Brands in the fast-moving consumer goods (FMCG) sector garnered the highest scores coming out of the COVID-19 pandemic in areas related to positive consumer brand relationships according to Kantar's BrandZ™ analysis.

Based on what BrandZ™ considers to be the building blocks of brand equity, FMCG brands were found to be highest in being Meaningful, that is, meeting needs in relevant ways and/or building affinity; Different, that is being unique vs. competitors and/or setting trends; and Salient, coming quickly to mind.

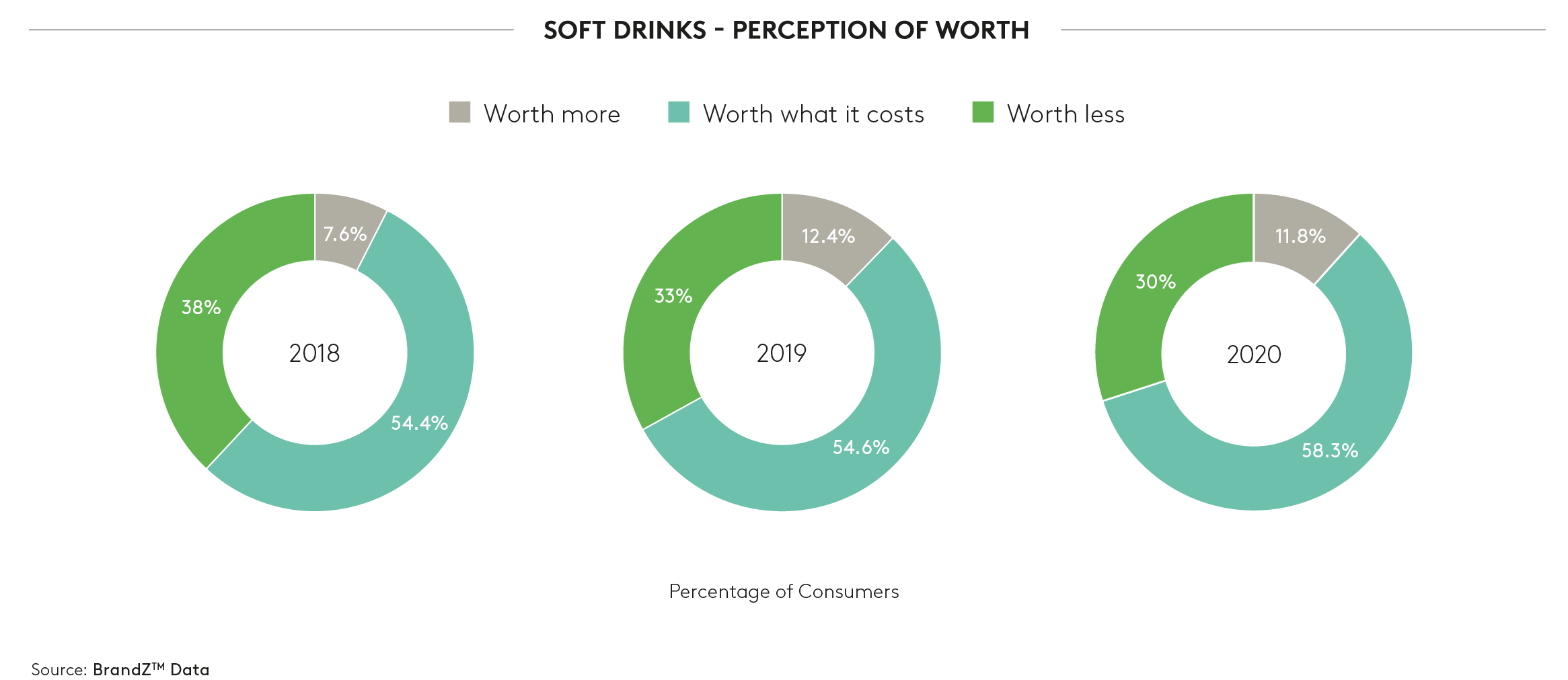

Among FMCG product categories, soft drinks, in particular, increased in perceived worth.

Even though the percentage of consumers in the report who were price-driven increased from last year, and despite the financial pressure of the pandemic and greater price consciousness, the research showed that people recognized soft drinks as increasingly worth the cost.

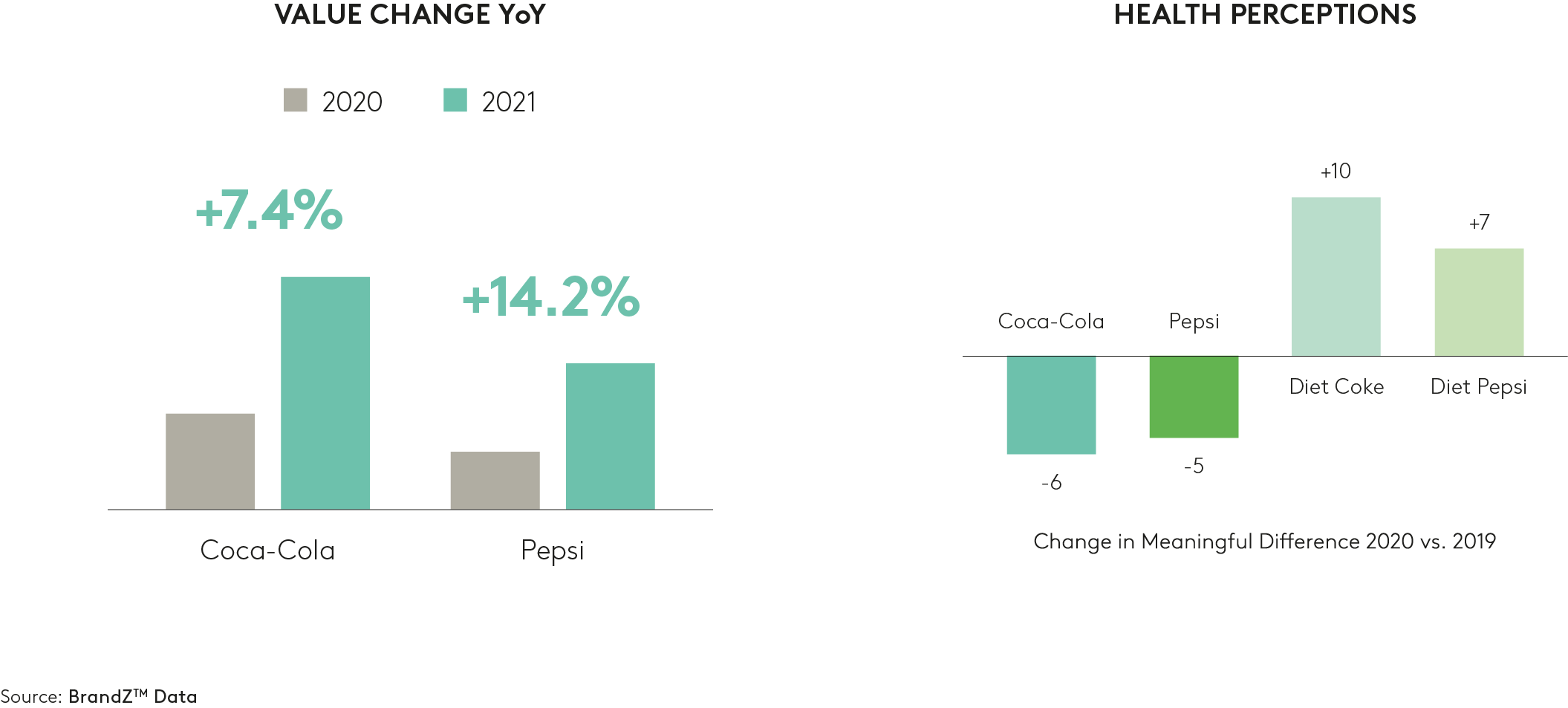

As a result, category leaders Coca-Cola and Pepsi increased in value during the pandemic. Coca-Cola’s value increased 7.4% from 2020, while Pepsi’s value rose 14.2%, largely due to the pandemic-related demand for snack food, an important part of the PepsiCo portfolio.

Beyond an increase in value, Coca-Cola and Pepsi also increased in equity and innovation. Coca-Cola’s Innovation score grew to 120 from 112 as it added an energy drink and hard seltzer to its brand portfolio. Meanwhile, Pepsi’s Innovation score increased only slightly, from 105 to 106. The BrandZ Index average is 100.

“Months of social distancing, financial pressure and uncertainty changed consumer spending priorities and shopping habits,” said Arifa Sheikh, Senior Director of Brand Strategy at Kantar. “While these developments complicated ongoing challenges for some brands, soft drink brands had a relative advantage navigating these challenges compared to other brands due to their ability to meet the needs of consumers and be top of mind at consideration.”

Coca-Cola and Pepsi were among a number of FMCG brands to enjoy brand value growth. Tide rose 26% in brand value, also improving in areas of Trust, product Superiority and Communication.

The proprietary BrandZ™ Valuation Methodology uses consumer viewpoints to assess brand equity, and how consumers perceive and feel about a brand as a measure of potential success or opportunity. The in-depth quantitative consumer research is conducted on an ongoing basis worldwide. Globally, the research covers more than 3.8 million consumer interviews in more than 500 categories, and almost 18,000 different brands in more than 50 markets.

The BrandZ™ Insights 2021 US Retail ranking, report and extensive analysis are available online here.