Opening the floodgates to growth

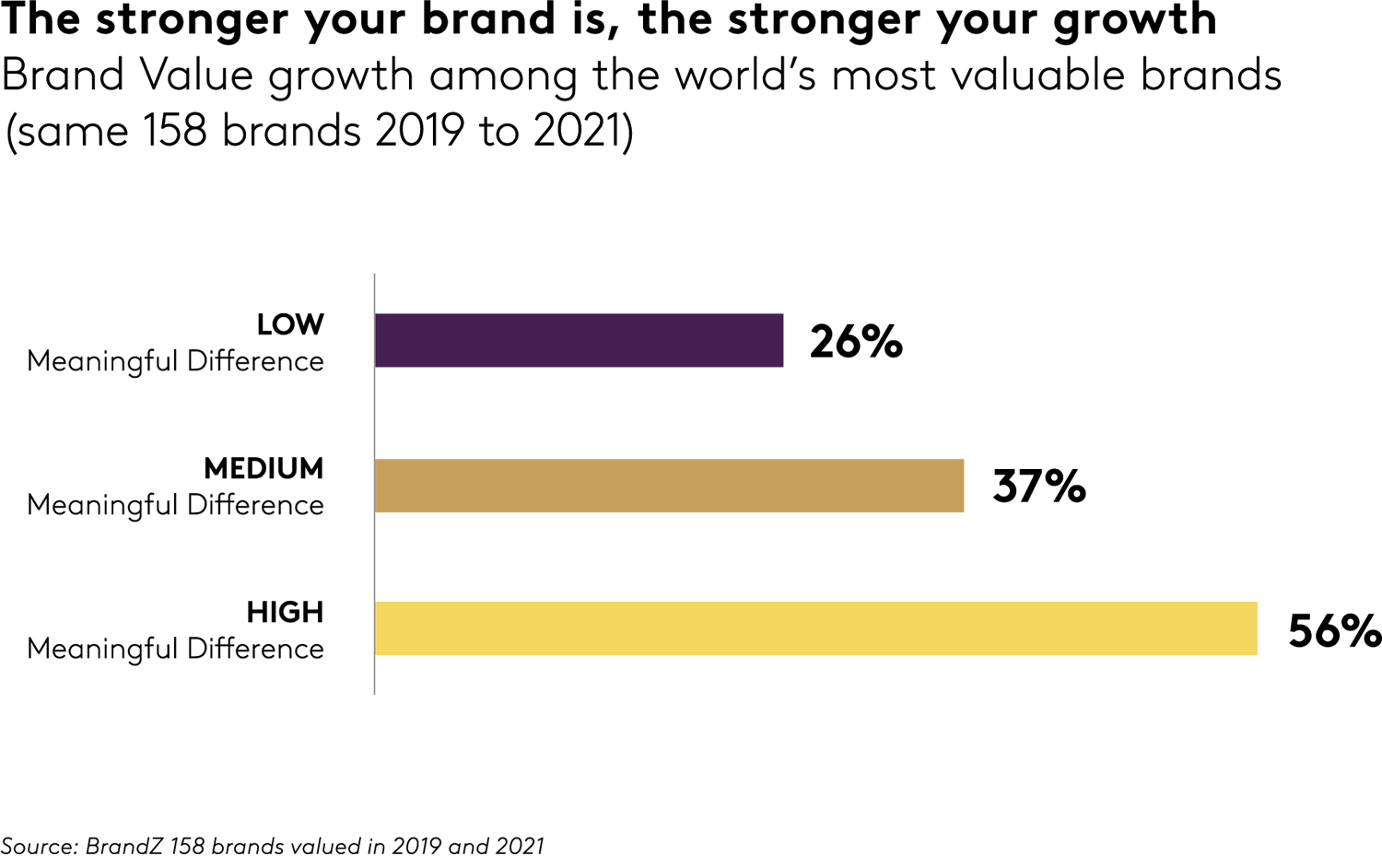

Years of Kantar BrandZ research has shown the importance of brand equity in creating business value. The data trends are clear: the stronger your brand is, the stronger your growth.

Here is a question to consider: Would John Lennon and Paul McCartney have been as successful on their own compared to the Beatles? Doubtfully so. The Beatles defined an era of music; on their own, the individuals within the Beatles would not have made the same impact.

Another example: The ‘Woodies’ were a dominant tennis force in the 90s, winning 11 Grand Slam doubles titles and becoming household names in their native Australia. On their own, Todd Woodbridge and Mark Woodforde were not competitive as singles players. But in doubles, the baseline play of Mark and volleying of Todd turned them into a winning machine.

For many children, meanwhile, a peanut butter sandwich on its own is ho-hum. But it can be transformed into a far more enticing proposition with the addition of jam. The two ingredients need each other!

Better than the sum of the parts

What connects these music, tennis and food icons is how the complementary nature of distinct parts strengthens the overall proposition, while also uplifting the individual parts themselves. In the same way, we can consider the elements that drive growth for our brands.

Through years of Kantar BrandZ research, the importance of brand equity in creating business value is undisputed. The data trends are clear: the stronger your brand is, the stronger your growth. However, we do still see individual businesses that are unable to translate their strong brand equity into growth.

Ministop is a well-established convenience store chain in Japan. It punches well above its weight in terms of brand power, reinforcing its brand position since 2018. In fact, 9 out of 10 Ministop shoppers are secured shoppers (i.e. their spend matches their predisposition to the brand).

Remarkably, we find that Ministop’s brand power is more than double its current presence in the market. All of this would point to a well-primed launchpad for accelerated growth - a reservoir of excess brand equity waiting to be transformed into sales. Yet growth remained unmoved up to 2020. So why is that?

Decoding the consumers’ decision journey

By combining Kantar BrandZ data with our research on consumers’ decision journeys, we’ve introduced a simple framework for thinking about how brands grow.

After analysing nearly 4,000 brands across a three-year time frame from Kantar BrandZ’s database, we identified the three stages of the consumer decision journey that were most important to overall brand value growth: Experience, Equity and Activation. Brands that managed to do well on all three facets realised a phenomenal 46% growth.

Experience and Equity refer to the influence on repeat and future choices respectively. Experience is how well the brand reaches current users and predisposes people to choose the brand again. Equity is how well the brand reaches out to new users, predisposing them to increase penetration. (Because shoppers are constantly seeking to minimise effort, predisposition has a massive influence on sales of branded goods.)

Activation refers to how well a brand can facilitate current sales. This means making sure the predisposed can buy the brand easily and capturing undisposed shoppers in the moment.

Activation is driven by the brand’s physical and virtual availability in the market. It includes all brand assets that are controllable and contribute to facilitating an easy transaction; these include findability, affordability, and packaging.

Pulling the right levers for growth

Picking apart these dimensions sheds some key insight on how best to drive growth for brands.

Brands that do well only on Activation, but neglect to build predisposition through Equity and Experience, typically shrink by more than 20%.

In contrast, a brand that leverages its Experience and Equity assets are rewarded with strong growth, with an average brand value gain of 20%. But in the same way that John and Paul are so much more effective together in the Beatles, brands that combine strong Activation, Experience, and Equity, can grow 46% - more than twice as fast as with Experience and Equity alone.

What the data tells us is that Activation alone will not create sustainable growth. But it can be a dramatic catalyst in accelerating further growth of brands that have already built strong brand equity.

And this brings us back to Japan and Ministop’s inability to unlock its brand potential. It is when we look at the brand’s market strength, that we get to appreciate what is holding the brand back. In particular, a red flag is the dwindling footprint of Ministop’s store locations, a crucial table-stake for convenience stores. Over a three-year period up to 2019, the number of Ministop stores declined by 14%. Without building Ministop’s physical presence to ensure accessibility, the efficiency of its brand building effort has been severely diminished.

Lidl, a discount grocery retailer paints a pointed contrast. In 2014, Lidl was well ensconced as a mid-tier discount grocery retailer in France. This is a tough position to inhabit in a mature market. However, Lidl made a few key strategic moves that would propel the brand forward over the course of the next eight years.

One key decision was to significantly increase Lidl’s communications investment, to strengthen its brand appeal. Despite being ranked sixth in the French retail category in terms of market penetration, Lidl actively outspent its larger competitors until it ranked third in terms of communications spend. Then, and unlike Ministop in Japan, Lidl supported its brand-building investment with an aggressive acquisition strategy, to grow its footprint and accessibility to shoppers. By 2021, Lidl had become France’s third largest retail brand.

All you need is…balance

Plagiarising the Beatles song title, all you need in this case is not love, but balance. Because a balanced strategy is vital. Where brand-building efforts are supported with in-market activations, brand value growth can be optimised. A purposeful Activation Plan might be the catalyst to an accelerated growth trajectory for your brand. Brands that are Meaningfully Different, with strong Activation, can deliver greater financial benefits to companies.

Get in touch to discuss how to get the balance right for your brand.