Before the first episode of Friends aired in 1994, the creators flew the cast to Las Vegas for a jolly, saying: “This is your last shot at anonymity… after this you’ll never be able to go anywhere without being hounded.”

Maybe we should have done the same with ‘Share of Search’ a few months ago. It’s recently been celebrated as both ‘the most important metric you’ve never heard of’, the natural successor to share of voice, and even an accurate lead indicator of market share. It’s being explored with increasing interest because it’s ticking a lot of boxes: the concept is pretty simple, the rationale makes common sense, and it looks practically useful.

Firstly, what is it? Share of Search is the volume of search queries for a brand as a proportion of all of the search queries for all the brands defining a category. It’s based on exactly the same principle as sales and market share, but uses the number of times a brand’s name is typed into Google.

So, how can brand managers get the best out of Share of Search? Is it as a proxy or predictor of Share of Market? An alternative to Share of Voice? Or both? Or does it have more to offer if you dig a little deeper?

What does Share of Search tell us?

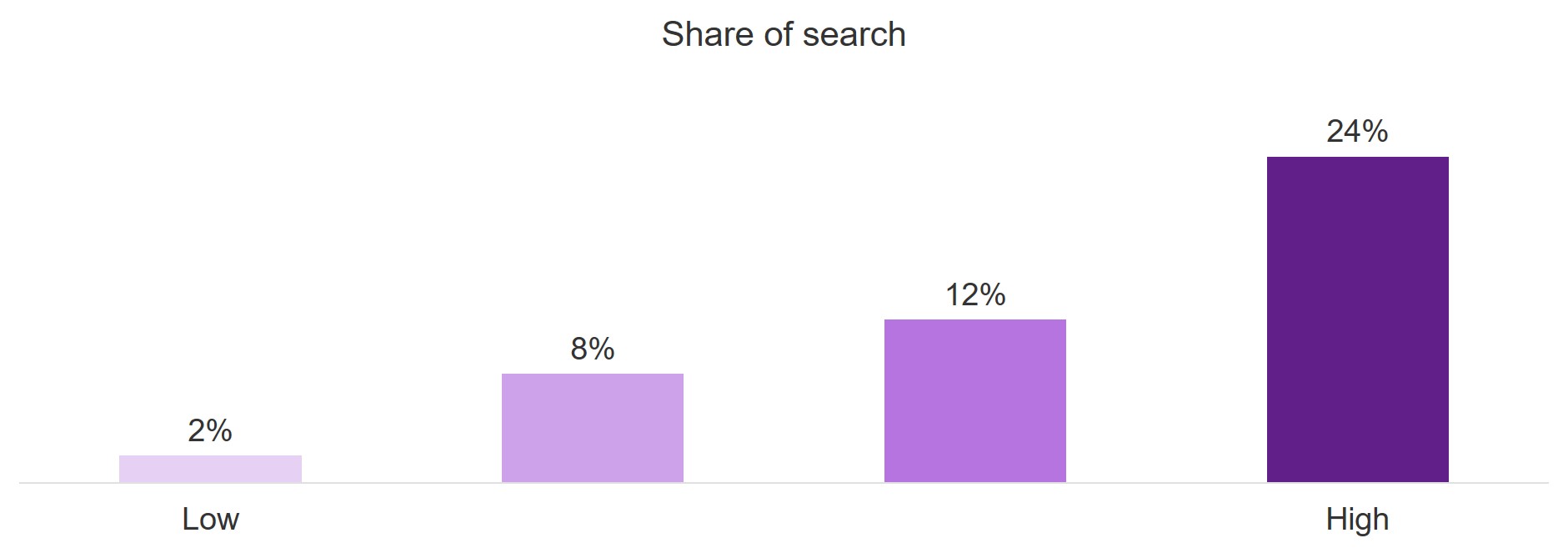

One thing’s for sure: brands with greater Salience are those most likely to come to mind for a given category need, and those brands are the ones most likely to be searched for online.

Source: Kantar R&D, 4 regions, 32 brands, 4 categories, Q2 2014

This immediately gives Share of Search kudos because it’s indicative of a brand’s mental availability and that – as anyone who’s been living in marketing land for the past ten years will tell you – is a key ingredient for growth.

So, is that all we need to focus on? Well, not quite. Brand Salience (coming to mind quickly when triggered by a need) is undoubtedly fundamental, but it’s not the whole story. A combination of being Salient but also Meaningfully Different is where growth is maximised. So why the big fuss over Share of Search?

The true value of Share of Search

Where this metric starts to come into its own is not necessarily as a proxy for other established concepts (although this is a shorthand that’s not without its charms), but in combination with those concepts. It’s here that Share of Search can help answer questions about your brand’s current momentum and where in the funnel there might be problems or opportunities to be leveraged.

With the relatively simple application of Share of Search data, you can quickly get to some meaty insights:

1. Is my brand generating enough search interest?

Start relatively simply: look at Share of Search against Share of Market for a given time period. Existing work in this area has shown there to be a relationship between the two for various categories, but don’t stop there – use it to figure out whether your brand is generating its fair share of interest. Higher Share of Search than Share of Market for your brand and you could be primed for growth, because it’s a good indicator of mental availability. Lower Share of Search than Share of Market for your brand suggests a risky future trajectory.

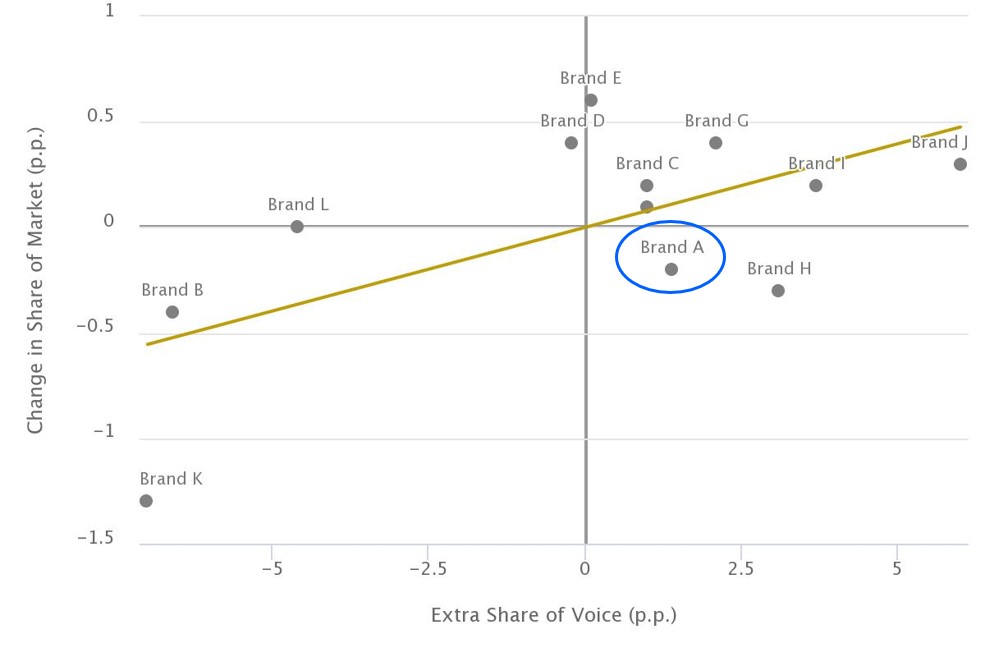

2. What momentum does my brand have?

Compare change in Share of Search to change in Share of Market. If you’re in the top right here you’re in a great space – both mental availability and market share are growing. If you’re not, and one of your competitors is, take heed. If there’s a contradiction in your brand’s progress here you need to know: you might have blockages in the purchase journey that are preventing search growth becoming market share growth or you might be growing market share through heavy price-related promotion rather than brand interest.

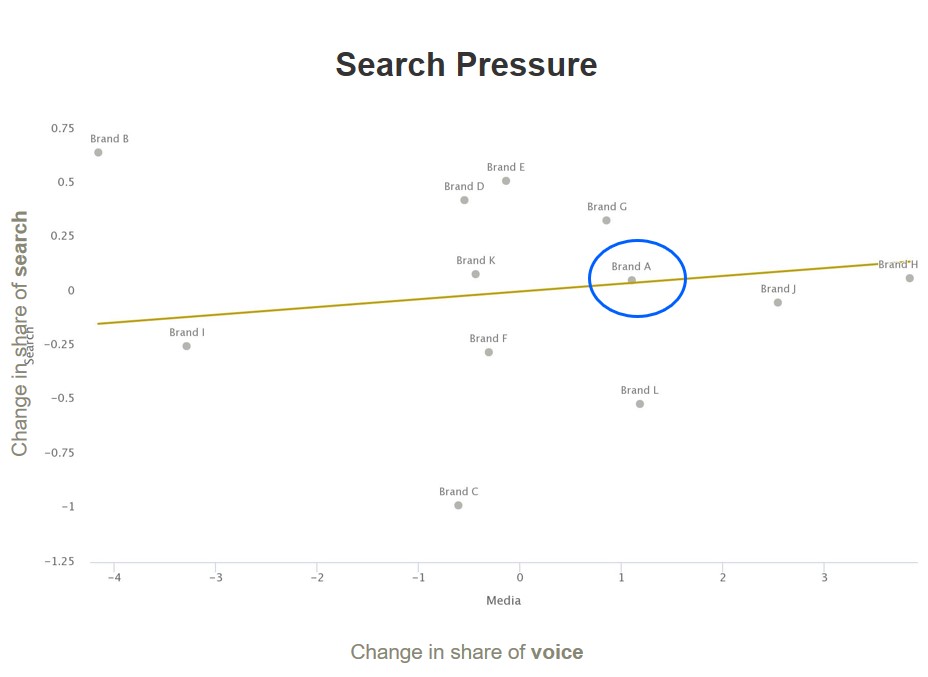

3. How much brand interest am I generating with my media spend?

In Marketing Week recently, Mark Ritson was enthusiastic about Share of Search’s benefits over Share of Voice given the contemporary complexities of a non-TV-dominated and blurry category world.

That said, there are still important insights to be had for your brand when you compare Share of Search to Share of Voice within your category.

In the example below, it was clear when looking firstly at Share of Voice vs Share of Market that Brand A had a problem: media spend wasn’t translating into share of market as expected.

Where’s the issue? We might point an accusatory finger at their campaign investments and assume we need to start again.

But, wait! Looking at Share of Voice vs Share of Search we can see that in fact the campaign investments were generating interest in the brand at the expected rate. It’s not the campaign that needs attention: it’s the journey between interest and a sale that’s getting blocked. Point that finger in another direction and get to work!

Share of Search is getting more attention and quite rightly so. It’s proven to be indicative of important brand outcomes and, when used in combination with other brand indicators, has the potential to identify opportunities for brands to grow.

There’s now additional, interesting evidence from Les Binet’s recent work that Share of Search can predict market share for some brands and categories with a few months of lead time (for some, enough time to course-correct). However, even without that, incorporating Share of Search into your understanding of your brand can unearth insights to help you invest better and grow more – and it can be done cost-effectively at scale.

Using search data for valuable insights

Share of Search is just one way search data can be applied powerfully as a brand indicator. Here are two others:

- When modelled against media spend, search volumes are a fast moving indicator of advertising effectiveness. Pull out the underlying trend here too, and you’ve got a dynamic model of how your media investments are affecting interest in your brand, comparable over time and campaign.

- Clever use of search data can vastly improve your customers’ digital journey or can put you ahead of the curve of changing consumer needs, especially in a more dynamic, COVID-19 world.

What brand managers should do now

With all of this in mind, if you’re a brand manager, you might ask yourself:

- Am I missing out on the opportunities for growth that Share of Search can highlight?

- How can I incorporate Share of Search into my brand measurement in a simple and cost-effective way?

- How else could search data be keeping me one step ahead?

One watch-out for the DIY-ers though… whilst Share of Search is pretty accessible through Google trends, identifying the best insights from it might be best done in collaboration. With that in mind, you can reach out for a friendly chat about how Kantar can help you make better decisions with this newly famous metric, as part of our latest brand guidance programmes.

Like those six unknowns heading to Vegas in 1994, Share of Search is about to hit superstardom. Hopefully it has a good agent.