Argh! Private Labels are eating my lunch

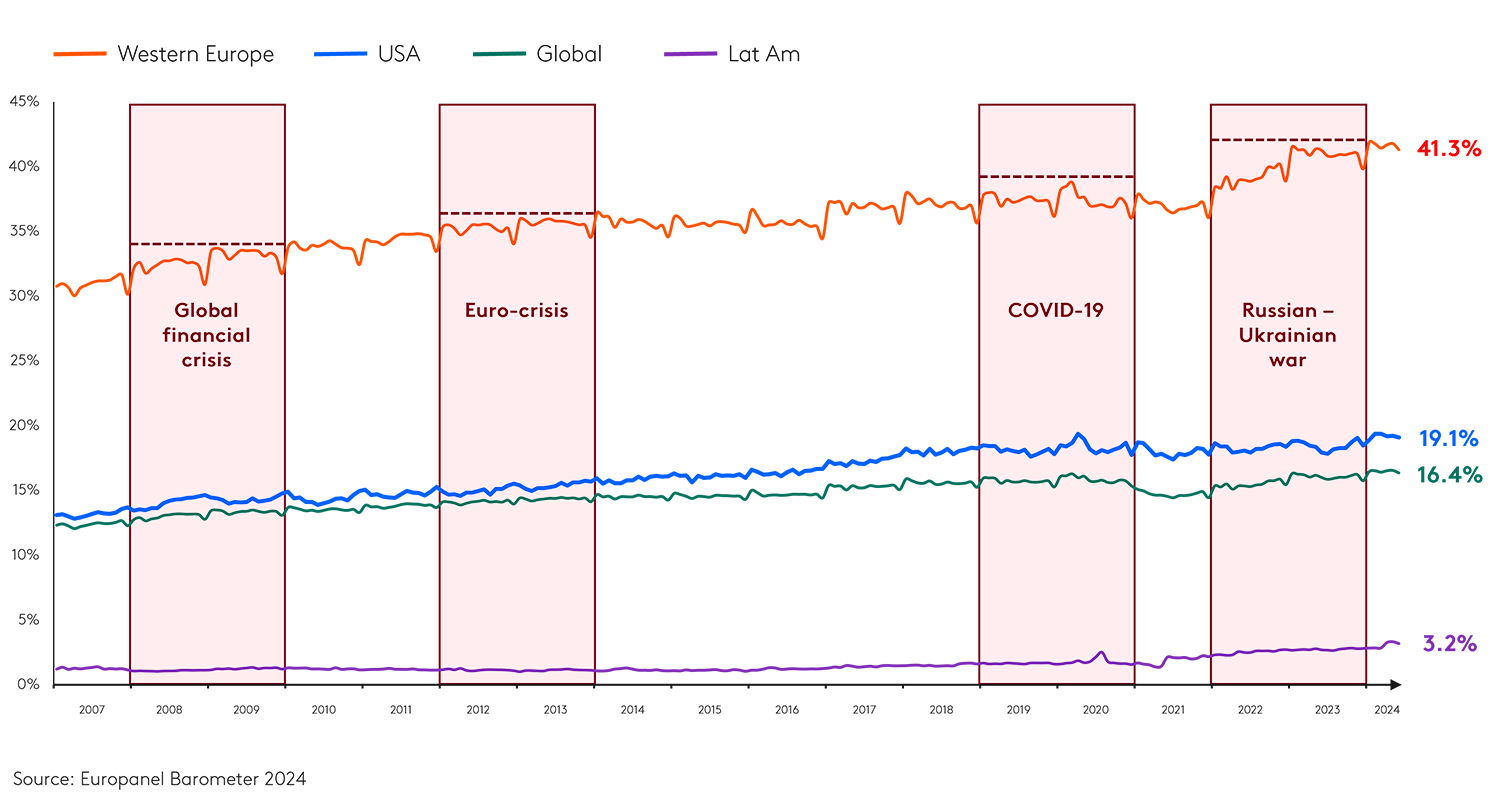

From the get-go, PL had an advantage as their survival rate trumps that of branded new products, also their natural charm with low- and high-income households puts no limits on purchase intent. But it’s macroeconomics that fuelled their prosperity; every single crisis of our permacrisis has accelerated the market share of PL, chipping away at that of brands.

Another PL share record in Europe and USA early 2024

Our BrandZ analysis predicts that PL’s value share (% of money spent on PL in the category) will grow over the next 12 months. But contrary to popular belief, price is not the single reason to choose Private Label products; more than 50% of shoppers are attracted to them for their perceived quality, and a third of them see no differentiation between PL and the branded offering – so why not?

How can Roman, the CMO of a medium-sized brand in the soft drink category, stop the loss to PL? There are three steps:

1. Make price your ally

Are there too many PL brands around you? Fret not. Our BrandZ analysis of over 1,000 categories proves that the presence of PL doubles the perceived price range, and so the strongest brands (the ones that are meaningfully different to more people) can command a price premium.

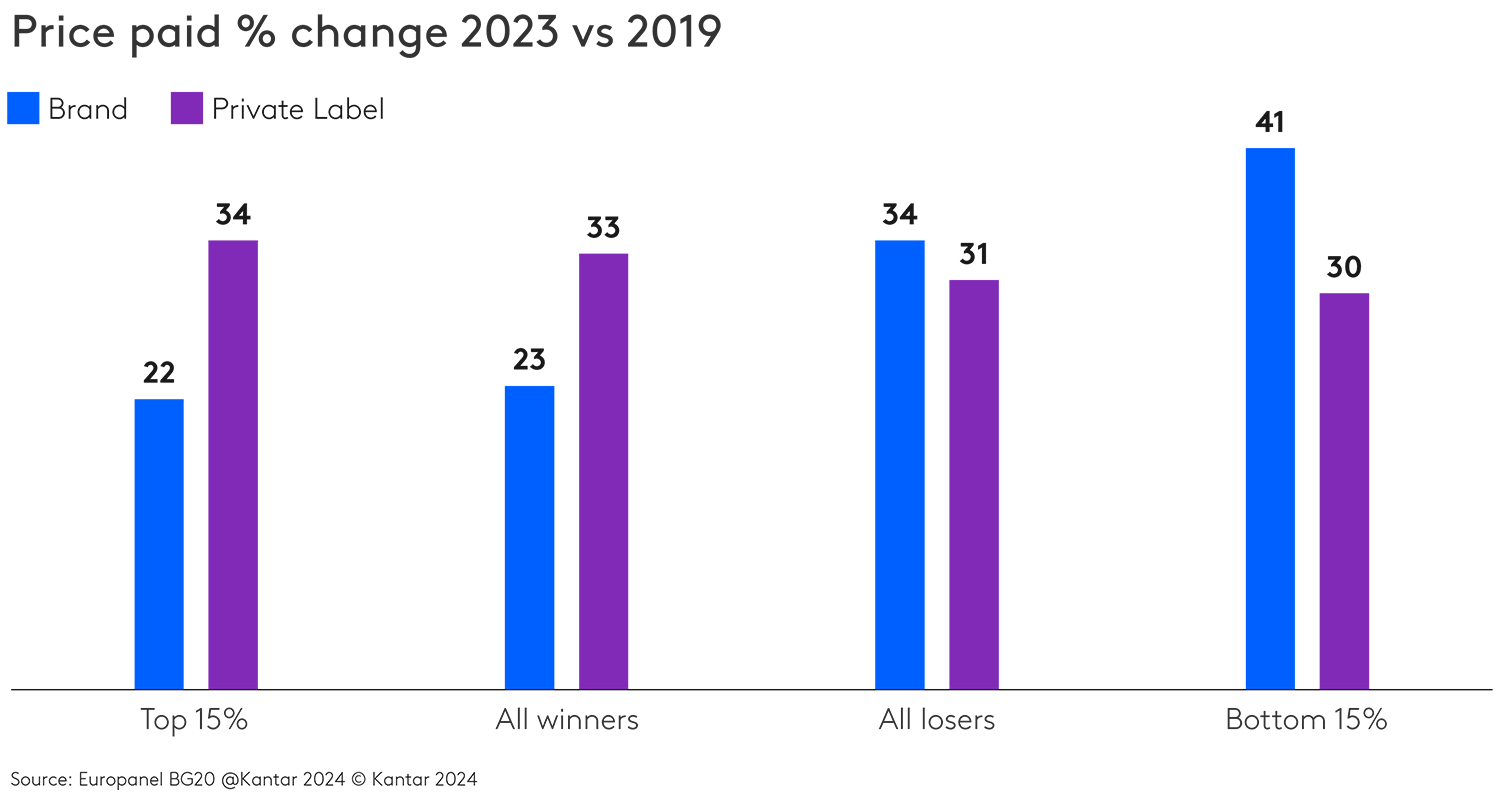

Saying this, our research into different pricing strategies suggests that brands that show pricing constraint win. Over the last four years, prices of winning brands went up by just over 20%, while losing brands increased prices by more than 30%. Notably, the winners increased prices less than PL.

Winning brands have increased prices less than losing ones and less than PL

2. Stay active, innovate and thus stand out

Brands with high penetration are more likely to decline than grow. In fact, the average top 10 brand in Europe has lost 0.14% share to PL within three years.

Interestingly, those that fail to find new space with no new products on the shelf lost twice as much, whereas those that launched the most new SKUs were in the top quartile of winning brands. Being active allows you to better defend your share: not only to get incremental sales from new products but also to keep your existing assortment on the retailer’s shelf.

Our results align with Professor L. Lamey’s extensive research on how brands can fight against PL. Lamey urges brands not to compete on price but to double down on quality. The single best way to keep customers from abandoning brand products, she concludes, is to introduce significant, distinctive innovations that are truly different and noticeably better.

3. Fish where the fish are

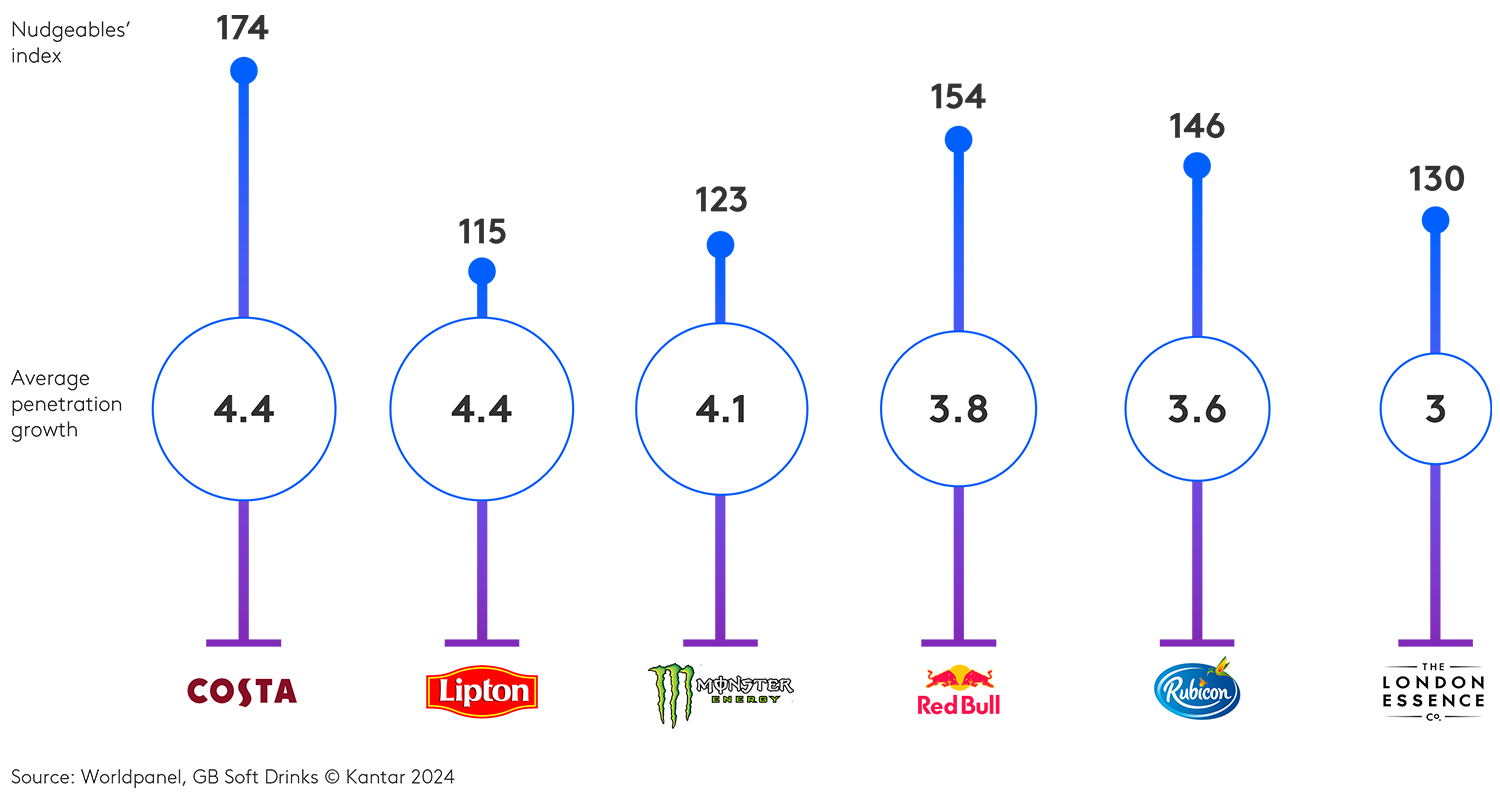

What if you could use consumers’ unloyal tendencies in your favour? The perpetually curious shoppers (let’s call them Nudgeables) make up 15% of the addressable market and can unlock billions of value: in the UK alone, this group amounts to 3.6 million households. By predisposing them and making your products more present, more visible and more accessible to them at the point of purchase, you can improve your marketing efficiency by 24%. How come?

Our study proves that there is a strong correlation between penetration growth and % of Nudgeables for a brand. A recent case study from the UK reveals that 77% of growing soft drink brands are over-represented by these brand-switchers. To illustrate, we picked the top six medium sized brands in terms of five-year average penetration growth – Costa, Monster, Red Bull, London Essence Co., Lipton Ice, and Rubicon; all these brands reported significant over-representation of Nudgeables vs. their category.

Predisposed undecided consumers = penetration gains

Leveraging the Nudgeables’ potential is likely the most lucrative opportunity for brand growth as it limits PL share gain and feeds brands’ own penetration gains.

Flip the narrative

“The scariest thing about private label”, Mark Ritson shared, “is not that it picks up share when times are tough, it’s that it never quite relinquishes it”. Someone once told him this. It was likely Professor Jan-Benedict Steenkamp. In his research with Lamey, they discovered that brands claw back about 1/3 of their market share loss after a recession ends. The remaining 2/3 is somewhat lost forever as people get accustomed to PL and learn to appreciate their quality.

Does this mean that PL share gains are inevitable? Not necessarily. The average category might have seen a 2.2% PL share increase since 2019, but the story flips in categories where the strongest performing brands compete. There, PL has actually lost share.

Strong brands have been pushing back in many ways: Magnum and LEGO for instance used advertising (award-winning advertising as judged by consumers themselves) to defend their price premium and gain back those who had got distracted by brand-alikes. Others (like Premier Foods) reigned in promotions or even redefined their prices at a lower level, like Wray. Many simply kept reinforcing their meaningful difference; like Mutti who refocused on quality (100% Italian tomatoes!) and ItalPizza who never stopped innovating their flavour options. At the heart of their every action lies the realisation that it’s a lot easier to get people to try something new than it is to convince them to stick with it. Consumers who are ‘forced’ by the cost-of-living crisis to try out PL, won’t return to brands unless brands reward them with a better value/price equation.

If we were to give Roman a single piece of advice, this would be to use value as a moat of protection against PL. Imagine a marketing-euphoric scenario where a slowdown in consumer spending was seen as an opportunity, not a threat. During the 2008 financial crisis, Roman and his team refreshed their brand. During Covid-19, they became more unmissably superior. During the 2022 inflationary peak, they gave consumers more value for the money they spent. By 2024, they were managing a stronger brand, one that showed resilience to market shocks and for which many consumers would resist the replacement temptation with a PL. Yes, people would still waver between trust, credibility, quality and ‘saving money’, but more often than not, consumer predisposition would load the dice in the brand’s favour.