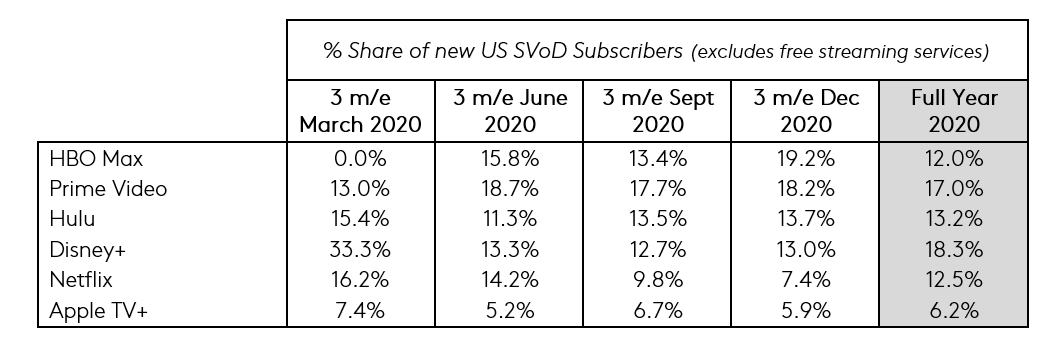

The release of “Wonder Woman 1984” helped HBO Max claim the lion's share of new subscription video-on-demand (SVoD) subscribers in the U.S. during the last quarter of 2020, according to the latest research from Kantar. However, Disney+ took the top spot for the year.

Other findings from our Entertainment on Demand service included:

- 233 million U.S. SVoD subscriptions reached by December 2020

- Disney’s “The Mandalorian” series was the top-rated title for the fourth quarter

- “The Crown” and “The Queen’s Gambit” from Netflix were the second- and third-highest-rated titles over the holiday quarter

The fourth quarter of 2020 saw HBO Max momentum accelerate, leading the charge for new subscribers. The data suggests the decision to simultaneously release “Wonder Woman 1984” to HBO Max alongside movie theaters has been a sound one. 41% of new HBO Max subscribers during the quarter cited specific content as their key motivator for signing up, an increase from 32% the previous quarter, with “Wonder Woman 1984” the key title for one in five of these new content-driven subscribers. Despite the number of new releases going straight to SVoD, the same proportion of HBO Max subscribers went to the movie theatre in the fourth quarter as they did in the third (15.3% Q4, 15.4% Q3).

After flat subscriber growth in the third quarter, Netflix again saw share of new subscribers fall in the latest quarter, accounting for 7.4% of new subscribers, less than half the share achieved in the first quarter. Whilst Netflix subscribers remain highly engaged, the content slate and current proposition does not appear strong enough to drive continued subscriber growth in the presence of multiple highly competitive service launches. We are also seeing challenges coming from two other sources; the price rise in the fourth quarter has driven an increase in planned cancellation, with this rise cited as the key reason and the continued blowback from the “Cuties” release. Whilst overall retention remains solid, in the fourth quarter almost one in 10 cancellations was directly a result from fallout from the “Cuties” release, or broader disagreement with Netflix’s political leanings. These reasons impact both potential acquisition opportunities as well as retention of existing subscribers.

Overall 2020 was a transformative year for the streaming industry due to the COVID-19 pandemic, reaching a total 233 million video streaming subscriptions by the end of the year. Bundling became a phenomenon. The average U.S. home now has 3.5 video streaming subscriptions, compared to 3.1 at the start of 2020.

Whilst Disney+ tends to dominate the headlines, Hulu remains a powerhouse in its own right, driving a higher share of new subscribers in the fourth quarter than Disney+. Rather than relying on key headline titles to attract new customers, Hulu is winning through a powerful combination of being perceived as excellent value for money and having a strong variety of TV series.

Amazon Prime Video continues to perform well, taking 18.2% share of new subscribers in the latest quarter and showing little sign of being negatively impacted by new service launches. The increase in online shopping continues to act as a catalyst for increased overall Prime membership, with this jumping up to 56.4% of U.S. households, up from 54.5% in the third quarter. This increased Prime membership continues to supply a steady feed of new Prime Video users and cushion Prime Video from the increasingly competitive landscape.

Since launching in the second quarter, Peacock continues to make progress in both the advertising-funded video on demand (AVoD) and SVoD space. Stripping out Peacock Free, their ad-supported no cost option, Peacock achieved 4.4% share of new SVoD subscribers in the fourth quarter. 35% of Peacock users are premium subscribers, indicating consumer demand beyond their no cost option. As expected, given the content on offer there is a significant gap in user advocacy rates between the free and paid versions of Peacock, with Net Promoter Score (NPS) for Peacock Free at just +7 compared to +26 for those who pay for the fuller service options. Current upgrade rates from free to paid are low, but the positive reaction to the paid service provides promise for increasing customer value in future quarters.

Across the year streaming, platforms have recognized the strategic importance of blockbuster content. 29% of new SVoD subscribers identify specific titles as a key factor in their sign up decision. America’s favourite shows and movies in 2020 according to consumer feedback were:

America’s most recommended SVoD shows during 2020:

- Ozark

- Tiger King

- The Mandalorian

- Schitt’s Creek

- The Queen's Gambit

- The Crown

- Cobra Kai

- The Boys

- Stranger Things

- Outlander

Based on a longitudinal panel of 20,000 consumers and boosted by 2,500 new subscriber interviews each quarter, the Entertainment on Demand service is designed to help the broadcast industry and investors understand the full consumer journey for digital video subscription services.