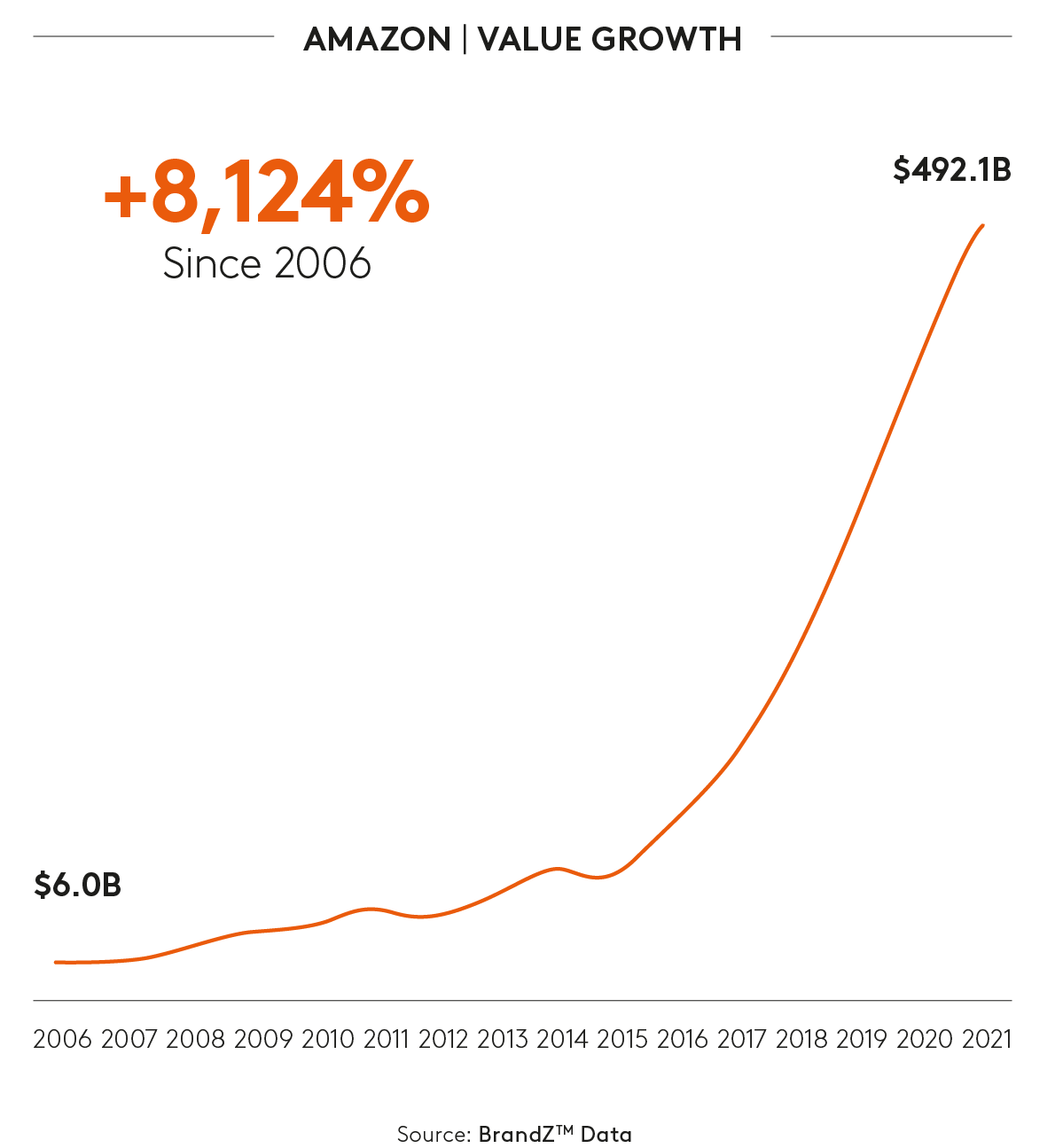

Amazon has opened up a wide post-pandemic brand equity gap over competitors, according to our most recent BrandZ™ analysis.

While shoppers in the report viewed Amazon, Walmart and Target as all being “Meaningful,” that is, meeting consumer needs in a relevant way, and “Salient,” that is, quickly coming to mind, Amazon was viewed as being significantly “Different.”

Amazon, in fact, achieved overwhelming “Meaningfulness,” “Difference” and “Salience” scores. In each of these categories, which BrandZ™ considers core building blocks of brand equity, Amazon scored approximately 200, double the average score in the analysis. Amazon’s ability to be seen as simultaneously “Meaningful,” “Different” and “Salient” also helped drive its brand equity to a level far surpassing that of its closest competitors. On a scale where an average brand scores 100, Amazon scored 289 on the BrandZ™ Power Index, which measures the ability to drive current market share.

Comparatively, Walmart and Target scored below average on the Potential Index, signaling their need to strengthen perceptions of Difference. Walmart and Target scored less than 100 in Difference, while Amazon scored more than 200.

The proprietary BrandZ™ Valuation Methodology uses consumer viewpoints to assess brand equity, and how consumers perceive and feel about a brand as a measure of potential success or opportunity. The in-depth quantitative consumer research is conducted on an ongoing basis worldwide. Globally, the research covers more than 3.8 million consumer interviews in more than 500 categories, and almost 18,000 different brands in more than 50 markets.

The BrandZ™ Insights 2021 US Retail ranking, report and extensive analysis are available online here.