Take-home sales at the grocers rose by 3.8% in the four weeks to 4 August 2024 compared with a year ago, according to our latest data. Grocery inflation increased for the first time since March 2023 to 1.8%, up from 1.6% last month.

Having reached its lowest rate in almost three years in July, August saw inflation nudge up again slightly. While this is noticeable following 17 straight months of falling rates, it actually marks a return to the average levels seen in the five years before the start of the cost of living crisis.

It is a mixed picture on supermarket shelves with prices now rising across 182 product categories, as the costs in 89 others fall. Kitchen towels and baked beans are now 7% and 5% cheaper respectively than they were last year. With this kind of pricing spread, shoppers will find that the type of product they’re putting in their baskets will really dictate how much they pay. They’re continuing to take advantage of the wide range of promotions being offered by the grocers to help keep the price of shopping down. Spending on deals rose by 15%, while sales of products at their usual price saw no increase.

Welcome sales boost from both summer and sport

Despite the ongoing pressures on consumers, this month saw people getting into the party spirit to celebrate the summer of sport. While people continue to make smart choices to manage their budgets, we should never underestimate Britons’ love of big occasions. Many marked the start of the Olympics over drinks and snacks – sales of wine were up 35%, while nuts increased 60% and crisps rose by 10% on the Friday of the Opening Ceremony in Paris, compared with the previous week. England fans also roared on The Three Lions as the men’s UEFA European Football Championship Final reached its closing stages with £10 million spent on beer on the day of the final, the most spent on a Sunday in more than three years.

As the country cheered on its sporting stars, for many it felt like summer finally arrived in July and August. Sales of burgers leapt by 32% compared with the same time last year, as Britons finally lit the barbecue. Chilled prepared salad sales rose by 22% while the amount spent on ice cream was 23% higher. It wasn’t all fun in the sun though – 28% more was spent on cough lozenges as people battled with COVID-19 and other summer colds.

Ocado and Lidl fastest growing retailers

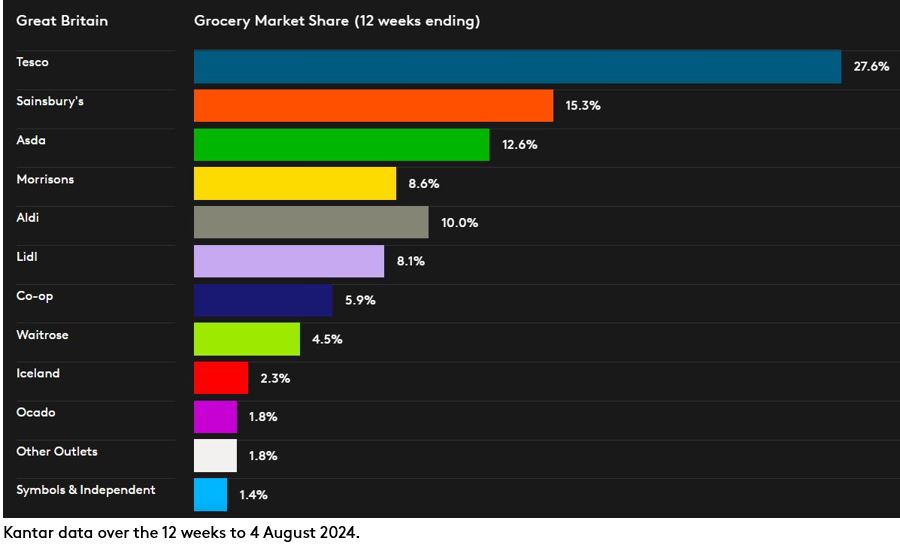

Sainsbury’s market share has risen by 0.5 percentage points over the 12 weeks to 4 August, compared to the same period last year – its largest year-on-year share gain since July 1997. It was again the fastest growing of the traditional supermarkets, with sales increasing by 5.2%.

Britain’s largest grocer Tesco has now maintained its streak of winning share every month since August 2023. Its hold of the market climbed by 0.6 percentage points to 27.6%, while its sales jumped by 4.9%. Asda now takes 12.6% share, while Morrisons’ stake stands at 8.6%.

Discounters Lidl and Aldi both saw sales growth. Buoyed by a 7.8% boost in sales, Lidl won an extra 0.4 percentage points of the market, taking its share to 8.1%. Aldi’s market share is now 10.0%.

Sales rose by 11.3% at online-only retailer Ocado, continuing its 6-month run as the fastest growing grocer. Its share is up by 0.1 percentage point compared with last year, now standing at 1.8%.

Waitrose’s share increased by 0.1 percentage point to 4.5%, and with sales also up by 4.5%, it logged its strongest growth since November 2023. Frozen specialist Iceland now holds a 2.3% share, as shoppers there spent 4.1% more at its tills, while Co-op takes 5.9% of the market.