Network service providers undeniably fuel our personal and working lives. We rely on them for connection, entertainment and information. They create connections to the people and things that we depend on every day. As a technology-driven industry, telecommunications is ever-evolving, and providers have led much of the digital transformation that has re-shaped our world over the last few decades.

And yet telco-baiting is a global sport. We love to hate them. Everyone has a story to tell about how their current or previous provider has treated them badly. Unsurprisingly, customer loyalty and associated churn are a big issue for most providers. This dynamic is endemic — a problem for the industry — and it will only get worse with time as incumbent providers’ competitive analogue moat of infrastructure and profits erode with the introduction of new technologies.

A lack of differentiation

Consumers find little meaningful difference between the main providers. There are, of course, important technical differences between providers in network performance, and the specific products and services offered. But the average consumer isn’t hugely interested in the technical differences providers often showcase. CX+ 2020 Technology, Media and Telecommunications (TMT) research shows that just half of all customers are clear on what their network service provider stands for. And this customer understanding of brand promise varies widely between providers, from a low of just 22% to a high of 72%.

There are exceptions, most notably when entertainment content becomes part of the package and when less established providers (often mobile virtual network operators or no-frills providers) find ways to innovate around a clearly targeted offer and/or a clear point of difference. But for many customers, the service is a perceived utility and price the main differentiator of choice.

CX relationship building

This emotional disconnect between providers and the customer starts before a contract is even signed. Normalised patterns of interaction establish negative dynamics and counter-productive customer expectations from the beginning of the relationship. At the point of entry to the brand, people are forced to navigate through complex product information to try and identify the best deal, while provider sales staff try to up-sell potential customers to a more expensive plan. Adversarial tension and lack of trust are established from the outset. A similar pattern often plays out in the customer journey further downstream at potential renewal points, when many customers feel like they have to threaten to leave in order to get a good deal – with the added assumption that new customers are likely to get the best deals anyway. In the interim, if anything ‘goes wrong’, it can be hard work and time consuming for the customer, who must navigate through automated channels to try to resolve the issue or get through to a human who can help. It often feels like a battle between customer and provider!

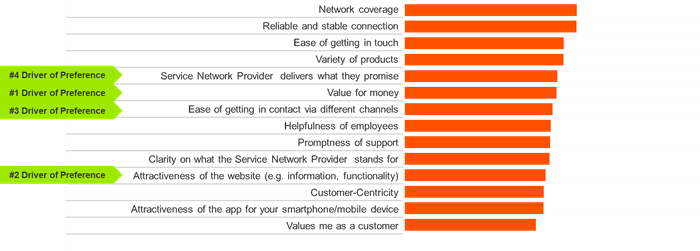

‘Ease of getting in touch’ is the #3 driver of brand preference globally

Even if this isn’t always the case — and it is starting to change — it’s an ingrained perception that’s been built over time, by an industry that was established in a pre-digital era. Legacy customer management systems were built at scale, often evolved through acquisitions and mergers and inevitably have been difficult and slow to transition to seamless digital-first models that are already well-established in other sectors. As providers move to digital service channels, customers will often stick to what they know and not change, unless there is good reason to do so. They’ve been burnt too many times with things like tone-deaf interactive voice response systems and clueless chatbots, that have clearly been more about cost reduction than improved CX. New service channels need to be a genuine improvement, with well-communicated end-user benefits that deliver against the brand promise.

Consumer perceptions of what ‘good’ looks like has also changed significantly over the years and continues to evolve. Customer experiences with brands outside the category set expectations for what any large company should be able to provide. Disruptive digital natives have grown by smartly identifying unmet consumer needs, matching them with a clear proposition, and then delivering it simply with laser focus through customer experience as a point of meaningful difference. There are many examples but to put it simply — the Amazon effect. If Amazon can do what they do — at the scale that they operate — and deliver the level of customer experience that they do, then why can’t my telco provider? And almost everyone uses Amazon, so expectations are set that other brands in other customer categories must live up to. Even if comparisons are subconscious, they are still being made.

Meaningful difference is at the core of CX innovation

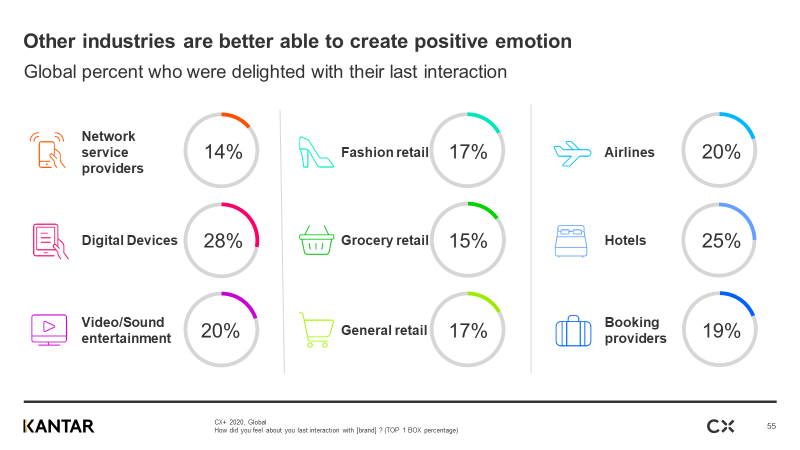

Consumers have relatively low expectations for telco CX, and often find their provider still falls short of those expectations. Just 14% of network service provider customers were delighted with their last interaction — the lowest for any category studied in CX+ 2020.

Other industries are better able to create positive emotion

COVID-19 has also forced customer sales through ecommerce channels and shifted customers to digital service channels, so the pressures to deliver excellent service have only intensified. Society will become more reliant on provider services over time, and there is a clear opportunity here for providers. Beyond the obvious need to deliver functional requirements with the best technical service possible, creating meaningful difference through CX excellence remains the challenge. Some smaller, disruptive providers, such as GiffGaff and Sky in the UK have risen to the task. Sky expanded their offer into mobile in 2017 in partnership with O2, with a clear link to streaming their existing entertainment packages. But they also deliver tangible and differentiated customer benefits, such as allowing customers to roll over unused data for up to 3 years and allowing people to draw on unused data as partial payment for upgrades.

Successful telecom brands will raise the CX bar

It’s difficult to shake off established norms that have played out for 30+ years. But imagine a major telco provider that clearly communicates a differentiated brand promise — one that uses data assets and analytics to anticipate and personalise what customers need? One that uses the precious few interactions to genuinely make customers feel valued? This would be a provider who will have done for telecommunications what fin-tech disruptors, such as Revolut and Monzo, have done for the personal banking world. By offering non-product-focused services and innovative benefits, such as categorised monthly spend accessible via a frictionless app for custom budget tracking, they have found a way deliver clear advantages.

A few telecoms providers have charted a way towards the future in this way, and you can learn more about them in CX+ 2020 TMT. But enormous white space remains for innovative telecommunications brands to do this at scale. Providers can help themselves by removing silos and creating stronger internal partnerships between brand, innovation and CX, which allows for a stronger customer-centric proposition. A clear brand promise, authentically delivered through CX excellence, with products and services innovation driven by genuine customer need… From a customer point of view, why would you not want that? All very strong reasons to move the conversation beyond price and access, allowing customers to actively choose brands for what they deliver, stay loyal for longer and spread the word.

To find out more watch our webinar: Reboot your CX understanding to supercharge growth. Or get in touch.