Cruise vacations have long been a popular choice for travellers looking to relax and visit multiple destinations in a single trip. There have never been more variety or options in cruising for travellers based on their personal interests, destinations or desire to travel with family. Consumers are prioritising features and making decisions about which cruise line to travel with and which routes to sail as they evaluate the biggest barriers to booking.

In the latest Connecting with the Tourism Community report from the Profiles team at Kantar, new insights were shared into the ways global tourists are travelling. This research includes insights from more than 10,000 consumers from ten countries and uncovered the sentiments, motivators and drivers behind the decisions travellers make about how they travel, and their opinions about cruise vacations.

The Wide Appeal of Cruises

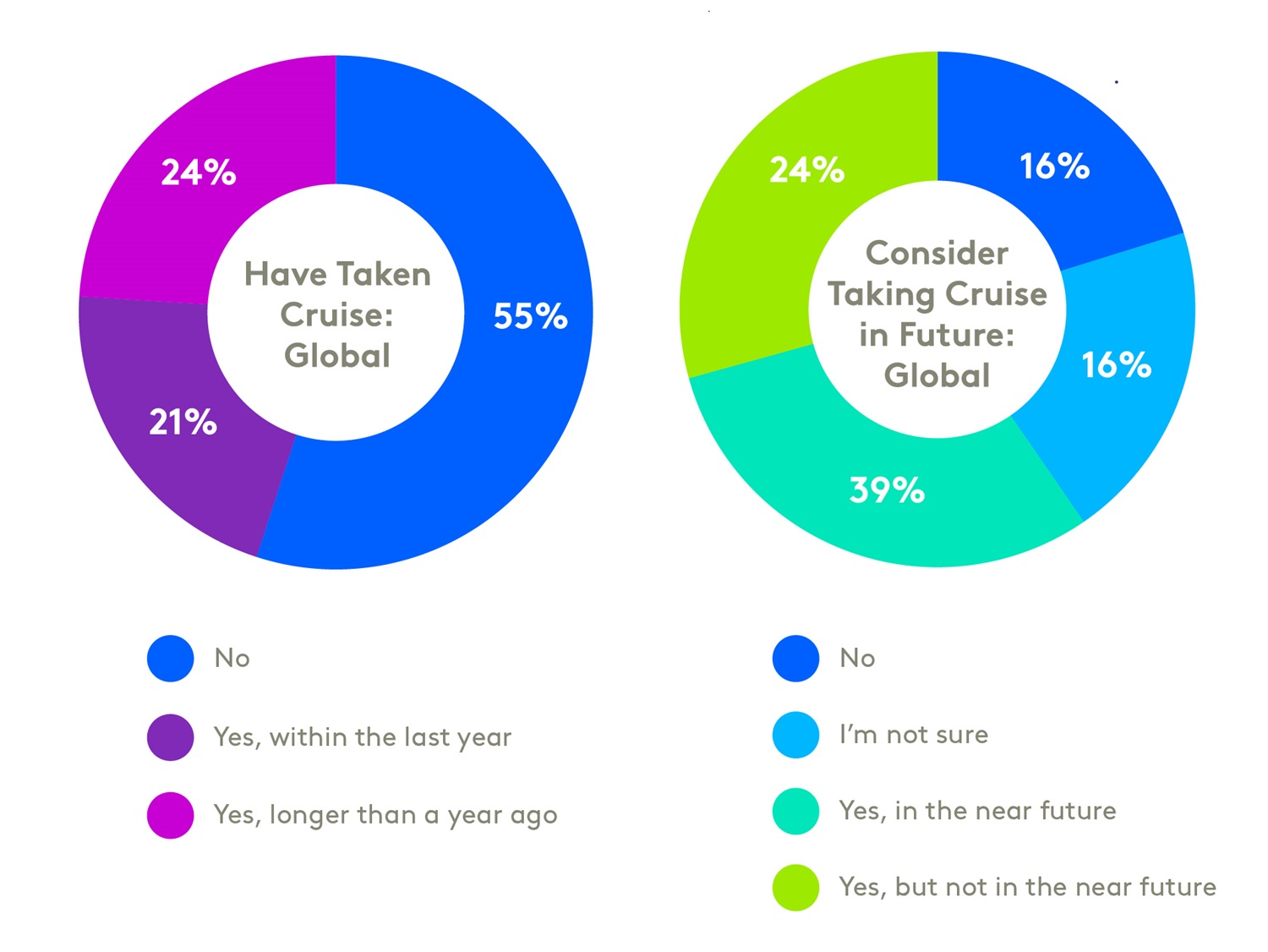

According to the report, 45% of global consumers have taken a cruise, and an even larger share—68%—say they would consider taking one in the future. This suggests strong demand, with nearly seven in ten travellers open to the idea of cruising.

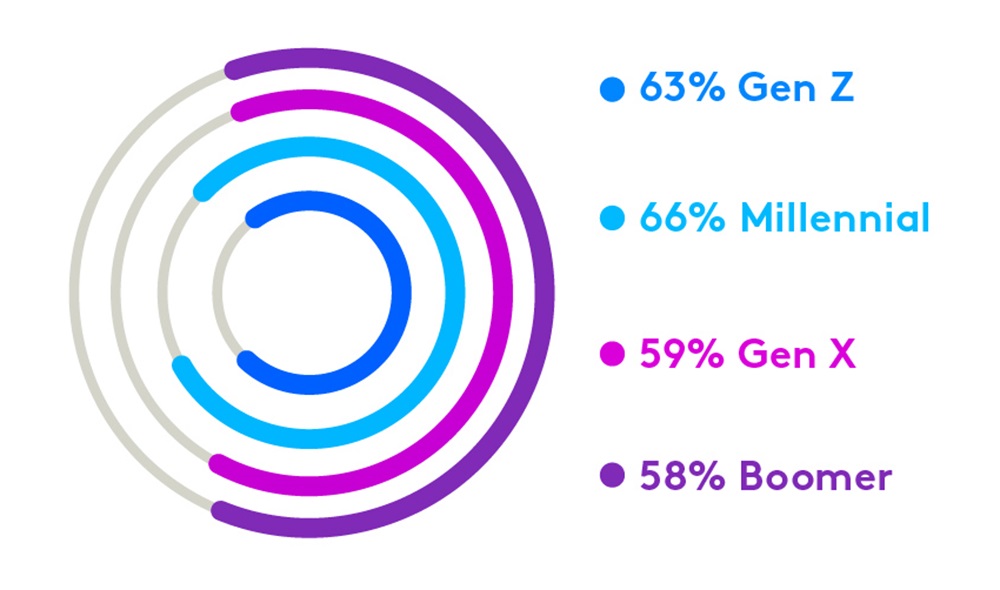

One common misconception is that cruises cater mainly to older travellers. The data tells a different story: consumers across all generations see cruise vacations as appropriate for their age.

Family-Friendly Vacations

Family dynamics play a significant role in a person’s interest in cruises, aligned with the flexibility and convenience of cruises. Among families with children, 51% say they would consider taking a cruise in the near future. In contrast, only 26% of adult-only households feel the same way.

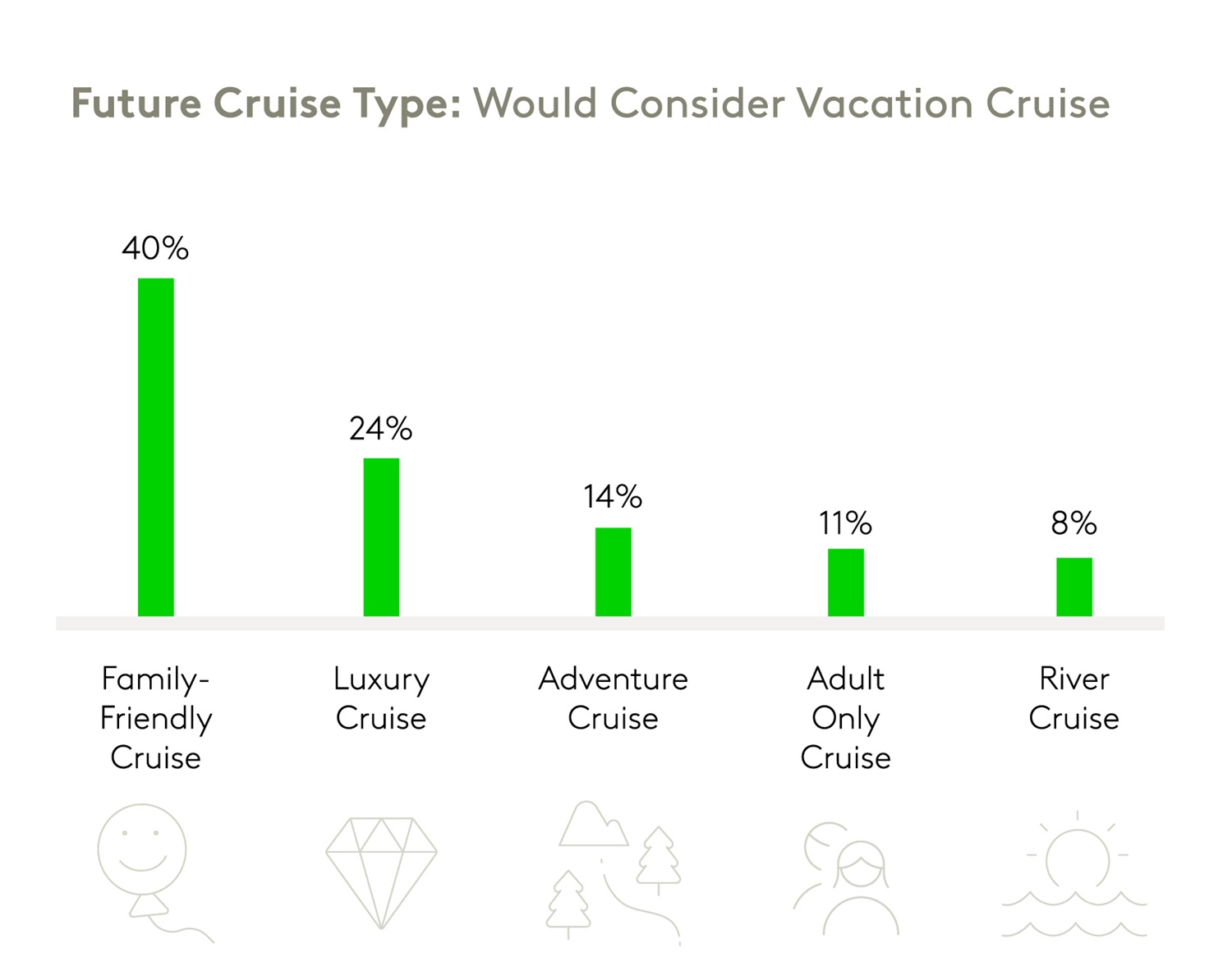

For those interested in cruising, family-friendly options are the most popular. About 40% of travellers considering a cruise would opt for a family-friendly cruise line, a preference driven largely by families with children. Among families, 53% say they prefer family-oriented cruises, with one-child households showing similar interest at 51%.

Meanwhile, adult-only travellers have different priorities. Adults without children are more likely to seek out luxury cruise experiences (26%) or adults-only cruise options (18%). This shows a clear divide in cruise preferences, with families looking for fun and kid-friendly amenities, while child-free travellers prioritise exclusivity, luxury, and premium experiences.

Barriers to Booking

Despite strong interest across global consumers, some travellers remain hesitant. Among those who would not consider a cruise, 44% say they simply prefer other types of trips. This suggests that personal travel style and preferences, and not negative perceptions or experiences, are the main reasons some avoid cruising.

However, price and availability of deals still play a role. While over half of cruise sceptics are firm in their decision, 22% indicate they could be swayed by special offers or pricing discounts.

What Matters Most to Cruise Travellers

When it comes to the ideal cruise experience, consumers have clear priorities. Among those considering a cruise or those that are undecided, the top-ranked feature is the ability to visit multiple destinations in one trip. This was followed closely by all-inclusive pricing and convenience, and then luxurious onboard amenities and services.

Get more answers

For more findings from this study, access the complete Connecting with the Tourism Community report. Find additional insights into how global consumers are travelling, the resources they use to plan trips and how they make decisions about where to go.

About this study

This research was conducted online among more than 10,000 consumers across ten global markets (including Australia, Brazil, China, France, Germany, Singapore, South Korea, UK, US and the UAE) between 12-24 November 2024. All interviews were conducted as online self-completion and collected based on controlled quotas evenly distributed between generations and gender by country. Respondents were sourced from the Kantar Profiles Respondent Hub.