Our Entertainment on Demand service revealed the following consumer behaviours in the three months to December 2020:

- Amazon Prime membership jumped again in Q4, with 53.5% of British households now Prime members, an increase of almost 2 million households during the year.

- 16.7 million British households held at least one SVOD subscription by the end of 2020.

- Disney+ increased retention to maintain overall subscriber growth.

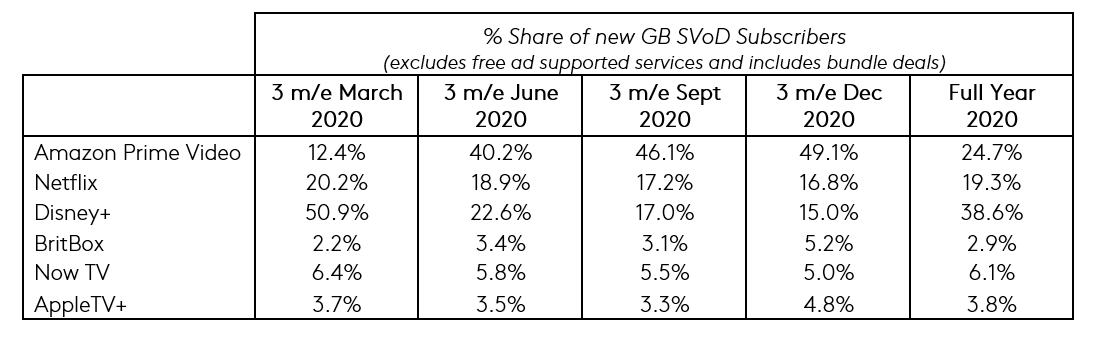

Q4 saw 1.3 million British households take out a new video streaming subscription, with Amazon Prime Video capturing almost half of these. BritBox had a solid Q4, rising above both Now TV and Apple TV for the first time, in terms of share of new subscribers. The relaunch of Spitting Image was a key element to this uptick, with 33% of new subscribers who cited “content” as their key driver for taking out a BritBox subscription naming Spitting Image as the key title.

Amazon Prime Video continues to benefit from being integrated with Prime Membership, with Amazon Prime subscribers rising to 53.5% of households in Q4 2020. In addition to increasing overall Prime membership, Amazon also saw an increase in the proportion of Prime members using Prime Video, rising to 62.6% up from 60.5% the previous quarter.

Amazon’s increasing focus on live sports continues to pay big dividends, with the Rugby Autumn internationals playing a significant role in attracting new users, as well as the return of live football. The combination of Football/Rugby/Tennis acted as the catalyst for more than 1 in 4 new subscribers over the quarter. The Boys continues to perform well for Amazon, showing as the #4 most enjoyed SVoD title during Q4.

Netflix continued to dominate top content enjoyed over the quarter, with The Crown and The Queens Gambit taking #1 and #2 place in Q4 2020. Disney’s latest release of The Mandalorian was the #3 most enjoyed title, whilst The Undoing, available on Now TV (+Sky Atlantic) took #5 position.

As the UK endured different COVID-related Tier restrictions and lockdowns, SVoD viewership remained firmly focussed in home, with only 7% of subscribers watching content out of home over the quarter, showing just a 1% increase over the last 6 months. As Smart TV penetration continues to grow in Britain, the proportion of viewers accessing SVoD services directly through their Smart TV grew to 52% in Q4, whilst those using TV Sticks like Amazon Fire TV or accessing through their Pay TV provider continues to edge down. Despite this, almost 1 in 6 British homes use TV sticks/dongles to access their SVoD services, with Amazon Fire TV dominant in this category (with 74% share), compared to 13% for Roku, 5% for AppleTV and 4% for Google Chromecast.

Disney+ has held double digit share of new SVoD subscribers throughout the year and, due to its huge lanch performance in Q1 2020, comes out as #1 in terms of total new SVoD sign ups over the year. Disney+ is also showing good progress in bringing its retention rate under control, with customer churn of just 6% in Q4, almost half that of its churn rate in Q2.

AppleTV+ hit a year high in share of new subscribers in Q4, at 4.8%, but this was only enough to secure #6 spot. Consumers continue to have an overall negative rating of AppleTV+ for Variety of TV Shows, Number of New Release Films, and Variety of Classic Films; however, Quality of Shows remains positive. The recent announcement of a further extended trial for AppleTV+ users to July 2021 is well timed, as the latest research results show 26% of AppleTV+ users in Q4 2020 plan to cancel the service, up from 16% in Q1 2020.

Of these planned cancellations, 45% say they are not prepared to pay after the free trial is over, whilst a further 35% say they are not using the service frequently enough to justify the cost.

Based on a longitudinal panel of 15,000 consumers and boosted by 2,500 new subscriber interviews each quarter, the Entertainment on Demand service is designed to help the broadcast industry and investors understand the full consumer journey for digital video subscription services.