Latest data from Kantar shows smartphone usage fundamentally shifting as consumers adapt to a new home-based reality, and Xiaomi overtaking Huawei in Europe.

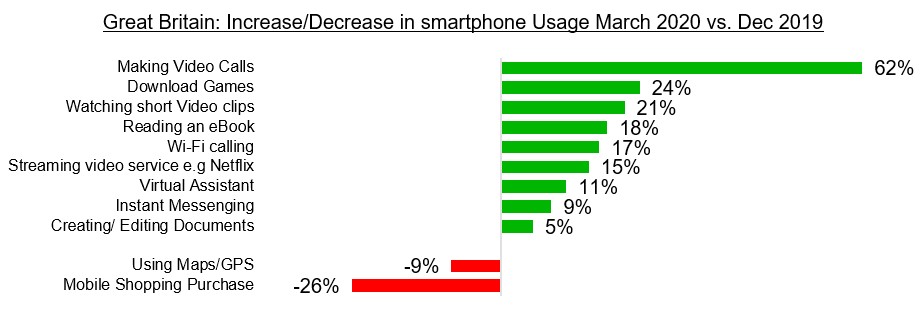

Our smartphone OS data for the first quarter of 2020 shows that consumer behaviour has shifted significantly as a result of COVID-19, with people’s needs from technology changing rapidly to accommodate the new home-based reality many find themselves in. In Great Britain alone, video calling is +62% vs. the previous quarter, while purchases made via mobile phones have dropped 26%.

COVID-19 is dramatically impacting how consumers are using their smartphones. With so many countries around the world in lockdown situations, it’s perhaps not surprising to see such a significant increase in video calling as people seek to connect with each other for work and personal activities. The data also shows that consumers are increasingly looking for ways to entertain themselves, for example through mobile gaming (+24%) and watching short-form video content (+21%). There is, however, a demonstrable reduction in mobile phone usage to make shopping purchases and for navigation (-9%).

Smartphone sales have also been impacted by the crisis, though the global picture is not yet clear. While the iPhone 11 is the top selling model in Q120 across both EU5 and the US, and Samsung A series models continue to sell well across all markets, the COVID-19 crisis is having an effect. In China, where lockdowns came into place earlier, the data shows a significant hit to smartphone sales volumes.

If you are to look purely at smartphone brand trends, the impact of the COVID-19 crisis is not immediately apparent. Those trends that were in force previously still exist; Huawei continues to haemorrhage share in Europe, with Xiaomi picking up where Huawei left off. In fact, in first quarter, Xiaomi overtook Huawei for the first time, taking third place in across Europe with 15.4% share vs. Huawei (excl Honor) with 14.6%.

If we look to China, where the impact of COVID-19 was first felt and particularly in Wuhan province, we can see a dramatic impact. Q1 2020 smartphone sales in Wuhan fell by -55% vs. the same period 2019. The impact in Wuhan on sales was even greater in the month of February (-67%), with March data seeing a slight easing in the decline.

Samsung performance across Europe was fairly flat at 30.3% (-0.7%pts YoY), whilst in the US Samsung made significant share gains, hitting 30.5% (+3.7%pts YoY).

On the surface Samsung share gains in the US are impressive but look a little deeper and these gains are predominantly driven by low to mid-range A Series models, like the Galaxy A10(e), which are helping to drive overall volume, though are negatively impacting average selling price. The number of Premium handsets Samsung sells in the US has fallen from 45% of Samsung sales in Q1 2019 to 37% in Q1 2020. By contrast, Apple has risen from 69% to 71% over the same time period. The positive news for Samsung is that these lower ticket models are driving proportionally increased switching from Apple. The success of this strategy will be whether Samsung is then able to upgrade these consumers to more premium models in 2-3 years’ time.

The timing of Apple’s announcement of iPhone SE (2020) is well timed, given the financial impact COVID-19 is having on consumers around the world and the increasing traction Samsung is gaining with its revamped Galaxy A Series. Retailing at $399/£419 this new addition to Apple’s line up puts it in a strong position to weather the impact of the deteriorating economic picture and at the same time providing its existing customers with an affordable, smaller screen model to upgrade to.

Check out our data visualisation tool to view and analyse smartphone OS market share data online. The latest sales share figures for the major operators can be viewed and compared with historical figures here, and all graphics within the Kantar dataviz are available to embed in your site.