Today we released the results from the second wave of our global study exploring the market implications of the coronavirus. More than half of people globally (52%) say their day-to-day lives have now been impacted by the current situation – up from 39% in wave 1. Now surveying more than 30,000 consumers across 50 markets, our COVID-19 Barometer helps brands understand how people are feeling and reacting to the “new normal.”

Financial concerns are the number 1 worry

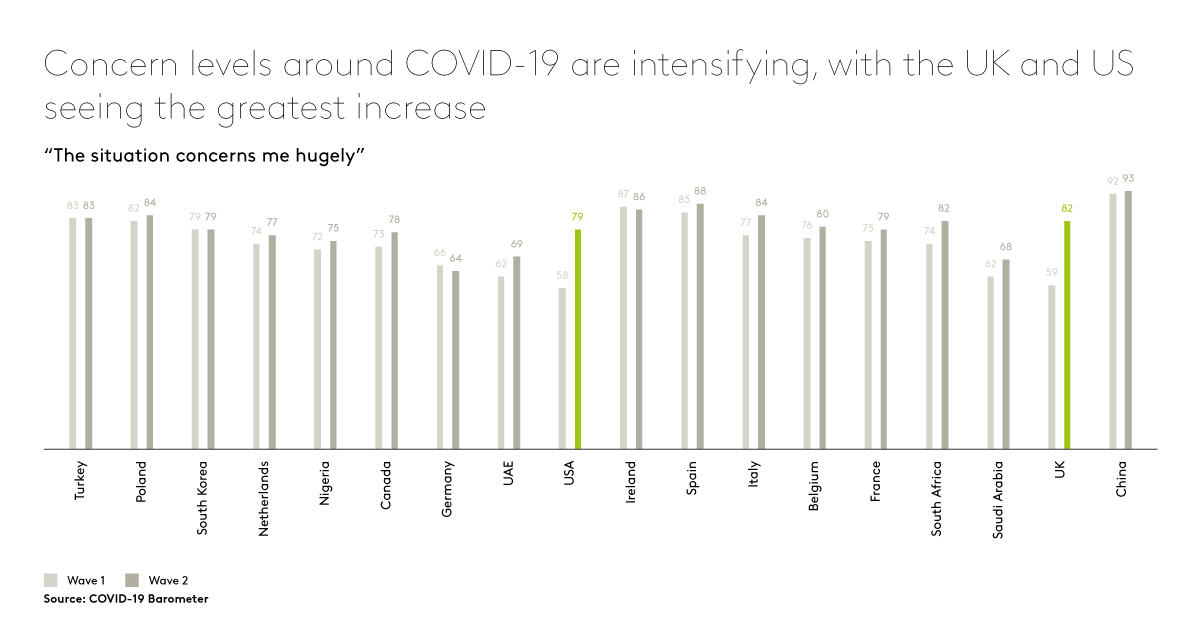

All around the world, overall levels of concern are intensifying as the pandemic progresses. The rise is particularly evident in the UK and US, where concern levels have increased by 23 percentage points to 82% and 21 percentage points to 79% respectively. But it is financial concerns that outweigh personal health concerns at this stage of the crisis. 68% of people say the situation demands more proactive financial planning, and 60% are worried about the economy’s ability to recover, while only 50% of people are concerned about falling sick.

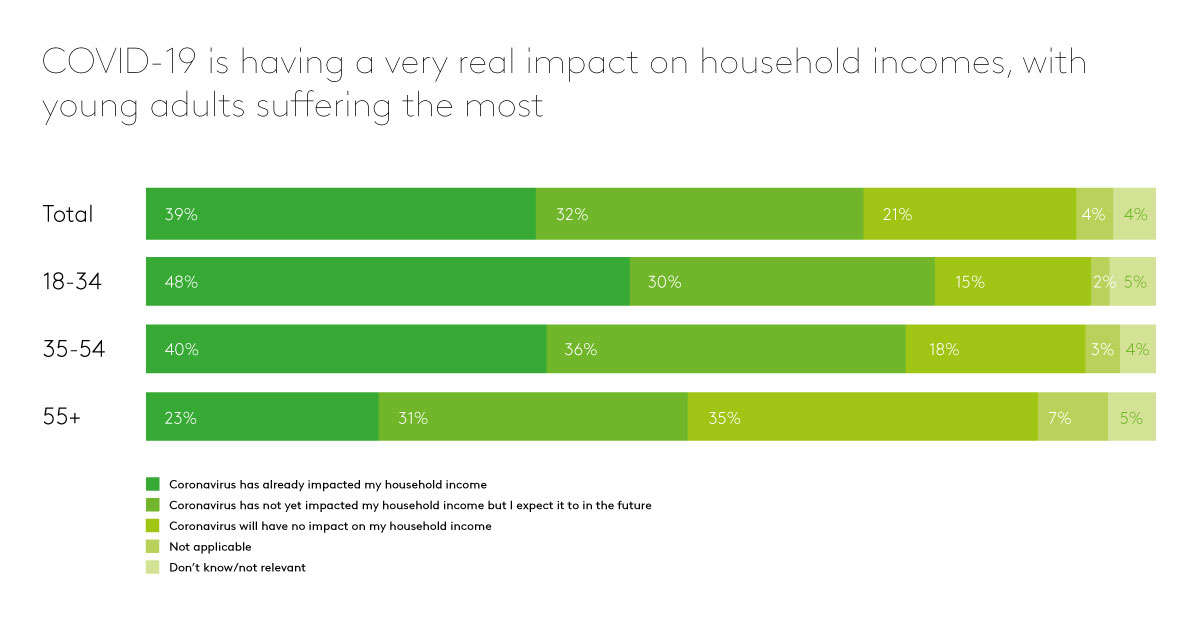

The financial concern is driven by the very real impact COVID-19 is having on household incomes. 71% of people surveyed globally say that their household income has or will be impacted by coronavirus. This rises to 78% amongst millennials, who are more likely to work in positions or industries that are at risk.

News consumption is up, as people seek to stay informed

Being prepared and keeping well informed is the primary response across markets, seen as paramount by more than a third of respondents globally (34%). National media channels, such as nationwide TV channels and newspapers, are still seen as one of the most trusted sources of information, with 54% of people identifying them as a trustworthy source. Audience Measurement data collected by Kantar has recorded significant viewer increases in new outlets around the world:

- In China, the time spent watching news programmes has more than doubled in the first three months of the year from 9 hours in 2019 to 18.5 hours in 2020.

- In the UK, 17 out of the 20 most watched shows in 2020 have been BBC News.

- In Brazil, the share of time spent watching the news has increased by a third through the month of March.

Trust in government websites has increased to 54%, vs 48% during wave 1 of the research, suggesting that as the severity of the pandemic increases, people are increasingly looking to their government for information and support.

Those most affected see this is an opportunity to reset

Young adults are more likely to be feeling the financial impact of the coronavirus and are experiencing the most change to their day-to-day lives. Many are making more healthier lifestyle choices, as people look to take control of what they can. 59% of 18-34s say they are eating healthier, 57% are using this as an opportunity, and 48% claim to be exercising more regularly.

We are also seeing more change and experimentation from this age group; 44% are using the time to focus on personal development, and 25% are choosing to meditate.

Older age groups (55+) are trying to get a much sunlight as possible in the context of greater restrictions to their freedom of movement.

Consumers increasingly expect companies to ‘step up’

Data from the first wave of the COVID-19 Barometer research found that people expect businesses to prioritise staff welfare and to play their part in supporting society through the pandemic. Analysis of data from the second wave suggests the public role for companies is accelerating, as people expect practical help from companies, including the donation of useful items and helping the government. 47% of people now expect companies to support hospitals during the crisis (vs 41% in wave 1), while 39% say that companies should be making themselves available to governments (35% in wave 1).

Like companies, brands are also in the public eye – and are expected to be practical, realistic and helpful. 31% of people want brands to help them during their everyday life suggesting that how brands behave now will be remembered in life after the pandemic.

Only 8% of consumers believe that companies should stop advertising, with many claiming that it is a welcome distraction, reminding them of more normal times.