Kantar today announces Q2 2020 results from its Entertainment On Demand service in Great Britain, revealing the following consumer behaviours in the three months to June 2020:

- After a surge of 6 million SVoD sign ups during the 3 months to April, which covered the early COVID-19 lockdown period and launch of Disney, new subscriptions have fallen back to a more normal level, hitting 826k in Q2.

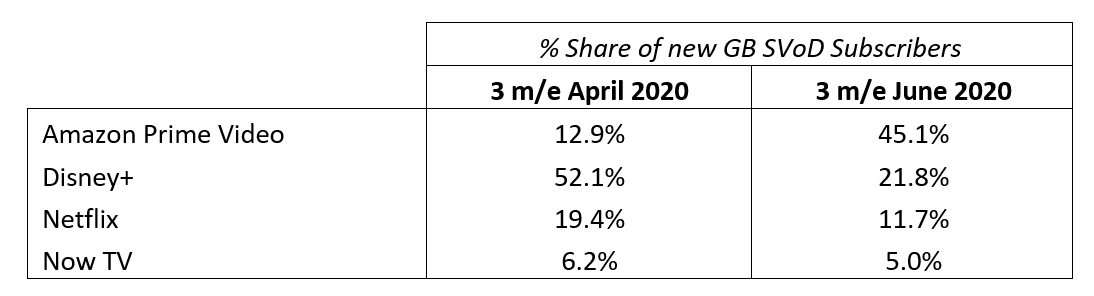

- Amazon Prime Video led in new sign ups, securing 45% share over the quarter, with performance particularly strong amongst first time SVoD subscribers, driven up by free trial promotions.

- 22% of new subscriptions were for Disney+, a fall from the 52% it achieved in its UK launch quarter

- Disney+ saw a steep rise in lighter users, reflective of many UK schools returning back during the second quarter.

- Overall subscription stacking edges down as consumers start to show signs of drop multiple platforms

- Netflix planned cancellation rate continues to fall, hitting just 2.2%

- Netflix continues to dominate in customer advocacy, with a Net Promoter Score of +46, but Amazon Prime Video sees a big increase vs last quarter, in a clear sign of progress in closing the gap vs. the market leader.

Netflix continues as the most popular streaming service for subscriptions, whilst Disney+ growth is showing signs of easing off, after a bumper launch quarter. Given Netflix’s wide reach across the British population, it is no surprise that it dominates the most enjoyed content list with Ozark the #1 series over the quarter. Interestingly, Money Heist, came in #2 despite being subtitled, highlighting Brits’ appetite for foreign language content, whilst the now infamous Tiger King made it into the top 3 for 2 consecutive quarters. The largest contributor to new SVoD subscribers in the quarter were Gateway subscribers, those taking out an SVoD subscription for the first time, contrasting with the first quarter, where stacked subscribers, those taking incremental SVoD subscriptions, were the single largest group.

It is no surprise that Q220 didn’t see a repeat of the huge SVoD subscriber boost seen in the first quarter, which had the highly unusual combination of Disney+ launching and the UK in lockdown for the majority of the period. Amazon Prime took the highest share of new subscribers in the quarter, with the increase in overall online shopping as a result of Covid-19 measures, likely helping to make Prime membership, and it’s free delivery system, a more attractive proposition to British consumers.

Netflix continues to lead the way in overall customer advocacy rates, but Q220 has seen a big increase in advocacy amongst Prime Video subscribers with Outlander, Little Fires Everywhere, Bosch and Star Trek Picard the key titles driving this performance.

Whilst most platforms have seen usage fall slightly in the second quarter, as life in the UK edges back to normality, Disney+ in particular has seen a notable increase in lighter users, as schools begin to return back.

Based on a longitudinal panel of 15,000 consumers and boosted by 2,500 new subscriber interviews each quarter, the service is designed to help the broadcast industry and investors understand the full consumer journey for digital video subscription services.

Kantar Entertainment On-Demand is delivered by the same team that provides the world’s leading mobile phone manufacturers with global mobile phone purchasing and usage trends. It is the only subscription service providing both quarterly installed base and new subscription market share alongside deep analysis on purchase motivations, including named content, customer experience, and diagnostics on ‘at-risk subscribers’ as well as guidance on acquisition and retention strategies. Find out more here.