Before the outbreak of COVID-19, beauty and personal care was growing more than twice as fast as total FMCG. As a result, some of the biggest global manufacturers were shifting their commercial strategies to focus more on the sector.

But as lockdowns and social distancing became a new part of our lives, beauty and personal care usage fell. The sector was dealt a heavy blow.

And yet, some categories are already showing the green shoots of a recovery. And as we come to the end of a tumultuous year, there is hope for beauty brands and manufacturers to win in 2021.

Pre-COVID-19: A story of growth

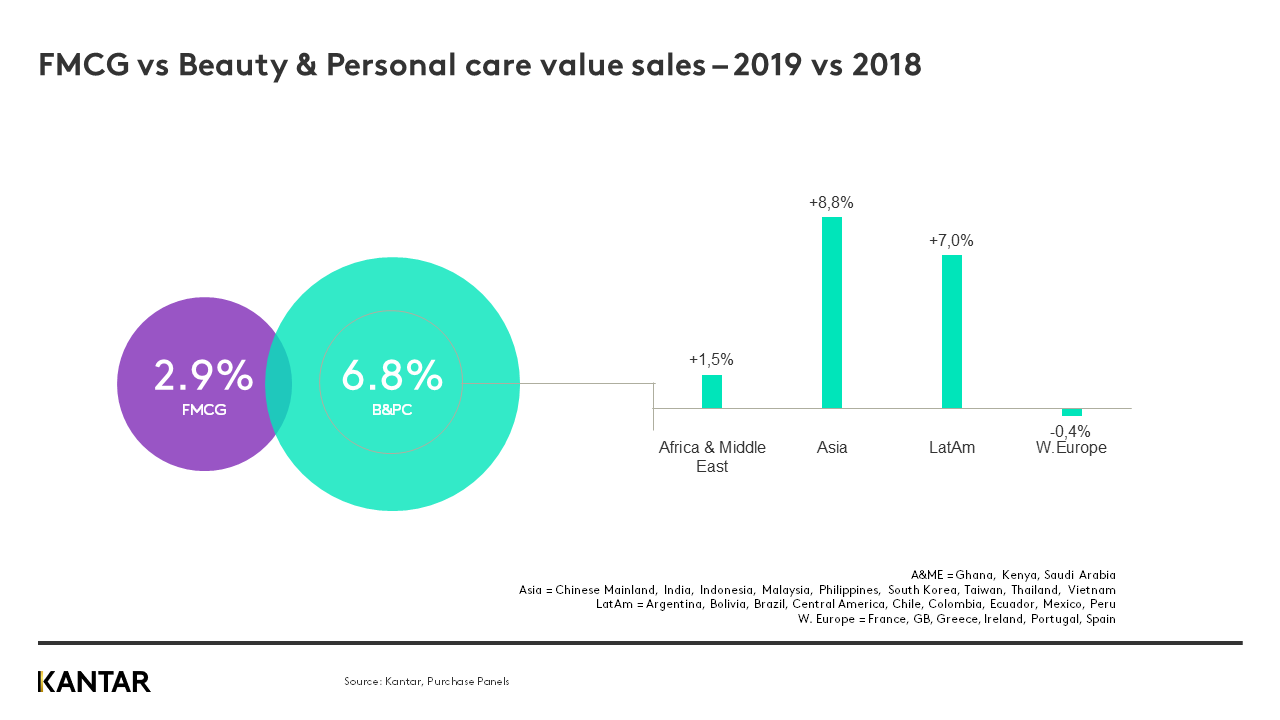

Before the pandemic struck, beauty and personal care was growing at 6.8% – more than twice the growth of total FMCG (2.9%). All 20 of the categories included in our sector definition were growing, with 16 of these at a faster rate than FMCG overall. Skin moisturisers (10.7% growth) and hair care (8.5%) were the main drivers. These categories had a combined 39% of sector spend and were responsible for over 50% of total growth.

This growth was driven by Asia (with 8.8% growth). The region accounted for two-thirds (67%) of the total value, with an enormous 40% from Mainland China alone.

Mainland China’s dominance of the industry isn’t solely due to its population size. The market has 21% of households, but these consumers spend much more on beauty products than their counterparts around the world – evidenced by the fact they were responsible for 65% of sector growth.

2019 was a standout year for the industry. All signs pointed to another strong year to come.

An industry hit hard

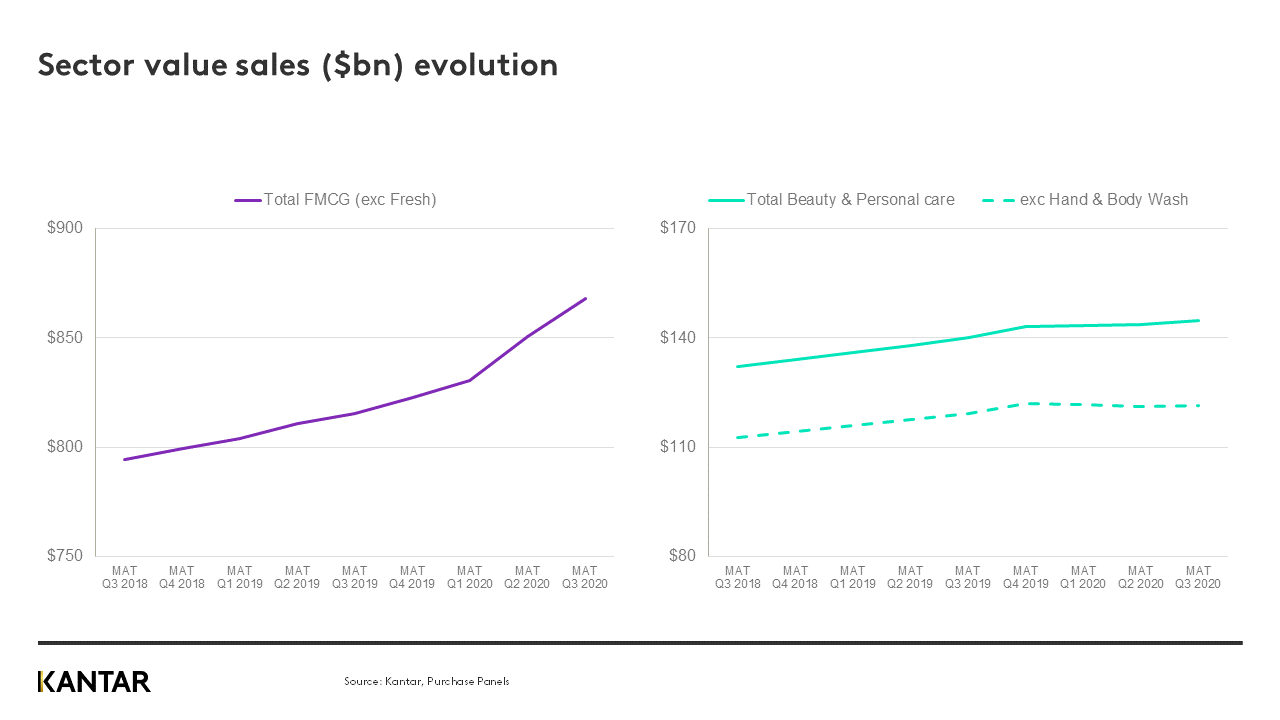

There’s no escaping the damage the pandemic dealt to the growth of the beauty and personal care sector. By the end of September, the value growth of the sector had slowed to 1.1%.

While this might not seem a significant fall, this is against the backdrop of being the most dynamic FMCG sector in 2019. This figure is also artificially inflated by sales of hand and body wash in 2020. Consumer demand for anti-bacterial hand gel rocketed as knowledge of the virus spread. Removing sales in this category reveals a starker picture: a drop in value growth of 0.4%.

At the same time, total FMCG has been booming. By the end of Q3, total FMCG overall sales were five times faster than the beauty and personal care sector, at 5.5%. We forecast annual FMCG sales to have grown between 7% and 8% by the end of 2020.

Value sales on a month-by-month basis showed an enormous dip in February (down 13%), driven by restrictions placed on movement in Mainland China. Another significant fall then occurred in the wake of European restrictions in April (dropping 10%).

These monthly falls in sales come through in the rolling annual growth of the sector (excluding hand and body wash). Value sales fell 0.3% in the first quarter of the year, and then 0.7% by the end of the first half. As stated, by September, the sector was only down 0.4% as it began its ongoing recovery. And with some of the mega-categories moving in the right direction, there are brighter signs on the horizon.

The impact of COVID-19: Mega-Category focus

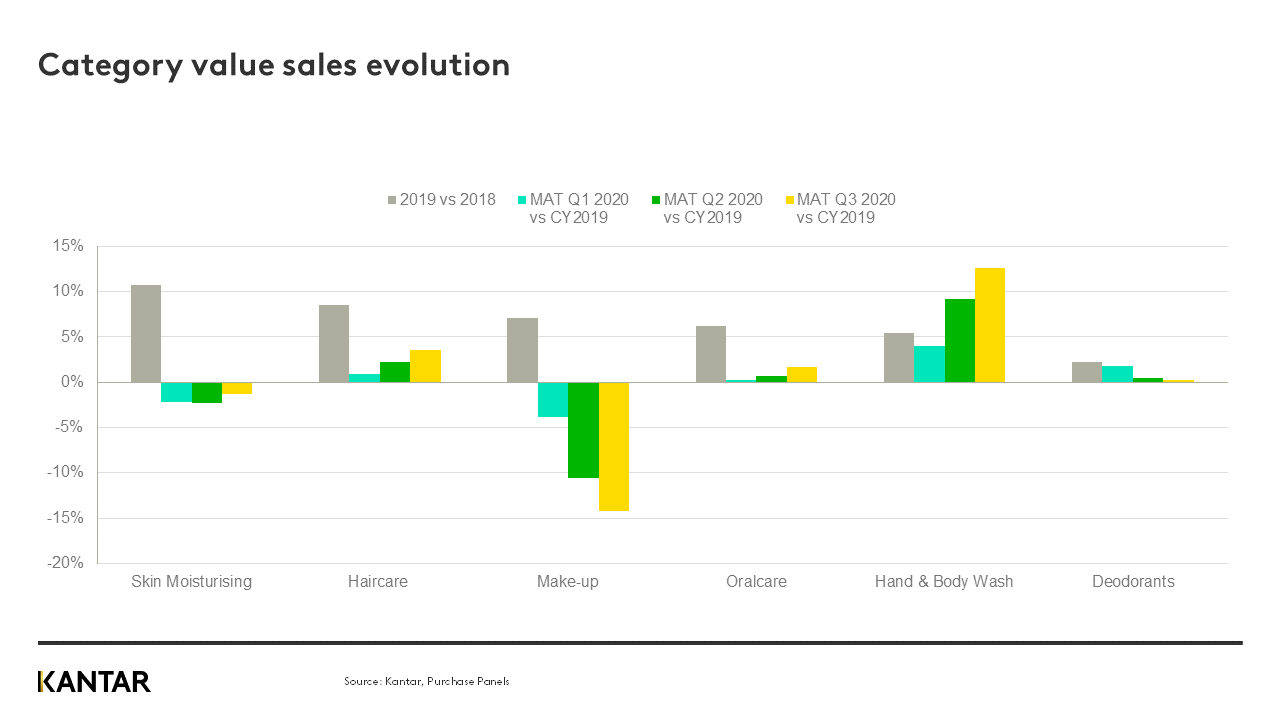

For some categories, there is an overall story of sharp decline followed by a steady climb back to growth, or towards recovery. However, there are some notable differences between each. First, let’s turn to the categories that are still declining or moving in the wrong direction.

The category hit hardest by COVID-19 has undoubtedly been cosmetics. As restaurants, bars and nightclubs around the world closed, category usage reduced dramatically. By September, make-up sales had fallen by 14.2%.

Deodorants is another category moving in the wrong direction. While remaining in growth, the category has seen this slow over the year. However, there are different dynamics at play here. In Q1, deodorant growth remained consistent with 2019 at 2%, and the decline came in Q2. The reason for this delayed impact is the lack of category penetration in China – just 5%. With this market driving the sector performance in Q1, it had little impact on Deodorants.

We turn now to some of the categories driving the sector’s developing return to growth.

Green shoots of recovery

Skin moisturising was initially hit hard by the pandemic. Its strong reliance on Asia meant its sales fell in Q1 by 2.2% and stayed at that level in Q2, with a 2.3% decline. However, by the end of Q3, decline had reduced to just 1.3% – a move in the right direction. This will need to continue for the sector to return to overall growth, given how integral the category is.

Meanwhile, growth in hair care and oral care did slowdown in 2020. Yet they both managed to remain in growth and have both seen an improvement in performance as we move through the year.

Finally, the success category throughout the COVID-19 pandemic: hand and body wash. The refocus on hygiene, with the use of anti-bacterial gel encouraged by many governments, has been incredibly beneficial to the category. Overall, by the end of Q3, it had grown by 12.6% – with full year category sales for 2020 likely to be over 15%.

Online accelerates, the global players outperform

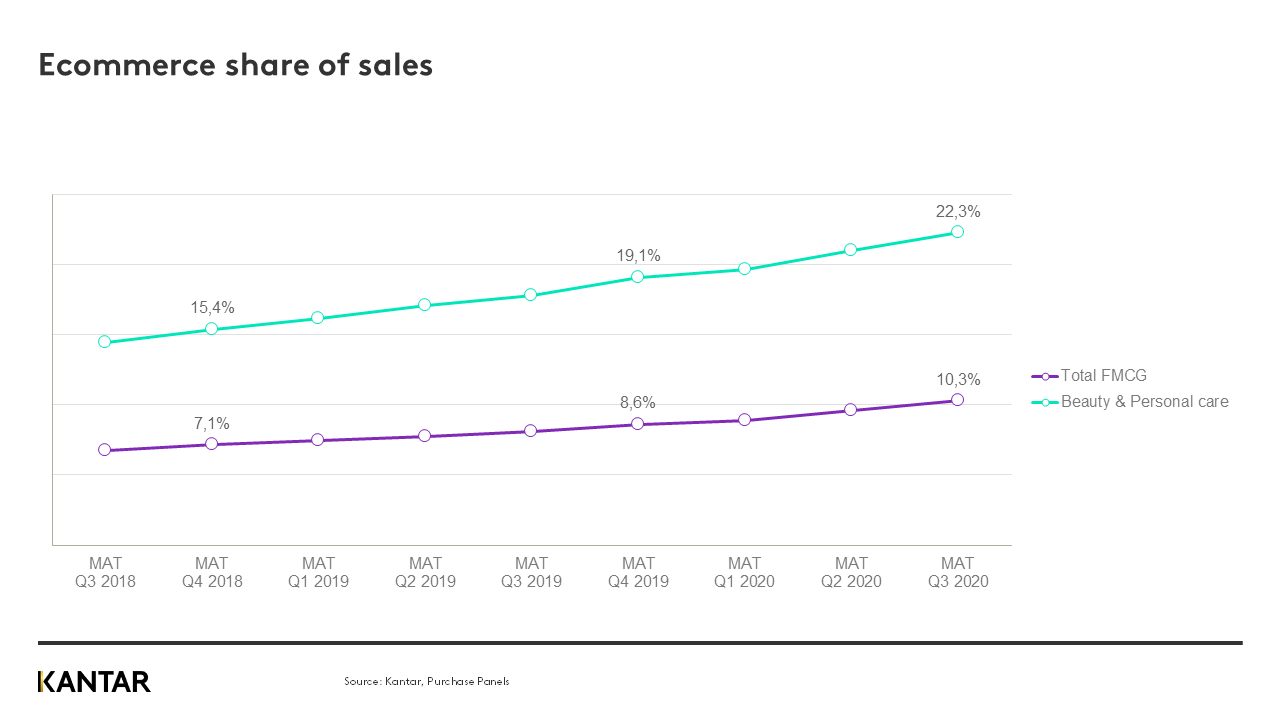

Before COVID-19, the share of sales for ecommerce in beauty and personal care was more than double that of total FMCG. And this importance was growing, having increased its share by 3.7% by the end of 2019. The channel accounted for 19% of sector spend and contributed 74% of growth.

The pandemic has served to accelerate this trend. Ecommerce sales to the end of September 2020 gained an additional 3.2% of sector spend. With no signs of slowing, the channel is set to reach well over 23% of spend by the end of the year.

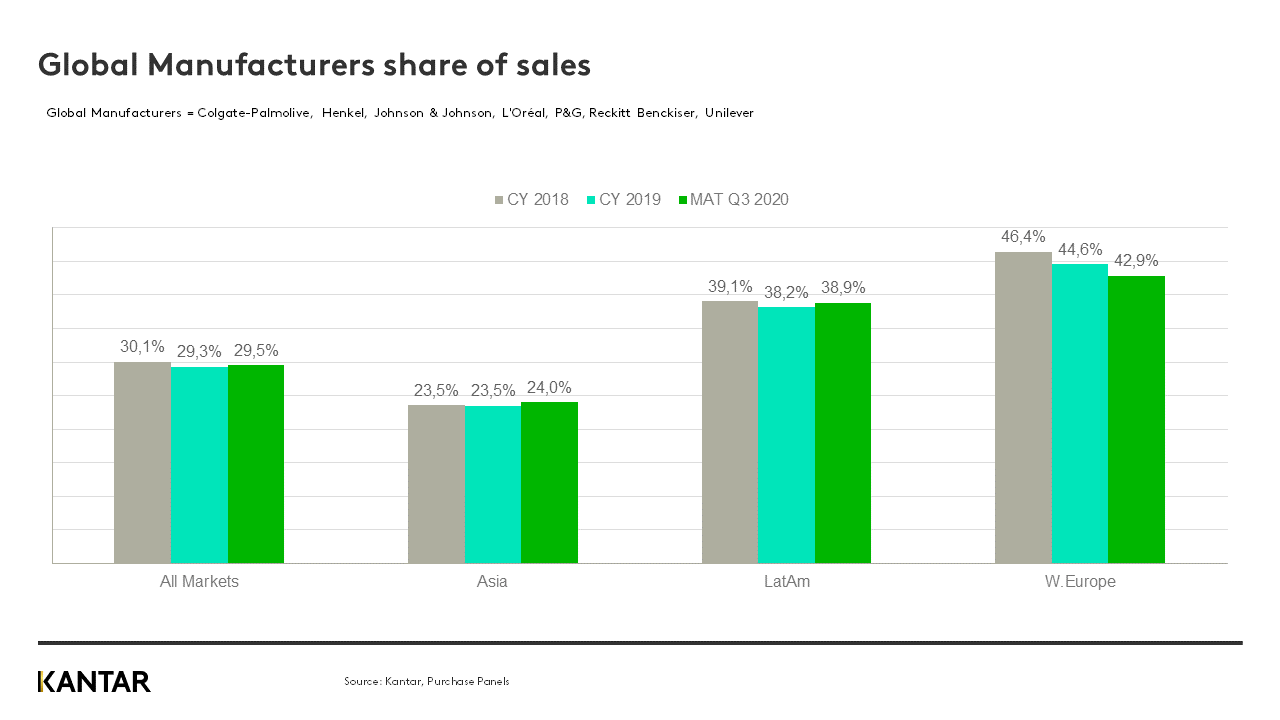

When it comes to manufacturers, the global players have done comparatively well – gaining share in 2020, having lost 0.8% in 2019. Despite having a lower share of trade in Asia and Latin America, it is in these regions that the global manufacturers have won back share (0.5% and 0.7% respectively) as they continue to lose out in Western Europe.

The question remains: will shoppers return to local brands in 2021, or are the global players back?

The road ahead

It has been a turbulent year for beauty and personal care. And with social distancing expected to remain in place for the foreseeable future, we expect growth to remain stagnant in the months ahead.

Yet promising news of successful vaccines could cause even more category impact in the mid-to-long term. Some categories will continue their burgeoning recovery into strong growth. Some may stagnate or decline in the post-pandemic world. With that in mind, there are important considerations to make in order to win:

- Beauty’s future outlook should be understood on a category by category basis. Will cosmetics ever recover now people are accustomed to being ‘makeup free’ when working from home? Will skin moisturising return to previous growth levels, particularly with premiumisation being key for the category and recessionary pressures more likely to take hold in 2021?

- Hygiene will continue to be important. Hand and body wash will continue to perform strongly in the post-pandemic world. Shoppers are now attuned to using products that communicate hygienic benefits and this trend will continue into the long term. Brand messaging should be shifted to meet this need.

- The acceleration in online will continue, so embrace it. Find a way to stand out from the crowd in a channel where shelves do not exist. Explore options in direct to consumer (D2C) selling, which will become more widespread in the coming years.

Editor’s Notes:

All the data referenced in this article is taken from Kantar’s main take-home purchase panels. Markets included: Argentina, Bolivia, Brazil, Central America, Chile, Chinese Mainland, Colombia, Ecuador, France, GB, Ghana, Greece, Ireland, India, Indonesia, Kenya, Malaysia, Mexico, Peru, Philippines, Portugal, Saudi Arabia, South Korea, Spain, Taiwan, Thailand, Vietnam. The 2020 data covers to the end of September and is a Moving Annual Total (MAT) and is compared to full Calendar Year (CY) 2019.