FMCG retail has been one of the major players in the COVID-19 health crisis, demonstrating that it is an essential service in our day-to-day lives. It should therefore come as no surprise that FMCG experienced growth in each of the various stages of the pandemic. This resulted in a year-on-year increase of 15.9% in value and 13.9% in volume during the first half of 2020.

These figures come from the Balance de la Distribución y Gran Consumo en España [Balance of Distribution and Consumer Goods in Spain] just published by Kantar. While growth is beginning to taper off due to the reactivation of consumption outside the home, overall levels remain high in post-lockdown Spain.

Carrefour and Lidl experience growth as lockdown eases

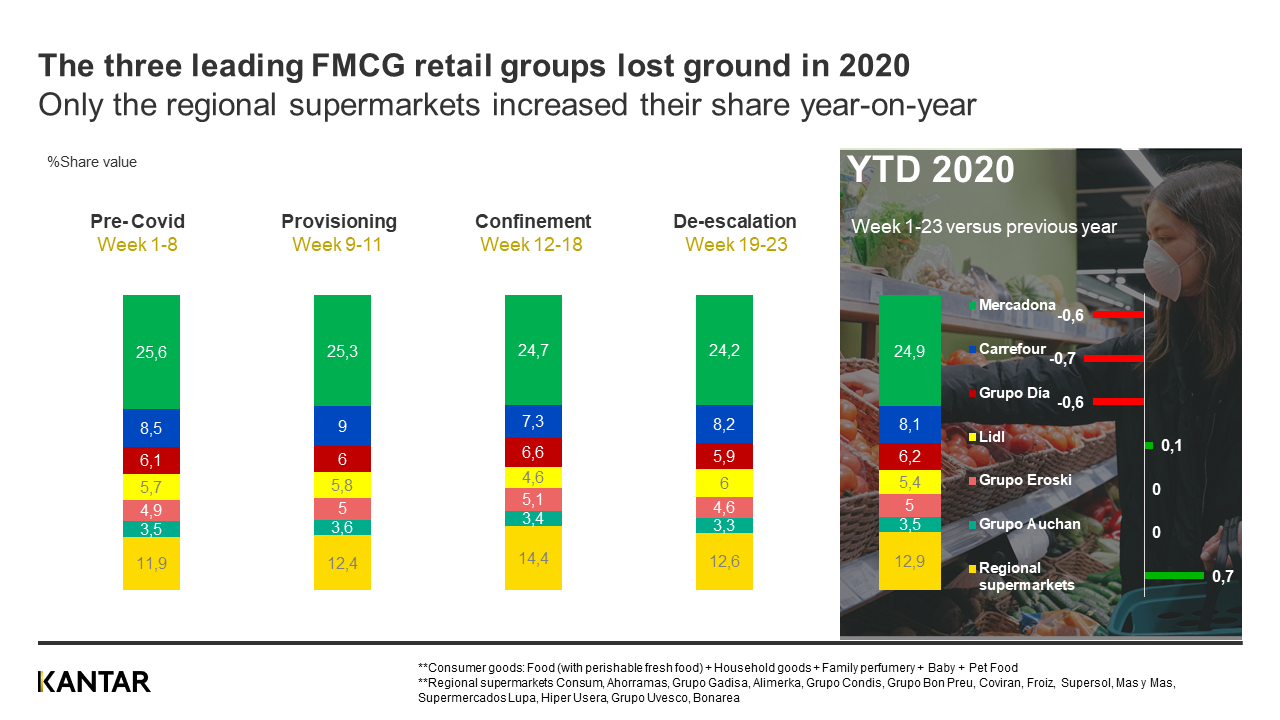

Spain's three leading distribution groups − Mercadona, Carrefour and DIA− lost ground to other retailers due to the crisis. Regional supermarkets are the only players that significantly upped their market share (by 0.7%) compared to 2019.

Carrefour and Lidl, whose results had been impacted during lockdown, are beginning to show signs of recovery. Carrefour rose from a market share of 7.3% in lockdown to 8.2% once it was eased, while Lidl improved from 4.6% to 6% in the same period. In both cases, these percentages are very close to pre-crisis performance.

Ecommerce and the local channel: the big winners

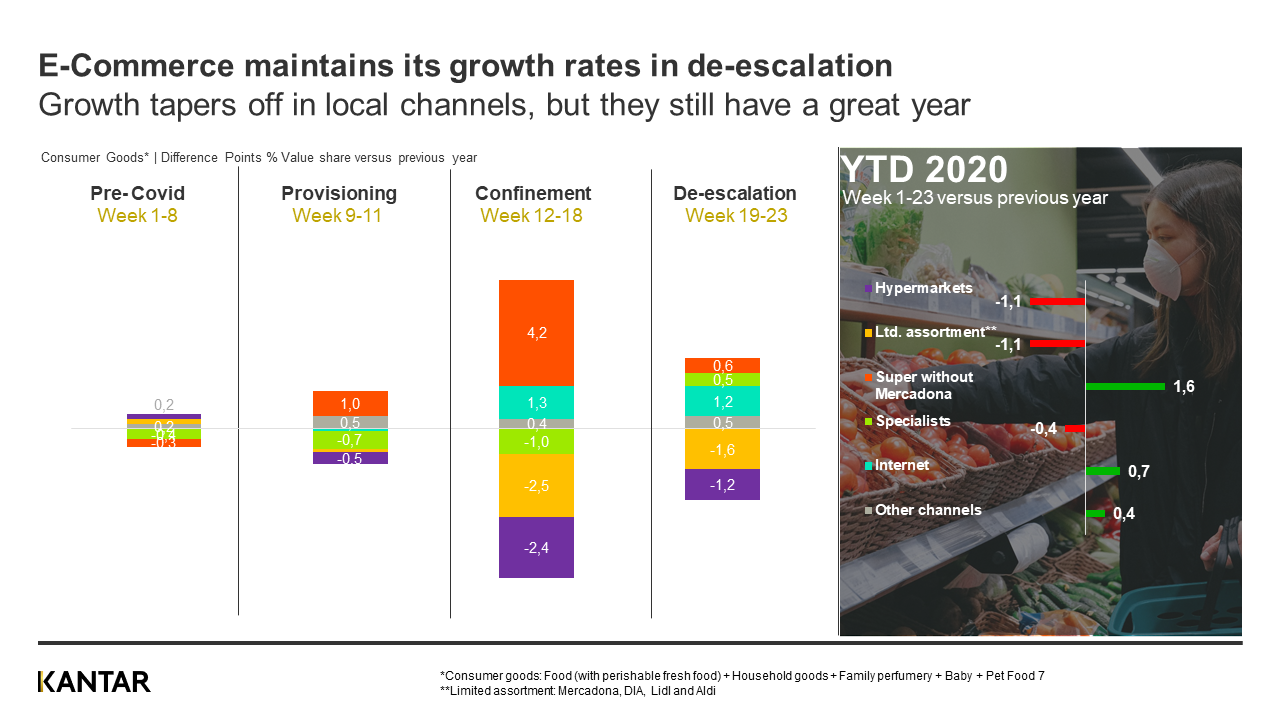

Ecommerce has performed particularly well during the pandemic, as it maintained its growth rates and increased share by 0.7%.

As for local supermarkets, although the level they attained during lockdown – up to 4.2% greater than 2019 – has dwindled since it eased. They have had a strong year overall though, with cumulative growth of 1.6% for the first six months.

Even post-lockdown, people continue to stock up on every shopping trip. Kantar’s data shows that spend per trip, which had fallen by -0.7% year-on-year in the pre-COVID phase and risen to 39.2% during lockdown, has reached a current annual growth figure of 26.4%.

The pre-lockdown shopping rhythm has not been recovered yet and trips to the supermarket are -3.6% down on the previous year. These behaviours will undoubtedly force retailers to monitor consumer movements continuously in the short term in order to understand them. It is a challenge, but also one that brings major opportunities.

Consumers switched from ham to soap and home baking

The impact of the crisis is also mirrored in the type of products consumed. This led to items such as hand soap, which notched up the highest growth figures in the panic-buying, lockdown and de-escalation phases, to grow by 339% compared to the previous year. The same goes for household gloves (+192%) and for home-baking products such as flour and yeast (+147%). In value terms these products knocked Iberian ham, cider, dried fruit and nuts off the top spot. Dried fruit and nuts had led the growth ranking in the first eight weeks of the year due to the Christmas period.

Another factor to be taken into account is the future of retail, which now has to contend with the challenge of making shops safe places for consumers. Consumer concerns seem set to extend beyond the easing of lockdown. In fact, 75.5% of consumers admitted that they will only give their patronage to shops that guarantee safety measures.

Finally, it should be noted that the effect of COVID-19 on our consumption habits is mirrored all over the world, and channels such as ecommerce are already at the forefront for some categories in countries such as France and China.