Hamza is the newly appointed CMO of an aspiring energy drink that struggles to get listed in stores. As a narrowly distributed CPG brand, it has a higher chance (than the big brands) to gain penetration. But still, the odds are against them.

He knows the rules: their lower market share grants them fewer buyers who purchase them less frequently. The main way to gain more buyers is to steal from the competition. The ‘good’ news is that shaky macroeconomics prompt shoppers to look around more. The bad news is that not all brands truly understand who they are competing with. When we studied 190 UK grocery categories, we realised that one in five failed the ‘good fit’ test - in other words, many of the smaller brands had lower frequency of purchase than expected for their penetration, and that Double Jeopardy - the most renowned marketing principle – wasn’t precise for them.

How can Hamza define their true competition, assess the future number of buyers accurately, and tip the odds of winning in their favour? Here are the three things brands with low penetration should understand, to break people’s habits:

1. Your battle for consumers doesn’t start in the aisles.

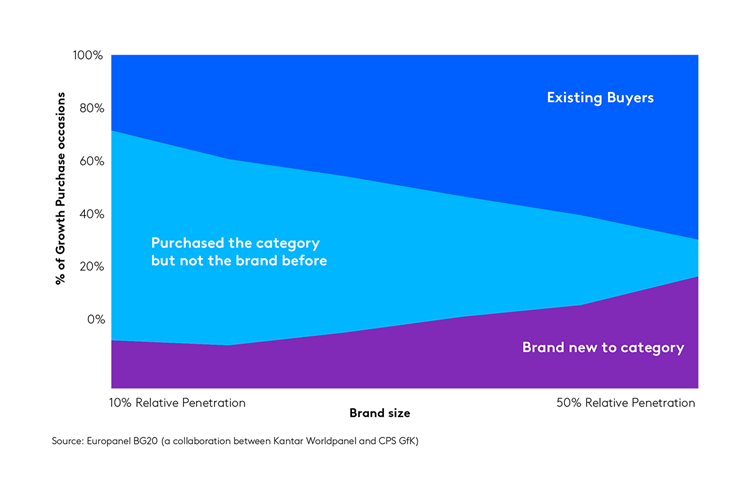

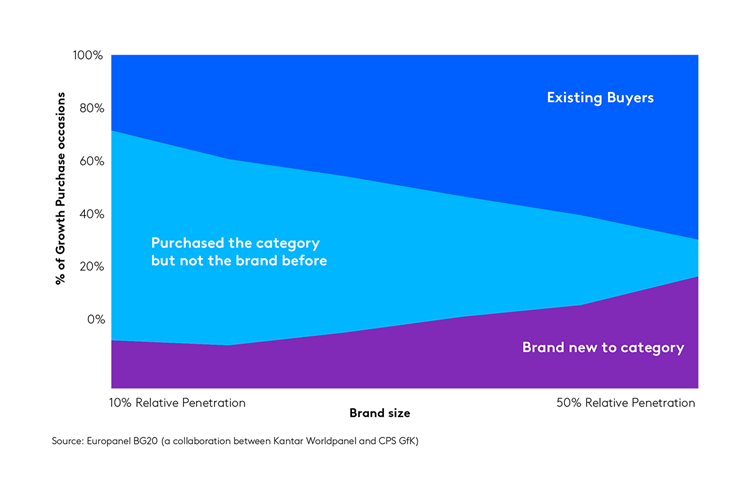

It starts in the consumer’s mind. People buy brands according to their proportion of equity, so the more people you predispose the greater the chances your brand will be purchased. Part of the consumer’s choice is explained by their past behaviour: we know that 6 out of 10 times, people will buy next the brand they last bought. So, for small brands to get in the game, they need to disrupt the habits of their existing category buyers; this is how they get 80% of their incremental growth.

When small brands grow, most of their increase in purchase occasions comes from existing category buyers, who never tried their brand before.

So, if you are a small brand, your aim is to make consumers think, break their past behaviour and steal from your competitors. But how?

The inaugural spot in your brand’s journey is to define your category very well. You need to find potential tensions that your brand can help resolve, and decide where to play. You start by unearthing insights about consumers’ behaviours and preferences. Then you work out how to answer their unmet needs and address consumption occasions. And just like that, you find your brand’s meaningful difference. Armed with it, you can load the dice in your favour: by being meaningfully different to more people, you give buyers a reason to think and go out of their way to pick you.

2. …but it’s in the aisles where it reaches a crescendo.

For that, you need to be where choices are being made. You need to Be More Present.

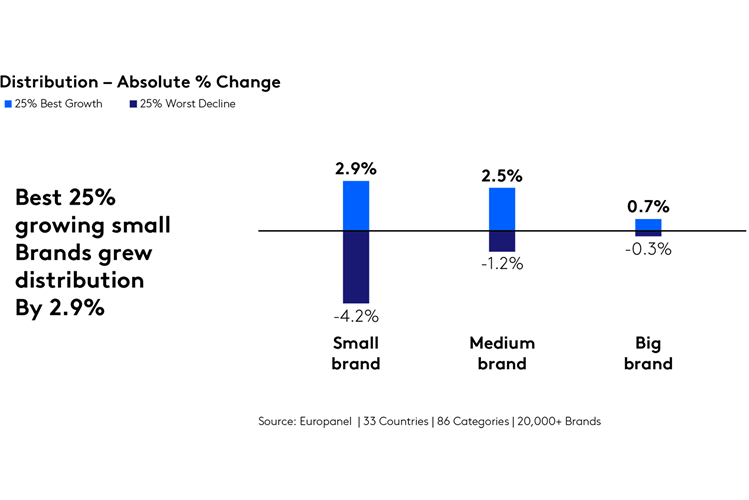

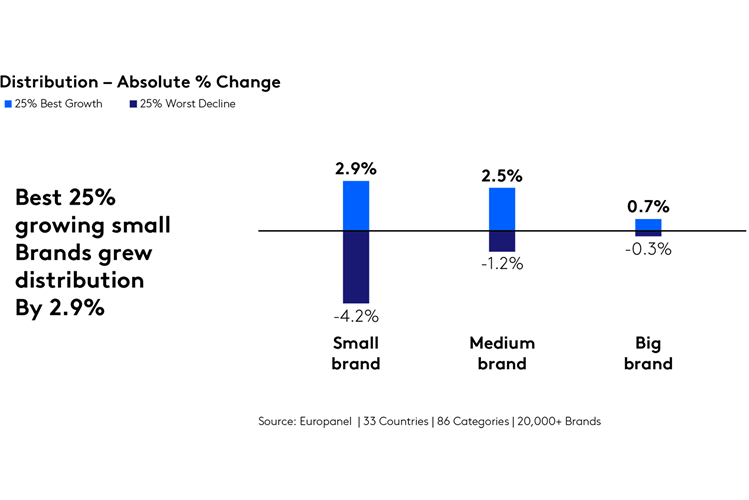

If you gain 1% in penetration, our Europanel data reveals, your brand will enjoy a 0.6% in market share. And if you are a small brand, this improved distribution can be a deterministic growth factor.

Shifts in distribution affect the trajectory of small brands more than that of big brands

Himalaya (personal care) and Horlicks (nourishing drink) both hit this mark. They gained 0.9 and 0.8 points respectively in 2022-2023, and each gained over 10 million buyers. But their story of triumph didn’t start in the aisles; they first ensured they met evolving human demands, and that their propositions differentiated them from the established category brands. And when it was time to activate, their claims to retailers about why they deserved shelf space were substantiated: they had the potential to become integral to the consumer’s daily narrative.

Our research shows that a value proposition paired with product demos, sampling and discounts can crack open ‘distribution’ doors, especially for the smaller brands. Professors Pauwels and Slotegraaf came to a similar conclusion in this paper. They demonstrated that smaller brands with meaningful difference can better optimise marketing investments, grow their presence and have a longer-term benefit from the strategic use of price promotions.

3. What you are missing on size, you need to make up in campaign effectiveness.

‘Can you do more for less?’ our starring CMO Hamza gets asked often.

It’s a pragmatic musing that’s rooted in a famous marketing truth. If your ESoV (excess share of voice) exceeds your SoM (share of market), you’ll drive growth, Binet and Field prove in their ‘The Long and The Short of it’: But smaller-sized brands need above average campaign effectiveness to grow their market share through ESoV - and often their smaller budget is a barrier. Often, not always.

Several Effie winners proved that high quality creative can actually mean you need a smaller media budget, observed our creative pundit Vera Sidlova. Flip, a Romanian refurbished mobile device seller, is a striking example of that. Their ‘new is for now, smart is forever’ campaign altered people’s perceptions to newness and created demand for second-hand mobile phones by converting buyers who had never considered buying one.

The David and Goliath story is not just a feel-good metaphor.

Instead of a sling and a rock, arm yourself with your relative difference.

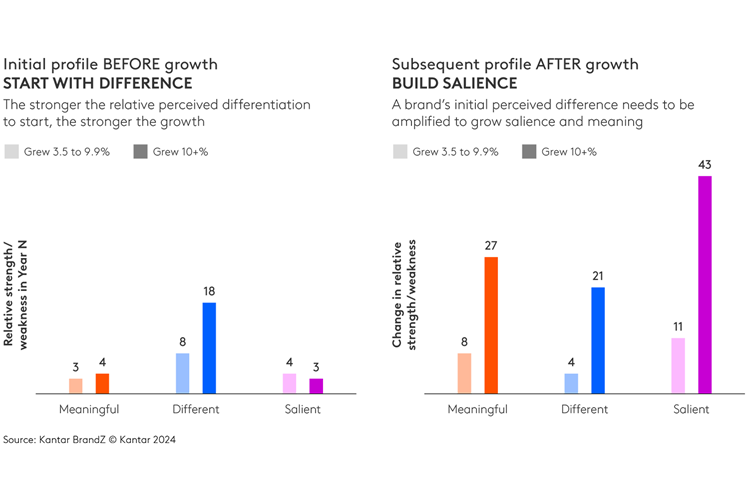

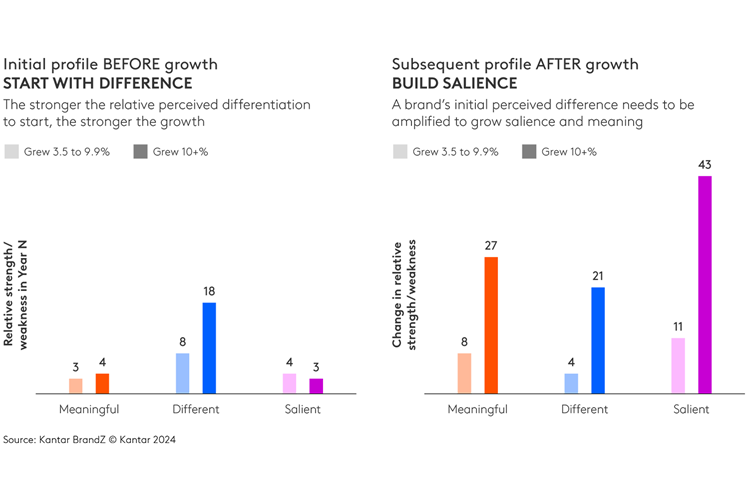

Penetration growth is hard to achieve: only 11% of brands managed to significantly increase it over the last year. The common denominator among them was a higher relative Difference than expected for their size. Our data shows that brands that grow their penetration start with a 7-point advantage in Difference, relative to brands that lose penetration. Also, that these brands start with Difference, which they then leverage into increased Salience and Meaning.

Strong growth often starts with strong perceived differentiation. Subsequently that difference is leveraged into increased salience and meaning.

All around us we can see real examples of underdog brands (like Hamza’s) now leading their category pack. Guzman y Gomez, Fever Tree, Nubank and many more, were at the bottom tier of their competitive sets a few years ago. All three found their meaningful difference, increased their penetration, and growth followed.

Never forget that your access to consumers is your superpower. Hamza started with their needs - he found out how consumers saw the world and never stopped monitoring their perceptions towards his brand. Growth will come, not because of luck, but because he’s systematically working towards it. The brand tracker in his back pocket proves that he’s moving in the right direction.

Whether you are starting now or are an established brand, our promise is this: Blueprint for Brand Growth will help you stay on track to sustainable growth and healthy profits.

He knows the rules: their lower market share grants them fewer buyers who purchase them less frequently. The main way to gain more buyers is to steal from the competition. The ‘good’ news is that shaky macroeconomics prompt shoppers to look around more. The bad news is that not all brands truly understand who they are competing with. When we studied 190 UK grocery categories, we realised that one in five failed the ‘good fit’ test - in other words, many of the smaller brands had lower frequency of purchase than expected for their penetration, and that Double Jeopardy - the most renowned marketing principle – wasn’t precise for them.

How can Hamza define their true competition, assess the future number of buyers accurately, and tip the odds of winning in their favour? Here are the three things brands with low penetration should understand, to break people’s habits:

1. Your battle for consumers doesn’t start in the aisles.

It starts in the consumer’s mind. People buy brands according to their proportion of equity, so the more people you predispose the greater the chances your brand will be purchased. Part of the consumer’s choice is explained by their past behaviour: we know that 6 out of 10 times, people will buy next the brand they last bought. So, for small brands to get in the game, they need to disrupt the habits of their existing category buyers; this is how they get 80% of their incremental growth.

When small brands grow, most of their increase in purchase occasions comes from existing category buyers, who never tried their brand before.

So, if you are a small brand, your aim is to make consumers think, break their past behaviour and steal from your competitors. But how?

The inaugural spot in your brand’s journey is to define your category very well. You need to find potential tensions that your brand can help resolve, and decide where to play. You start by unearthing insights about consumers’ behaviours and preferences. Then you work out how to answer their unmet needs and address consumption occasions. And just like that, you find your brand’s meaningful difference. Armed with it, you can load the dice in your favour: by being meaningfully different to more people, you give buyers a reason to think and go out of their way to pick you.

2. …but it’s in the aisles where it reaches a crescendo.

For that, you need to be where choices are being made. You need to Be More Present.

If you gain 1% in penetration, our Europanel data reveals, your brand will enjoy a 0.6% in market share. And if you are a small brand, this improved distribution can be a deterministic growth factor.

Shifts in distribution affect the trajectory of small brands more than that of big brands

Himalaya (personal care) and Horlicks (nourishing drink) both hit this mark. They gained 0.9 and 0.8 points respectively in 2022-2023, and each gained over 10 million buyers. But their story of triumph didn’t start in the aisles; they first ensured they met evolving human demands, and that their propositions differentiated them from the established category brands. And when it was time to activate, their claims to retailers about why they deserved shelf space were substantiated: they had the potential to become integral to the consumer’s daily narrative.

Our research shows that a value proposition paired with product demos, sampling and discounts can crack open ‘distribution’ doors, especially for the smaller brands. Professors Pauwels and Slotegraaf came to a similar conclusion in this paper. They demonstrated that smaller brands with meaningful difference can better optimise marketing investments, grow their presence and have a longer-term benefit from the strategic use of price promotions.

3. What you are missing on size, you need to make up in campaign effectiveness.

‘Can you do more for less?’ our starring CMO Hamza gets asked often.

It’s a pragmatic musing that’s rooted in a famous marketing truth. If your ESoV (excess share of voice) exceeds your SoM (share of market), you’ll drive growth, Binet and Field prove in their ‘The Long and The Short of it’: But smaller-sized brands need above average campaign effectiveness to grow their market share through ESoV - and often their smaller budget is a barrier. Often, not always.

Several Effie winners proved that high quality creative can actually mean you need a smaller media budget, observed our creative pundit Vera Sidlova. Flip, a Romanian refurbished mobile device seller, is a striking example of that. Their ‘new is for now, smart is forever’ campaign altered people’s perceptions to newness and created demand for second-hand mobile phones by converting buyers who had never considered buying one.

The David and Goliath story is not just a feel-good metaphor.

Instead of a sling and a rock, arm yourself with your relative difference.

Penetration growth is hard to achieve: only 11% of brands managed to significantly increase it over the last year. The common denominator among them was a higher relative Difference than expected for their size. Our data shows that brands that grow their penetration start with a 7-point advantage in Difference, relative to brands that lose penetration. Also, that these brands start with Difference, which they then leverage into increased Salience and Meaning.

Strong growth often starts with strong perceived differentiation. Subsequently that difference is leveraged into increased salience and meaning.

All around us we can see real examples of underdog brands (like Hamza’s) now leading their category pack. Guzman y Gomez, Fever Tree, Nubank and many more, were at the bottom tier of their competitive sets a few years ago. All three found their meaningful difference, increased their penetration, and growth followed.

Never forget that your access to consumers is your superpower. Hamza started with their needs - he found out how consumers saw the world and never stopped monitoring their perceptions towards his brand. Growth will come, not because of luck, but because he’s systematically working towards it. The brand tracker in his back pocket proves that he’s moving in the right direction.

Whether you are starting now or are an established brand, our promise is this: Blueprint for Brand Growth will help you stay on track to sustainable growth and healthy profits.