Chaos and order

Governments around the world are slowly reopening societies and economies. However, people are reluctant to quickly return to their former engagement in activities. Almost half (46%) say they will delay their return to normal consumer habits because of concerns about their safety or the safety of their loved ones. Despite the best laid plans, it seems global citizens are taking an alternate route, with many preferring to forego the liveliness of restaurants and gyms and stick to the safety of homemade meals and living room workouts for the moment.

Wave 6 of Kantar’s COVID-19 Barometer, which has interviewed more than 100,000 consumers in over 60 markets worldwide, finds that 60% of people say they are staying put for at least another month. Another 30-50% are vowing to wait at least 2-3 months or longer before returning to economic activities, such as (non-food) shopping, visiting restaurants or bars, travelling more widely, or visiting gyms or cinemas. Maslowian needs around safety and security remain unmet. Until people are ready to climb the pyramid to the next level, economic recovery may stagnate. But brands can play a positive role with the right knowledge — to nudge people up Maslow’s hierarchy of needs.

Pandemic affiliations

Different things bring people together: kinship, ethnicity, politics or ideology. The British Isles is home to the UK Roundabout Appreciation Society, for those who seen no greater cause than beautifying the rotisseries of the roads. It is also home to the Ejection Tie Club, for fighter pilots who have looked death in the face at 30 Gs. While these two groups probably represent opposite ends of the human spectrum, the tribally affiliated individuals within them are apt to share common beliefs and behaviour – and this is key.

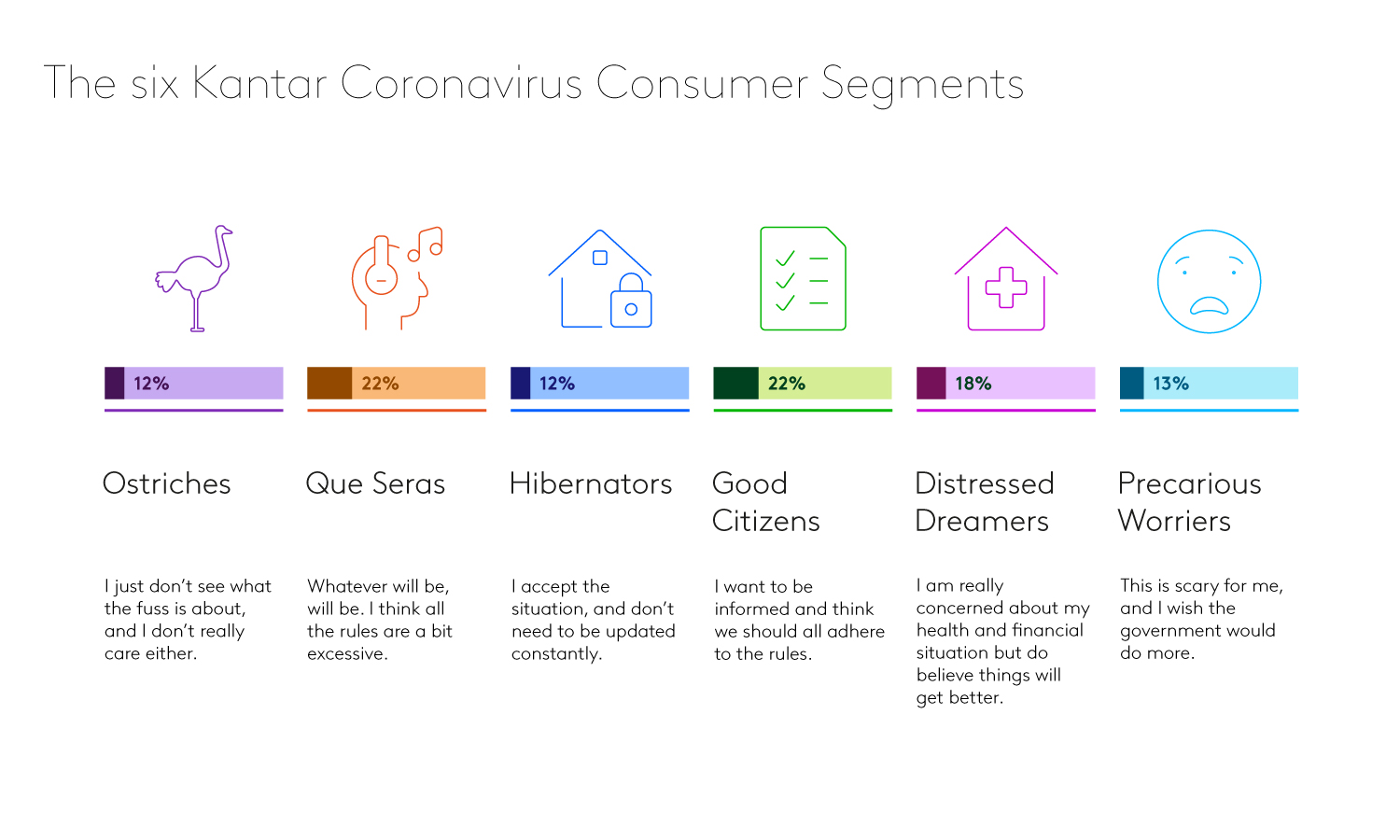

To help brands better navigate COVID-19 complexity, Kantar research has identified six distinct coronavirus segments – defined by the levels of worry that they are experiencing, their information consumption, how conscientiously they adhere to rules, and their trust in government. Our segmentation can help brands better plan, communicate, engage and innovate in ways that will encourage people with empathic understanding, and entice them to interact with brands in ways that will shorten the path to economic recovery. It informs a perspective of how each group responds differently to stress and adversity, empowering businesses to better navigate consumer environment in the near and longer term.

The six Kantar Coronavirus Consumer Segments are:

- The Ostriches (12% of consumers): I just don’t see what the fuss is about, and I don’t really care either.

- The Que Seras (Whatever will be, will be) (22%): I think all the rules are a bit excessive.

- The Hibernators (12%): I accept the situation, and don’t need to be updated constantly.

- The Good Citizens (22%): I want to be informed and think we should all adhere to the rules.

- The Distressed Dreamers (18%): I am really concerned about my health and financial situation but do believe things will get better.

- The Precarious Worriers (13%): This is scary for me, and I wish the government would do more.

The Coronavirus Segments in action

Businesses can use the segments to inform brand strategy, communications, customer experience and innovation. Marketers can first familiarise themselves with this landscape of differing emotional and practical needs to inform overall brand strategy. They must then appreciate each segment’s relationship with the category and their specific brand. This determines the overall role the brand can play in peoples’ lives and the primary benefit it will deliver, whether that is guidance for Precarious Worriers or inspiration for Que Seras.

Next, clarifying each segment’s unique behavioural dynamics within the category and brand will help focus investment around the strategic initiatives most likely to deliver value to the customer and the business. For example, Distressed Dreamers, who generally need support, are likely to respond well to practical interventions that reassure them at key steps along the path-to-purchase, whereas Ostriches who are eager to escape will be well-served by a brand that reduces friction caused by the pandemic and lets them forget it’s happening. Finally, these segments can be overlaid or combined with client brand segments to further propel learnings.

Tribes are transitional to growth

As lockdowns loosen globally, it is important that marketers meet people ‘where they’re at’, along their personal journeys towards resuming life. Like roundabout fans and fearless fighter pilots, our research mirrors the polarising differences observed in modern societies in the somewhat opposing sentiments of the two largest segments – the Que Seras and the Good Citizens. But taking the middle road for marketing won’t work to bridge the divide between these two groups. Rather, acknowledging and working with people’s differences in beliefs, attitudes and behaviour is essential to effective marketing, particularly when many are feeling stressed and disconnected and others are not. With this understanding businesses can work to effectively encourage re-engagement and foster the return to economic growth.

Please reach out for more information and advice specific to each segment.