Our Brand Footprint study, a detailed analysis of shopper behaviour, finds more of the world’s top 50 brands grew in 2020 than in any previous edition of the study. Twenty-nine out of 50 of the world’s biggest FMCG brands grew the number of times they were chosen by either increasing the number of households buying them, increasing the frequency of purchase, or both, during the pandemic according to new data.

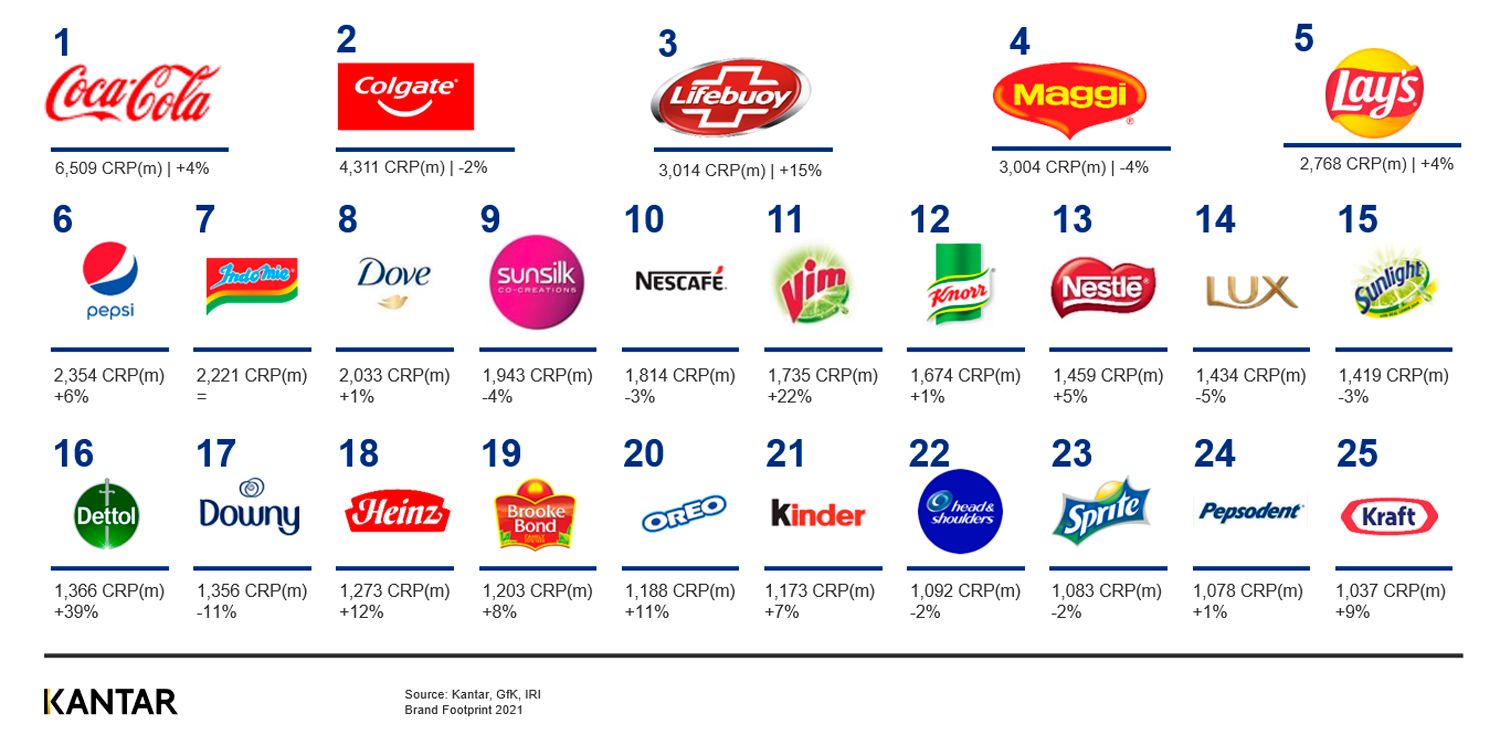

Coca-Cola remains the world’s most chosen brand for the ninth consecutive year, picked 6.5 billion times globally during the year, up 4% year-on-year based on take-home grocery sales. However, out-of-home sales fell 20% year-on-year as most major economies experienced pandemic lockdowns, giving a different picture of their overall performance. As online grocery shopping accelerated through the pandemic, Coca-Cola grew its ecommerce sales by 50% to be chosen 59 million times online. Colgate, Lifebuoy, Maggi and Lay's round out the top five most chosen brands, with Lifebuoy’s 15% growth lifting it beyond three billion times chosen and pushing it to #3 from #5 ranking, pushing Maggi and Lay’s down a spot each.

Dettol was the fastest growing brand of the year, with 39% growth, taking it to almost 1.4 billion times chosen and to #16 in the 2020 Brand Footprint ranking from #27 in 2019. Their increase, more than double 2019’s growth and four times their average growth in the past decade, was driven by an increase in penetration, with one in four households choosing Dettol during the year compared to one in five in 2019, alongside a 10% increase in purchase frequency.

The 25 most chosen FMCG brands on the planet

Hygiene and ‘convenience’ food brands benefitted most from the pandemic. Alongside Dettol’s increase in household share, Lifebuoy, Vim and Palmolive all increased their penetration rates. While in the ‘convenience’ food category Maggi, Oreo, Heinz, Lay's and Barilla were all chosen by more households in 2020 vs 2019.

The growth was achieved despite shoppers reducing the number of trips to the shops, as the average spend per trip increased 11%. As a result, consumers expanded their purchase choice and almost two thirds (64%) of the top 50 brands found additional shoppers during 2020. Other findings include:

- India and the U.S. accounted for 55% of the top 50 brand growth in 2020

- The proportion of growing brands which were mid-size and large increased from 50% to 54%

- Global brands’ share of total sales fell across regions; in the U.S., dropping to 63.3% (-0.4% vs 2019) while local brand share grew to 36.7%

- The top 50 ranking has remained largely consistent with 44 out of 50 brands appearing in each of the last five years

The pandemic accelerated the move to online grocery shopping, with online grocery sales increasing by 45.5%. As a result, shoppers turned to the biggest brands online. The top 5 most chosen brands online were Coca-Cola, Heinz, Nescafé, Colgate and Lay’s. L’Oréal Paris was the most successful online brand with 17% of its sales happening online; its 35% online growth partially offsetting its offline decline.

Access the report and explore the complete rankings here.