In the dynamic world of marketing and brand management, making a compelling case for continuous investment in branding can often be a challenging task. It's not merely about showcasing creativity or marketing prowess; it's about proving the tangible, long-term value that robust branding brings to a business. Kantar BrandZ’s Share Price Chart, published annually in our Most Valuable Global Brands Report, offers a powerful tool to demonstrate the undeniable link between strong branding and financial performance over time.

The key proof point

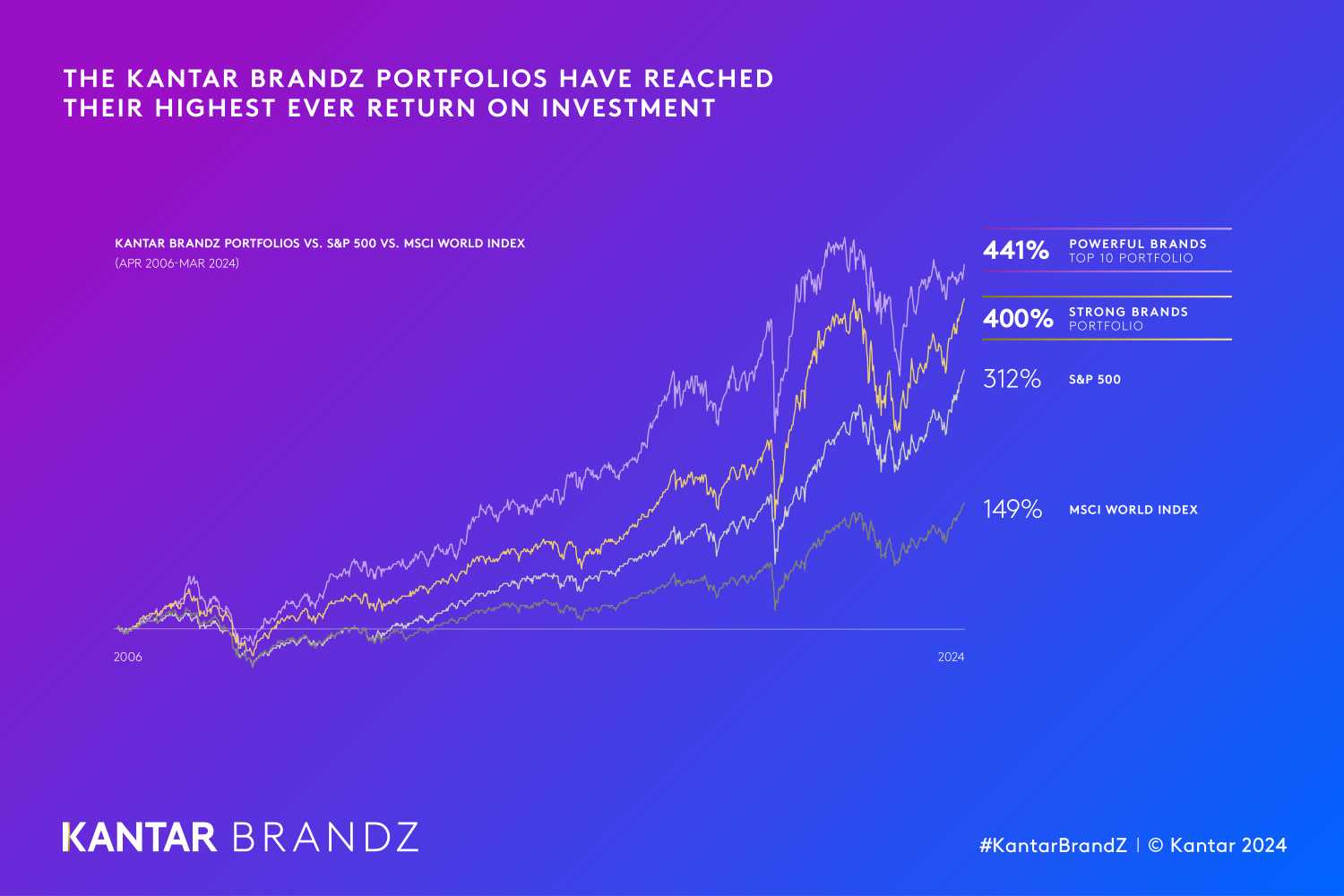

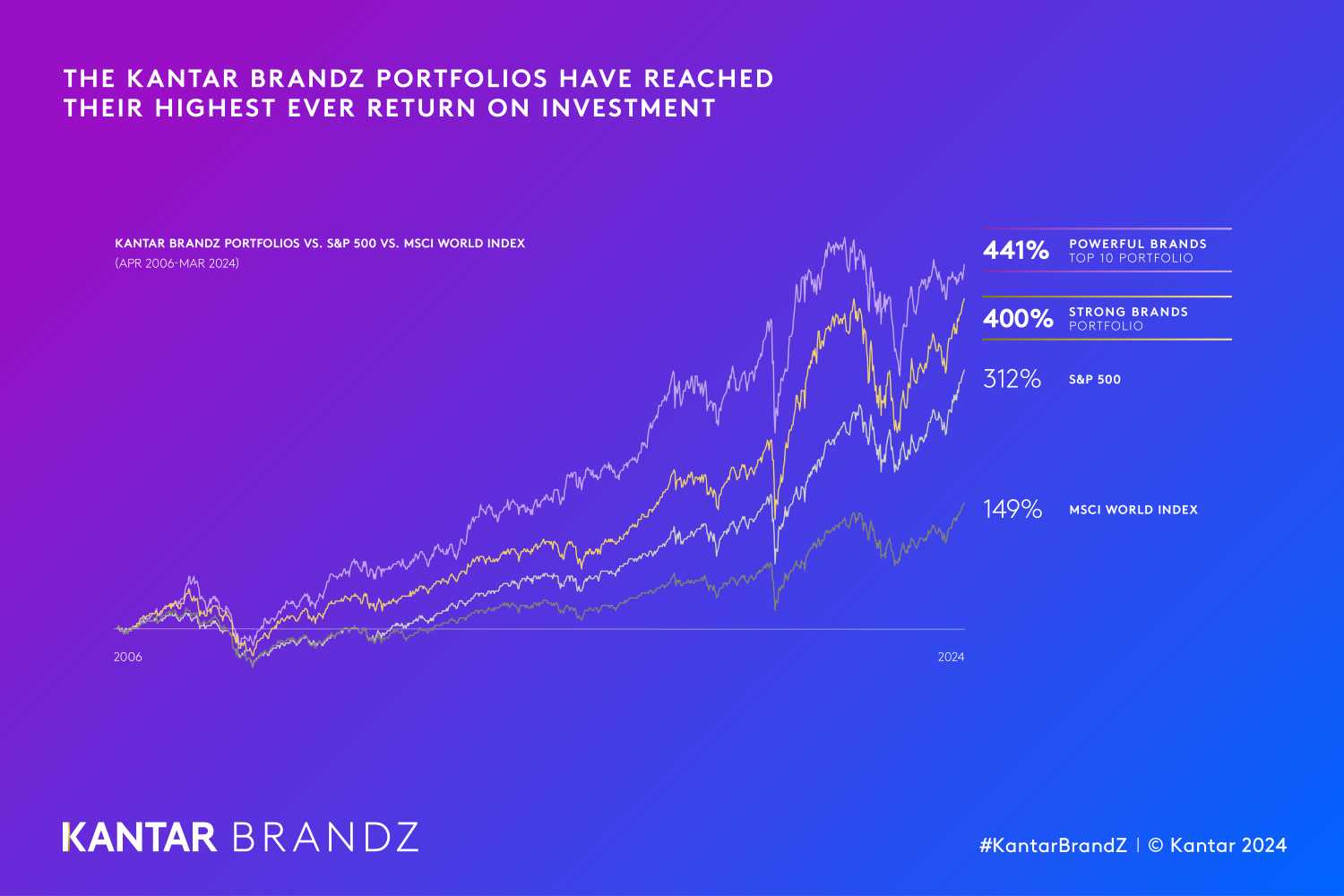

Kantar BrandZ data follows the share price performance of the world's most valuable brands. This chart distinctly illustrates how brands that consistently invest in their brand equity outperform those that do not. By comparing the share price performance of companies with strong brands against the average - illustrated by the S&P 500 and MSCI World Index of 1500+ stocks - the chart provides a visual and statistical testament to the power of branding.

A tangible proof of branding's financial impact

Kantar BrandZ’s brand valuations translate brand equity into financial metrics that resonate with corporate stakeholders. They showcase a clear correlation between brand strength and shareholder returns, effectively bridging the gap between marketing initiatives and financial outcomes.

For instance, analysis from Kantar BrandZ’s extensive global database reveals that the stock prices of companies with the strongest brands have consistently outperformed the market average since 2006. This consistent outperformance underscores the role of brand equity as a critical driver of sustained financial performance.

Making the case for long-term brand investment

Marketing professionals can leverage this evidence to advocate for ongoing brand investment. Here’s how:

• Demonstrating consistent outperformance: Kantar BrandZ’s Share Price Chart provides historical data showing that brands with high equity deliver superior financial returns over time: +88% return vs. the S&P 500 and +251% on the broader MSCI World Index. The ‘Top 10 Most Powerful’ trend - among the brands with the highest brand equity results - is even stronger. This data-driven approach can persuade even the most sceptical stakeholders by linking past brand investments to present-day financial success.

• Highlighting market resilience: During economic downturns, brands with strong equity tend to exhibit greater resilience. Top brands withstand market volatility better than counterparts with less brand equity, thus safeguarding business interests during turbulent times. This greater resilience and faster recovery were particularly notable following the global financial crisis and again over the COVID-19 pandemic.

• Establishing competitive advantage: Strong brands often enjoy better leverage on their marketing assets, better pricing power supporting higher margins, and increased market share. Kantar BrandZ’s Share Price Chart can support marketers to emphasise how brand investment translates into competitive advantages that are pivotal for long-term success.

A host of supporting evidence

A number of other companies, such as Interbrand, release their own brand valuation studies, which reach similar conclusions. Kantar BrandZ’s valuations and analysis are based on the uniquely validated and credible Meaningful Different Salient Framework developed over the last two decades. Unlike other brand valuation models that may rely heavily on subjective assessments, Kantar BrandZ’s methodology is rooted in the world’s largest brand research database and real-world financial data. This objectivity and depth make it a reliable indicator of marketing’s financial impact. Additional studies, such as that by Felipe Thomaz of Oxford University’s Saïd Business School, have proven the link between brand equity and stock performance.

Conclusion: the imperative of brand investment

So, don’t forget, Kantar BrandZ’s Share Price Chart is a strategic asset for making informed decisions about future investments. For marketing professionals, it provides a robust, data-backed narrative that can convince corporate stakeholders of the importance of continuous branding efforts. By leveraging this powerful chart, businesses can be steered towards long-term success, ensuring that brand investment remains a top priority in their strategic agendas.

2025 will mark the 20th year of Kantar BrandZ valuations and the ranking of the world’s most valuable brands for which we are undertaking a major historical analysis of the drivers of brand value and more, building on the launch of Kantar’s Blueprint for Brand Growth which offers a clear roadmap for achieving sustainable business growth.

Discover more insights on effective brand building in Kantar BrandZ’s Most Valuable Global Brands 2024 Report: www.kantar.com/campaigns/brandz/global

For a quick read on a brand’s performance compared to competitors in a specific category, Kantar’s free interactive tool, BrandSnapshot powered by BrandZ, provides intelligence on 14,000 brands. Find out more here.

The key proof point

Kantar BrandZ data follows the share price performance of the world's most valuable brands. This chart distinctly illustrates how brands that consistently invest in their brand equity outperform those that do not. By comparing the share price performance of companies with strong brands against the average - illustrated by the S&P 500 and MSCI World Index of 1500+ stocks - the chart provides a visual and statistical testament to the power of branding.

A tangible proof of branding's financial impact

Kantar BrandZ’s brand valuations translate brand equity into financial metrics that resonate with corporate stakeholders. They showcase a clear correlation between brand strength and shareholder returns, effectively bridging the gap between marketing initiatives and financial outcomes.

For instance, analysis from Kantar BrandZ’s extensive global database reveals that the stock prices of companies with the strongest brands have consistently outperformed the market average since 2006. This consistent outperformance underscores the role of brand equity as a critical driver of sustained financial performance.

Making the case for long-term brand investment

Marketing professionals can leverage this evidence to advocate for ongoing brand investment. Here’s how:

• Demonstrating consistent outperformance: Kantar BrandZ’s Share Price Chart provides historical data showing that brands with high equity deliver superior financial returns over time: +88% return vs. the S&P 500 and +251% on the broader MSCI World Index. The ‘Top 10 Most Powerful’ trend - among the brands with the highest brand equity results - is even stronger. This data-driven approach can persuade even the most sceptical stakeholders by linking past brand investments to present-day financial success.

• Highlighting market resilience: During economic downturns, brands with strong equity tend to exhibit greater resilience. Top brands withstand market volatility better than counterparts with less brand equity, thus safeguarding business interests during turbulent times. This greater resilience and faster recovery were particularly notable following the global financial crisis and again over the COVID-19 pandemic.

• Establishing competitive advantage: Strong brands often enjoy better leverage on their marketing assets, better pricing power supporting higher margins, and increased market share. Kantar BrandZ’s Share Price Chart can support marketers to emphasise how brand investment translates into competitive advantages that are pivotal for long-term success.

A host of supporting evidence

A number of other companies, such as Interbrand, release their own brand valuation studies, which reach similar conclusions. Kantar BrandZ’s valuations and analysis are based on the uniquely validated and credible Meaningful Different Salient Framework developed over the last two decades. Unlike other brand valuation models that may rely heavily on subjective assessments, Kantar BrandZ’s methodology is rooted in the world’s largest brand research database and real-world financial data. This objectivity and depth make it a reliable indicator of marketing’s financial impact. Additional studies, such as that by Felipe Thomaz of Oxford University’s Saïd Business School, have proven the link between brand equity and stock performance.

Conclusion: the imperative of brand investment

So, don’t forget, Kantar BrandZ’s Share Price Chart is a strategic asset for making informed decisions about future investments. For marketing professionals, it provides a robust, data-backed narrative that can convince corporate stakeholders of the importance of continuous branding efforts. By leveraging this powerful chart, businesses can be steered towards long-term success, ensuring that brand investment remains a top priority in their strategic agendas.

2025 will mark the 20th year of Kantar BrandZ valuations and the ranking of the world’s most valuable brands for which we are undertaking a major historical analysis of the drivers of brand value and more, building on the launch of Kantar’s Blueprint for Brand Growth which offers a clear roadmap for achieving sustainable business growth.

Discover more insights on effective brand building in Kantar BrandZ’s Most Valuable Global Brands 2024 Report: www.kantar.com/campaigns/brandz/global

For a quick read on a brand’s performance compared to competitors in a specific category, Kantar’s free interactive tool, BrandSnapshot powered by BrandZ, provides intelligence on 14,000 brands. Find out more here.