For many years, the specification of what is inside a laptop has been of little interest, as long as it was ‘up to the job’. Key purchase drivers were around specific functions/features and design. However, there is a new battleground and differentiator in laptop purchasing for the savvy consumer, and that is the associated benefits of the processor inside. Historically, Intel has provided the gold standard for speed and power. More recently, this is being challenged by AMD and Apple Silicon as consumers become increasingly tech-aware and demanding.

For many consumers, laptops are generally used for very basic functional activities that are also carried out on smartphones and tablets. Usage insights from the past month shows the top 5 activities carried out on laptops in the US are: emails (90%), online shopping (71%), reading articles/news (71%), online banking/personal finance (67%) and social networking (65%). What sets laptops aside is the ‘productivity’ element. Among groups of consumers who own all three (laptop, tablet and smartphone), when asked what activities they prefer to do across these devices, laptop disproportionately comes out top for activities like those mentioned previously. In addition, laptop users also create and edit documents, manage files, stream videos, and edit photos/videos.

To aid productivity, manufacturers have focused on internal laptop hardware and marketed the benefits to consumers to demonstrate that their products are the best inside and out. The push on chip development has been a highly competitive area, with the likes of Apple, Intel and AMD battling it out to bring consumers the best laptop experience. For Apple, this means more control on future product developments where there are no preset boundaries on future laptop performance developments. Additionally, as the ‘gaming’ category continues to grow, consumers will be looking for products that support this experience.

So which laptops are consumers currently choosing and why?

Looking at Q1 2021, HP is the top selling brand in the US, taking 25% of sales... although its share is down 4 percentage points year on year. Mac shows strong performance in the latest quarter with 23% sales share, up 8 percentage points year on year. The top sold laptops are Apple MacBook Air 13", followed by Apple MacBook Pro 13" (2020).

In Great Britain a similar trend is seen; HP is the top selling brand with 20% of sales, down 10 percentage points year on year. Mac is up 4 percentage points year on year with 17% sales share in the latest quarter.

When deciding on which laptop to buy, 53% of US buyers in Q1 2021 first decide on their OS, 25% look at brand first, and 22% are open to either. For those who are open, cost of device plays a big factor in their purchase decision. Brand-first buyers consider specific features for their device: speed/power, battery life, quality of materials, and display performance. Those deciding on OS are driven by ease of use, ability to run the productivity tools that are needed, and previous experience with the OS.

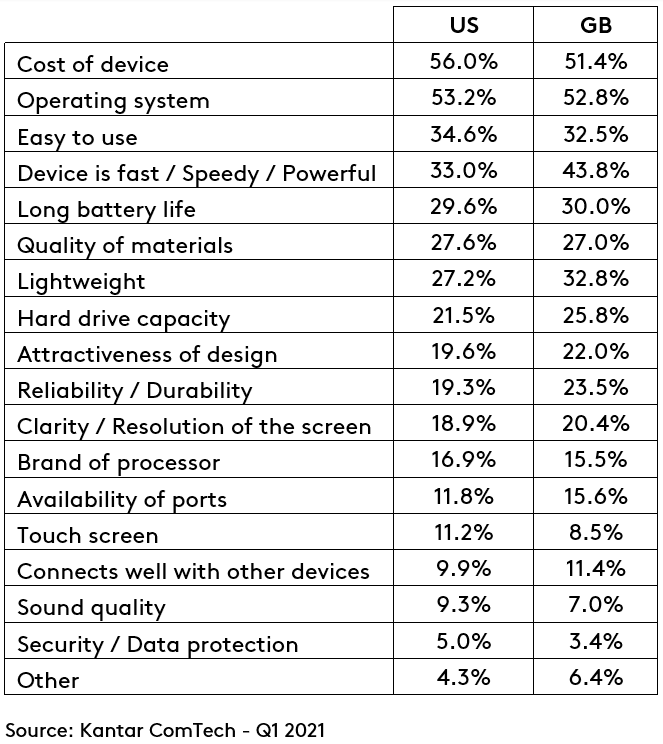

The speed and power of devices as a specific driver of purchase has increased year on year. Other areas that have similarly increased include the cost of the device, and the clarity/resolution of the screen. Interestingly, brand processor ranks 12th out of the 17 drivers given and in Great Britain this ranks 13th, demonstrating that brand of processor alone is not a strong lever to drive purchase. Instead, performance benefits are what resonate with consumers. However, for those who are specifically driven by the brand of processor in Q1 2021, 77% look for Intel, 9% AMD and 7% Apple Silicon.

As manufacturers continue to build and organize infrastructures around hardware technology developments, as well as software development, the growing trend of wanting speed and power isn’t going away any time soon.