First quarter 2021 results from our Entertainment On Demand service in the US reveal the following consumer behaviors:

- Over 7% of US households took out a new video on demand subscription (SVoD) in the first quarter. This means US SVoD subscriptions reached 241 million by March 2021.

- WandaVision was the top rated title over Q1 2021, with The Mandalorian at #2 and Bridgerton also proving popular, taking third place.

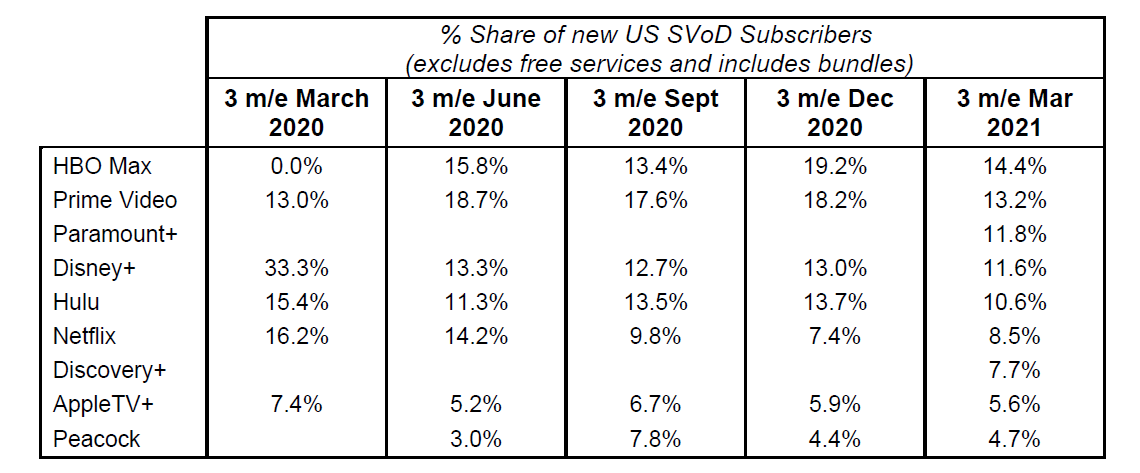

HBO Max holds on

In a quarter that saw the launch of Paramount+ and Discovery+, it’s all the more impressive that HBO Max held onto the top spot in share of new SVoD subscribers. HBO is not just winning new subscribers, its also dramatically increasing the advocacy rates of its subscriber base at the same time. When HBO Max launched in Q2 2020 its Net Promoter Score (a measure of subscriber advocacy), was the 10th highest in the SVoD market, it’s now joint second. This bodes well for both retention and word of mouth recommendation to drive future subscriber acquisition. Subscribers specifically cite the number of new release films as a key catalyst to their increased satisfaction with the HBO Max service.

More ad-supported services?

The average number of SVoD subscriptions in each US households continues to rise, hitting 3.8 in Q1 2011, up from 3.3 a year ago. With paid subscription stacking increasing, so is the number of households that plan to cancel at least one SVoD subscription in the next 3 months, which hit 24.9%, up from 20.5% the previous quarter and 23.2% a year ago. With the cost of hosting multiple video streaming subscriptions increasing, ad-supported services are experiencing strong growth, with Peacock Free and Tubi leading in growth. Some 49% of American’s now agree they don’t mind seeing some advertising if it makes video streaming services cheaper.

As the battle for new subscribers intensified further, we are likely to see more ad-based tiers come online to widen adoption and provide consumers with more choice.

A strong performance for Paramount+

Looking to individual performance, Paramount+ successfully won more than 1 in 10 new SVoD subscribers in the quarter, as its rebrand and expansion of CBS All Access hit the market. Star Trek proved the key pull for the new service, with 53% of new subscribers saying they signed up because of a specific title and 24% of these citing Star Trek. Stephen Kings’ The Stand also proved a key pull, with 9% of new content drive customers referring the mini-series.

Welcome Discovery+

Discovery+ launched into the US on 4 Jan 2021 and captured 7.7% of new SVoD adds in the quarter, an impressive number for a service with a narrower focus on documentary and reality-based content. In a nod to the effectiveness of the Discovery+ TV launch campaign, 68% of new subscribers said watching a TV advert for the service was a key part of their decision-making process, whilst 40% stated they were enticed through a free trial offer.

The service has proved particularly popular with post-family working and retired households, together accounting for 45% of their subscriber base. Titles including Ghost Adventures, Fixer Upper, 90 Day Fiancé and Expedition Bigfoot all proved important titles to drive subscriber acquisition in the quarter.

Disney+ still growing

Disney+ continues to show solid growth in the US market, winning 11.6% of new SVoD subscribers in the quarter. Overall WandaVision was the top rated SVoD title, followed by The Mandalorian –achieving the top two highest rated titles across the US is an impressive feat that takes the content challenge directly to Netflix.

It’s clear that Disney+ is winning acclaim for the quality of its titles, but consumer sentiment is also improving significantly across the amount of original content it offers: net satisfaction in this area has improved from +20% in Q1 2020 to +33% in Q1 2021, a key measure for long-term retention.

Notes

Entertainment on Demand is the newest offering from Kantar’s Worldpanel Division, to help entertainment industry and investors understand the full entertainment subscription service consumer journey.