After five years of premiumization, the Chinese market saw a sharp decline in overall spending in the early months of 2020 due to the dramatic effects of COVID-19. Cautious consumers stocked up on necessities, sought out lower-priced goods, and held off on anything deemed unessential during this uncertain time.

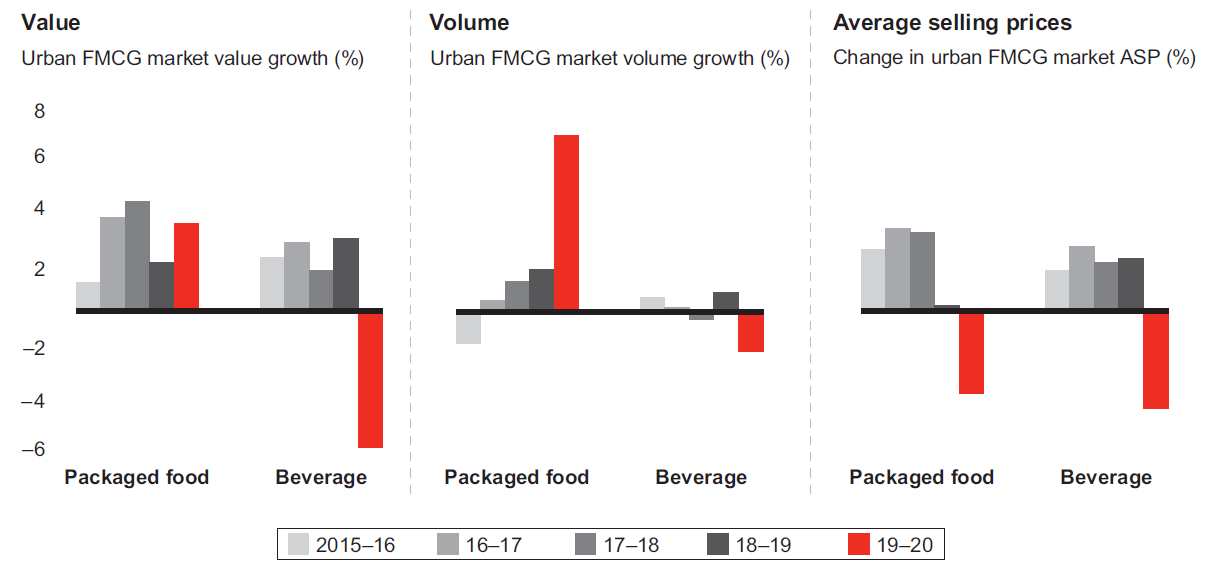

Overall FMCG spending did recover in the second and third quarters; however, those gains were not enough to outweigh the significant slowdown earlier in the year, with overall value declining due to lower average selling prices (ASP) – the first FMCG deflation in five years. Sales were essentially flat in the first nine months of 2020 after three straight years of more than 5 percent annual growth.

It is not surprising that COVID-19 has had a significant impact on the Chinese FMCG market. What is interesting is the massive change in consumer sentiment. There is a lot more caution and promotion hunting. It is clear that this dichotomy will continue, with a focus on both premiumization and value.

The research showed that while volume growth remained steady at the same 2 per cent level of 2019, the biggest contributing factor to the flat sales performance was a major decline in average selling prices (ASP). Those prices dropped by an average 2.1% in the first three quarters, with consumers buying more mass-market products and making more of their purchases online, where products are typically sold at promotional rates.

The ASP loss represents more than a 5% drop, considering the 3.4% increase in 2019. Indeed, after years in which selling prices outpaced inflation, the long run of premiumization or the ability to increase ASP above the rate of inflation ended this year, another victim of COVID-19.

It was not, however, all bad news this year. Homecare categories enjoyed a healthy 9% value growth as consumers stocked up on necessities. Also, innovative healthy alternatives and increased home consumption boosted sales of carbonated soft drinks, which achieved 16% volume growth.

Despite this success, the research highlighted the divergent performance in various sectors such as packaged foods and beverages. Both sectors dealt with deflated prices, which declined 3.4% for packaged foods and 4.1% for beverages; however, the volume of packaged foods grew 7.2% in the first nine months, as consumers stocked up on instant noodles, frozen food and other staples to get them through lockdown and a tentative recovery. The volume gains for packaged foods represent more than a threefold increase over the same period in 2019. Yet, as package food sales boomed, beverage volumes fell by 1.6%, the result of a hiatus on social occasions.

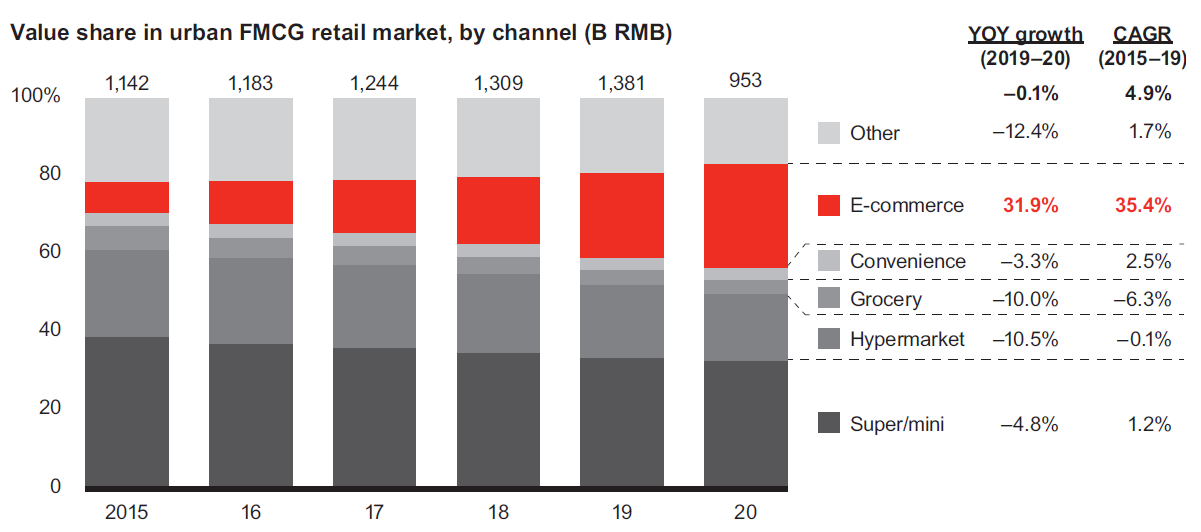

Emerging formats, such as livestreaming, which provides immersive experiences and personalised recommendations, played an increasingly important role in retail ecosystem this year. As the country locked down during COVID-19, it provided an entertaining alternative to physical shopping trips. As a result, livestreaming accounted for as much as 7% of total FMCG, apparel and electronics sales.

Online channels also continued to attract China’s shoppers during the early months of the pandemic and the recovery that followed, representing 26.7% of all FMCG sales in the first three quarters of 2020. That’s up from 21.9% in 2019, largely at the expense of hypermarkets and groceries.

What should we expect in 2021?

Occasions and needs

The out-of-home category, a victim of COVID-19, will gradually recover. Even as it does, there will still be room for growth in categories consumed at-home as well as for health and wellness-related categories. Chinese consumers will continue to make purchases that will improve their wellbeing.

Digitalisation

Consumers are expected to continue increasing their spend in online and online-to-offline channels. China’s FMCG market will maintain its dynamic tradition. Consumers will become more demanding in their need for anywhere, anytime shopping and a seamlessly integrated omnichannel shopping experience.

Value proposition and price

As ecommerce steadily grows, so will the rate of heavy promotions. This will continue to serve as a challenge for most brands. The trend of steady and simultaneous growth in both premium and mass categories will continue, making it critical for brands to compete with the right value proposition and price.

Organisational change

Rapid and unexpected shifts like the COVID-19 pandemic shakes up industries. The best consumer goods companies will become nimble organizations that will enable them to address changing needs faster and better than their competitors.

The impact of the recent pandemic on Chinese consumers can’t be understated. Even though China has recovered better than other markets, the entire ecosystem has suffered a massive shock so it is essential that companies truly understand what it will take to win in this new normal. By analysing and embracing the trends with a consumer-centric mentality and data-driven insights, companies should be able to remain connected to their customers and take the lead as we move past the impact of COVID.