As Americans become more unsettled with their shelter-at-home lives, new at-home behaviors are emerging that will no doubt impact incumbent marketers. Restless consumers looking to feel safe, fight boredom, and ultimately reclaim a sense of normalcy, are now also trying brands they might not otherwise choose. Americans are baking more, making it hard for supermarkets to keep traditional flour and yeast ingredients in-stock. We are also becoming more self-sufficient, proudly sharing how to farm used lettuce, tomatoes, and onions via social media.

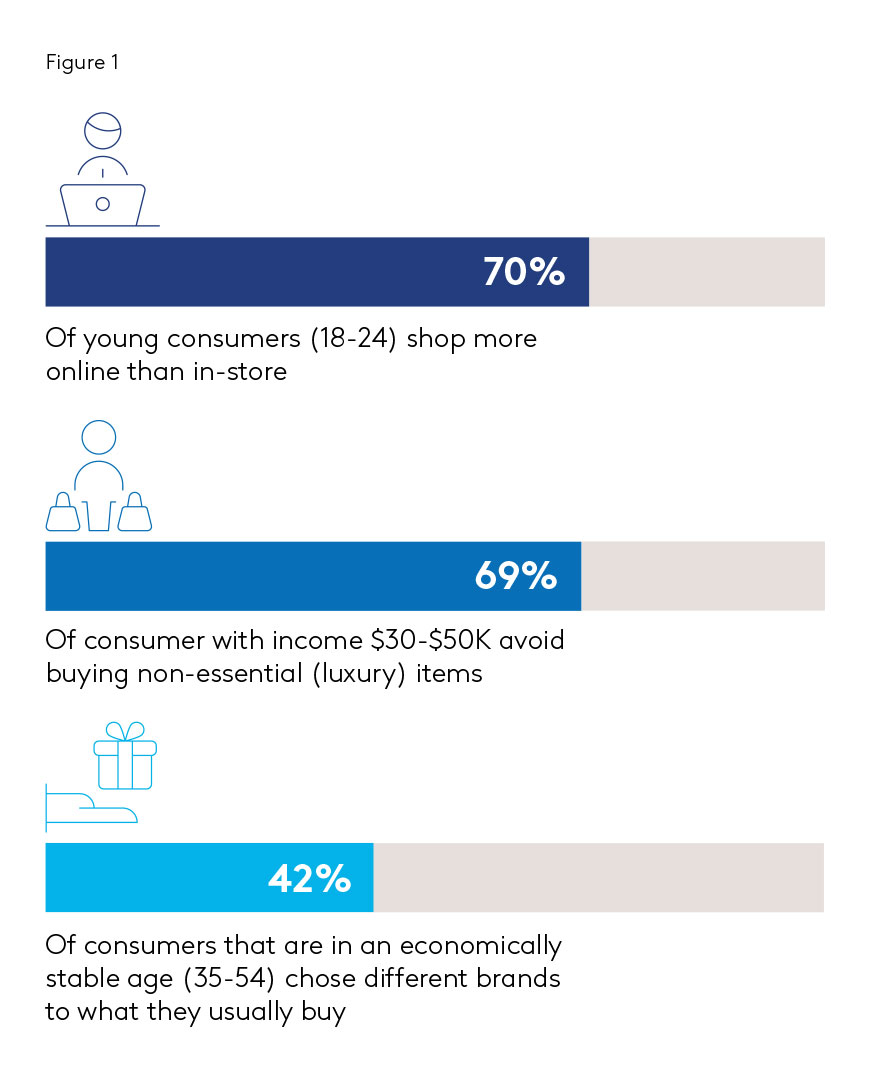

We are even spending time inspiring others through unexpected gifts of rocks painted with inspirational messages. These new activities foreshadow a wave of unanticipated consumer behaviours that will continue to change over the next several months and perhaps years. Since the start of the pandemic, Kantar has been measuring how consumer behaviours are changing. Over the last month, online shopping has increased from 45% to 58%, including an increase to 70% among 18 24 y/o. To save money, Americans who are avoiding the purchase of non-essential items has increased from 43% to 60%, with consumers with income $30-$50k peaking at 69%.

Consumers are more promiscuous with the brands they are purchasing. Forty-two percent of the economically-stable 35-54 y/o consumers have tried different brands to those they would usually buy.

These changes come to life when looking at real consumer voices and videos using Kantar’s Qualitative VideoVoice method.

Changing consumer behaviour is playing out within the alcoholic beverages category in particular, where consumers are finding new ways to enjoy themselves by trying new brands.

It’s clear that now more than ever, Americans are willing to try new things. For brand managers anticipating how these emerging behaviours will impact their category is paramount. Increasingly, consumers are being pulled into a new trial, especially when a preferred brand is out of stock or takes too long to be delivered. This pulled promiscuity represents an opportunity for challenger brands to win new users and retain them as loyal customers. This also means that regular incumbent brands may be under attack and will need to act to maintain their tried-and-true customer base. No matter how you look at it, brand inactivity now would be detrimental.