Take-home grocery sales increased by 6.1% in the four weeks leading up to 29th September 2024, according to our latest data. In September, as families got ready for school, sales volume increased by 3.6%, as people shopped more frequently, with a 1.5% rise in shopping trips.

Grocery inflation stands at 2.67%, representing a slight decrease of 0.09 percentage points from the previous period.

Back to School

As households settled into their autumn and back-to-school routines of preparing school lunches and dinners, Irish households spent an additional €2.6 million on fresh vegetables and €1.9 million on fresh fruit. They stocked up on pantry staples, spending an additional €1.4 million on ambient bakery breads, nearly €1 million more on frozen goods, and €1.5 million more on soft drink carbonates. Some shoppers got an early start preparing for the Halloween season, which was reflected in a significant €3 million increase in spending on confectionery.

As shoppers returned to their back-to-school routines, they continued to purchase family-favourite brands. Brand sales grew by 8% compared to last year, outperforming own-label products once again this period, increasing their value share of total spending to 48.2%.

Even with branded products growing every month, own-label ranges also saw their value sales increase by 3.9% this month compared to last year. Most of this growth came from standard private label products, which added an extra €50 million in value to the own-label range. While premium own label represents a smaller portion of retailer offerings, it contributed an additional €9.2 million compared to last year.

Irish retailers’ update

Online sales have increased by 9.6% year-on-year, with shoppers spending an additional €17 million through this channel. Retailers are driving this growth by offering attractive online incentives including money off vouchers and free delivery in some cases, which have encouraged shoppers to return more frequently. The latest 12-week data shows that this increase in platform visits was the main contributor to the growth, rising by 12.3%.

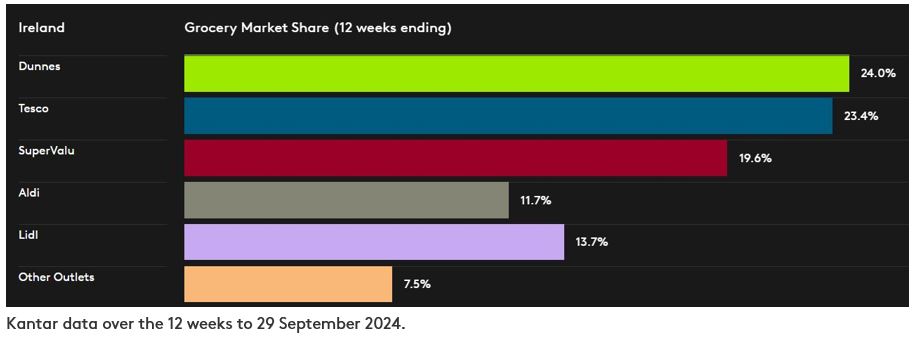

Dunnes holds a 24% market share and saw value growth of 9.5% year-on-year. Dunnes has the strongest frequency growth among all retailers, at 9.3% year-on-year, which contributed an additional €67 million to its overall performance.

Tesco holds 23.4% of the market, with value up 10% year-on-year. This growth mainly came from recruiting new shoppers, alongside existing shoppers making more frequent and larger trips, which contributed an additional €47.5 million to its overall performance.

SuperValu holds 19.6% of the market and saw growth of 1.7%. Its shoppers made more trips in-store than those of any other retailer—an average of 24 trips—which contributed an additional €13 million to its overall performance.

Lidl holds a 13.7% share of total spend and saw growth of 8% year-on-year. It continued to recruit new shoppers, contributing an additional €12 million to its overall performance. Aldi holds an 11.7% market share, with growth of 0.6% year-on-year. More frequent trips contributed an additional €18 million to its overall performance.