 |

|

4 |

= |

Lay's |

2,608 |

8% |

30.4% |

7.3 |

|

5 |

= |

Lifebuoy |

2,450 |

8% |

25.0% |

8.3 |

|

6 |

= |

Pepsi |

2,156 |

2% |

22.8% |

8.0 |

|

7 |

2 |

Sunsilk |

1,981 |

8% |

23.3% |

7.2 |

|

8 |

-1 |

Dove |

1,962 |

5% |

36.8% |

4.5 |

|

9 |

1 |

Indomie |

1,907 |

7% |

4.9% |

32.9 |

|

10 |

-2 |

Nescafé |

1,834 |

-2% |

22.6% |

6.9 |

Source: Kantar’s Brand Footprint report

More brands than ever chosen over 1 billion times

- There are now 40 brands around the world that are placed in consumers’ shopping baskets more than one billion times per year. In addition to the 22 Global ‘billionaire brands’, the number of local billionaire brands has grown from 14 to 18. All 18 are either Indian or Chinese.

- Five global brands joined the billionaires club: Brooke Bond, Head & Shoulders, Kinder, Heinz and Oreo.

- Coca-Cola remains the world’s most chosen brand on the planet, picked from the shelves over 6bn times during the year; followed by Colgate in second place (chosen 4bn times) and Maggi in third (3bn times).

India a key lever of growth

- In the latest ranking India was the country that contributed the most growth for 13 of the top 25 ranked brands. This compares to 8 of the top 25 in 2018, demonstrating the nation’s increasing importance to brand success.

- The unique shopping habits of Indian consumers become more evident in 2019, with FMCG brands being bought more often across the country and in smaller quantities.

- Homegrown brands like Patanjali and Dabur increased their nationwide penetration in 2019, challenging the dominance and growth of leading market players and underlining the global popularity of natural and ayurvedic beauty products

Sector winners and losers

- Across all FMCG sectors competition got tougher. Overall just 46% of brands achieved CRP growth in 2019 compared to 47% of brands in 2018, 49% in 2017 and 52% in 2016.

- CRPs in the dairy sector grew by 0.7%, with global brands losing market share to local brands for the second successive year.

- The food sector grew by 2.7% during the year while market share between global brands and local brands remained unchanged at 27.6%/72.4%.

- In the Beverage sector growth by global brands outperformed growth by local brands. As a result global players increased their market share to 38.4%

- Coca-Cola gained momentum for the first time since 2013, now picked from the shelves over 6.0 bn times in a year, with a much-improved performance.

- The health and beauty sector was the fastest growing category by CRP growth with an increase of 6.1%. Local brands benefited slightly more from the growth compared to global brands. Global brands now account for 59.6% of brand choices down 0.6% vs 2018, a second successive loss of share.

Find out more

To learn more about Kantar’s Brand Footprint, explore the data and request more information, please visit www.kantar.com/brandfootprint.

Watch the webinar here.

Notes for editors

About Kantar Brand Footprint: Kantar’s annual Brand Footprint study is based on research from 74% of the global population; a total of one billion households in 52 countries across five continents—covering 85% of the global GDP. As part of the study, Worldpanel tracks more than 22,900 brands across beverages, food, dairy, health and beauty and homecare.