At this year’s Festival of Marketing Mark Ritson lamented the lack of time marketers spend on brand ‘diagnosis’, a process of intense discovery to form an objective view of a brand’s challenges and a crucial step for developing your strategic plan and tactics. It’s a valid challenge and, as COVID-19 continues to disrupt and distract, dedicating the time for thorough market orientation is increasingly tough.

Diagnosis and strategy, though, are only the beginning. How can you ensure your plan stays on track?

There’s no question that traditional ‘brand planning’ cycles are being upturned, a trend predating COVID-19, and successful marketers are favouring more flexible approaches such as quarterly planning reviews and resets. Without the same agility applied to the data sources and analytics used to assess progress, very good plans risk being prematurely scuttled.

As a result, diagnosis is not the only place marketers should be asking tougher questions of the data sources available to them. When it comes to the vital signs of success that will fuel the actions and course-corrections to deliver the strategy, marketers should set high standards for the signals they use to guide them. It’s no longer enough to set your strategy and then check-in to an updated brand funnel a year hence.

Here are three tips to ensure your brand signals help you stay on strategy and respond in real time.

1. Broaden your data horizons

Asked about how the pandemic affected their businesses, our marketing and insights clients unanimously highlighted how the data sources used by their businesses had broadened in response to the diverse challenges they faced. Google and Apple location data, for instance, helped understand mobility for those remaining dependent on physical locations, while restaurant booking data helped assess the bounce back potential of the on-trade as restrictions eased.

Of course, shortage of data is often not the problem. To really stay on track for your long-term outcomes, it’s essential to know in the short term what to pay attention to and what to ignore. This requires the capability to combine data sets so that signals like location or bookings data can sit alongside brand metrics like awareness and consideration. By then applying analytics to remove the noise and identify the true short and long-term underlying trends and artificial intelligence to analyse thousands of data points in a click, you can pinpoint what call to make and when.

Regardless of category, the integration of search data can greatly help marketers keep their finger on the pulse. Search terms captured via Google are a high-definition snapshot of consumers that reveal expressions of rich and varied tensions or needs. Critically, these can often be entirely unexpected, demonstrating the strength of data which isn’t predefined by our bias or expectations. Access to always-on platforms that can easily identify the dynamic search trends within the category universe will soon become a key part of the post-COVID marketer’s toolkit.

Without the right data sets housed together with the capability to quickly identify the insights, the ability to ‘go long but plan short’ will take more effort, cost you more time and risk putting you behind the curve.

2. Secure credibility and confidence with the right short-term indicators of long-term outcomes

It’s not revolutionary to suggest that a decent brand plan will champion brand-building investment and most stakeholders can be convinced of the merits. The problem is brand building takes time to materialise in business metrics and time is often not in abundance. Even if you have proven indicators of brand strength as KPIs, there’s a risk in the absence of significant immediate results premature decisions can be made to cut back spend or change campaigns.

Brand tracking could be providing a much higher calibre of evidence to prevent this. What’s imperative is that marketers have access to short-term indicators that signal to the business that brand building is on track, even if the outcome is yet to be realised. To tackle climate change we are better served measuring carbon emissions in the immediate term rather than waiting to see changes in global temperatures. In the same way, by managing expectations of the right brand signals to pay attention to, marketers can engender the vital credibility and trust of the CFO and the CMO, inspiring confidence in the plan and the progress being made.

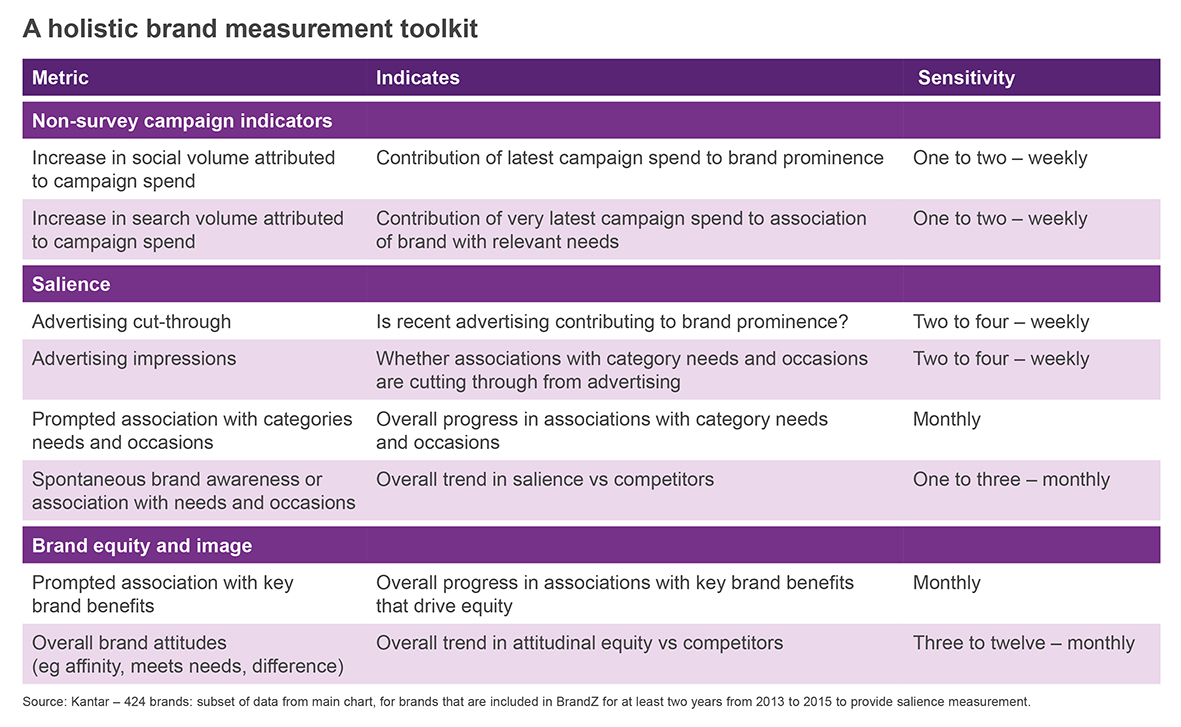

Some of the most pressing short-term questions often relate to the impact of marketing investment, but the fact is that most traditional brand tracking survey metrics do not move fast enough to fulfil this task at the speed marketers need them to. An in-depth exploration of the sensitivity of brand metrics (see image below) found that the ‘go-to’ metrics marketers might use to assess a campaign (consideration, brand image associations) move comparatively slowly. As such, the wrong conclusions could be drawn about the effectiveness of marketing spend if they are the short-term indicators of focus.

The results showed that only the indicators of brand salience move sensitively enough to provide evidence of progress straight after marketing activity along with search and social volumes for the brand. Changes in search volumes attributed to campaign spend can prove a sensitive weekly view of whether you are coming to mind as the answer to consumer needs. Social volumes treated in the same way indicate changes in the general prominence of a brand faster than traditional measurement. If more people are aware of your brand’s communications activity and the underlying trend of search and social mentions is up, these are reliable signals to the business that the strategy is on track.

Beyond brand salience, progress in associations with category entry points or with key brand benefits that drive equity will move more slowly but, if all is working optimally, will respond to activity. If all of these signals are heading in the right direction, the ultimate KPI of brand strength – that you are enriching the associations held for your brand in people’s heads in a desirable way to increase pre-disposition and drive sales – will follow.

3. Gain and retain stakeholder buy-in through commercial alignment, prediction and forecasting

The unprecedented disruption of 2020 created a shift in expectation for marketing and insights teams: from data providers to fortune-tellers. This shift is unlikely to reverse, and nor should it – predictive insight is essential but often missing. Of course, you need the right tools and, sadly, they don’t come in the form of a crystal ball but from interrogating, connecting, and projecting a varied range of signals.

There are two steps we suggest to help achieve fortune teller status. Firstly, house sales data alongside brand survey data and review how data movements relate to commercials in the short and long term. Secondly, incorporate the ability to detect and forecast trends, creating a complete understanding of what associations drive brand growth.

The additional capability to forecast future trajectories unlocks the answers that will support decision making and provide confidence and reassurance for key stakeholders. Brand equity is a commercial asset, and connecting it to profitable outcomes allows it to be treated as such in a brand plan.

The foundations of deep diagnosis to inform a sound strategy are, as Mark Ritson says, often overlooked to the detriment of many a brand plan, but it’s easy to also overlook how advances enable us to pro-actively monitor and steer progress in near-real time. The stagnant, brand tracking programmes with single-source data and flat lines are no longer the only option. With new platforms, better knowledge of the metrics that matter and the intelligence to find connected insights, once the diagnosis is complete for your brand, you can have the vital signs of success at your fingertips.

Find out here how we’re helping clients achieve their brand plans with the latest developments in brand guidance.