The American Marketing Association and Kantar surveyed marketers in mid-2020 to understand how their organizations view the role of ecommerce. While the pandemic has accelerated the importance of ecommerce for some companies, its strategic role is still unclear in others, with structural enablers acting as barriers to sustained growth.

Headlines over the past several months have touted the “new normal” and the accelerated growth of ecommerce as a priority source of revenue. However, our research indicates that the story is more nuanced. Some of our findings included:

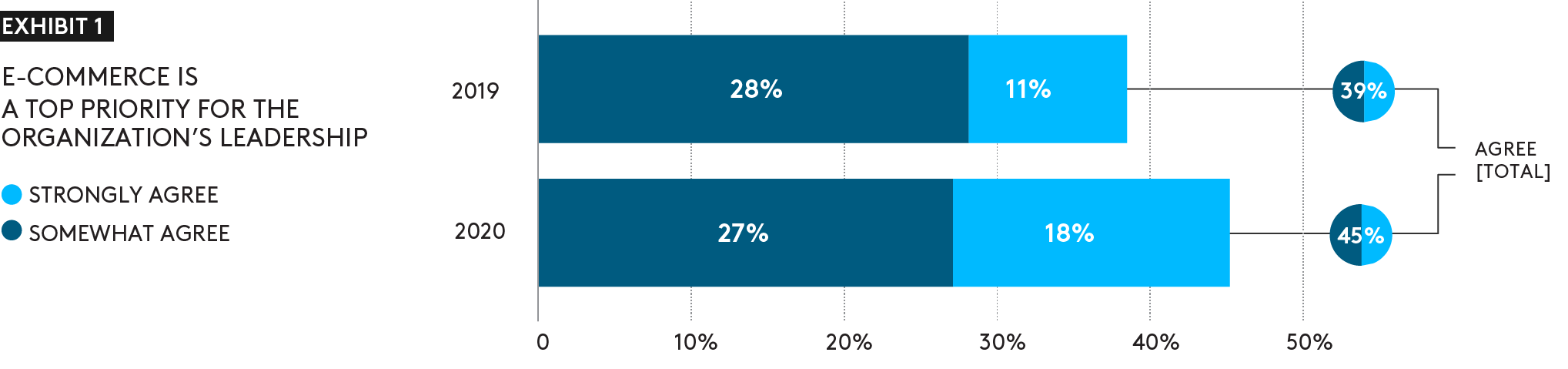

- The number of organizations indicating that ecommerce is a top priority for their leadership increased only slightly from the same time in 2019.

- If we look closer at the organizations that do indicate it as a top priority, we see that the coronavirus pandemic has accelerated e-commerce’s importance (see exhibit 2).

- We only see a modest increase in organizations actively engaging in ecommerce in general (from 51% to 57%). For most, the contribution to revenue remains modest or small (see exhibit 3).

- The pandemic has proved to be a catalyst for most of the surveyed organizations active with ecommerce, with 73% of respondents citing slight to significant increases in the channel’s contribution to revenue growth specifically because of the virus (see exhibit 4).

- The pandemic undoubtedly accelerated a shift to a larger share of ecommerce sales, but many organizations have yet to start this journey. The data suggest that there are significant barriers to success. Aside from the obvious challenge of freeing up budget to drive ecommerce growth, the study also identified internal factors that can hinder success including failing to have the proper operating model in place, a lack of clarity on responsibility, insufficient integration with media planning, and failing to leverage ecommerce to generate consumer insights.

Incorrect operating model in place

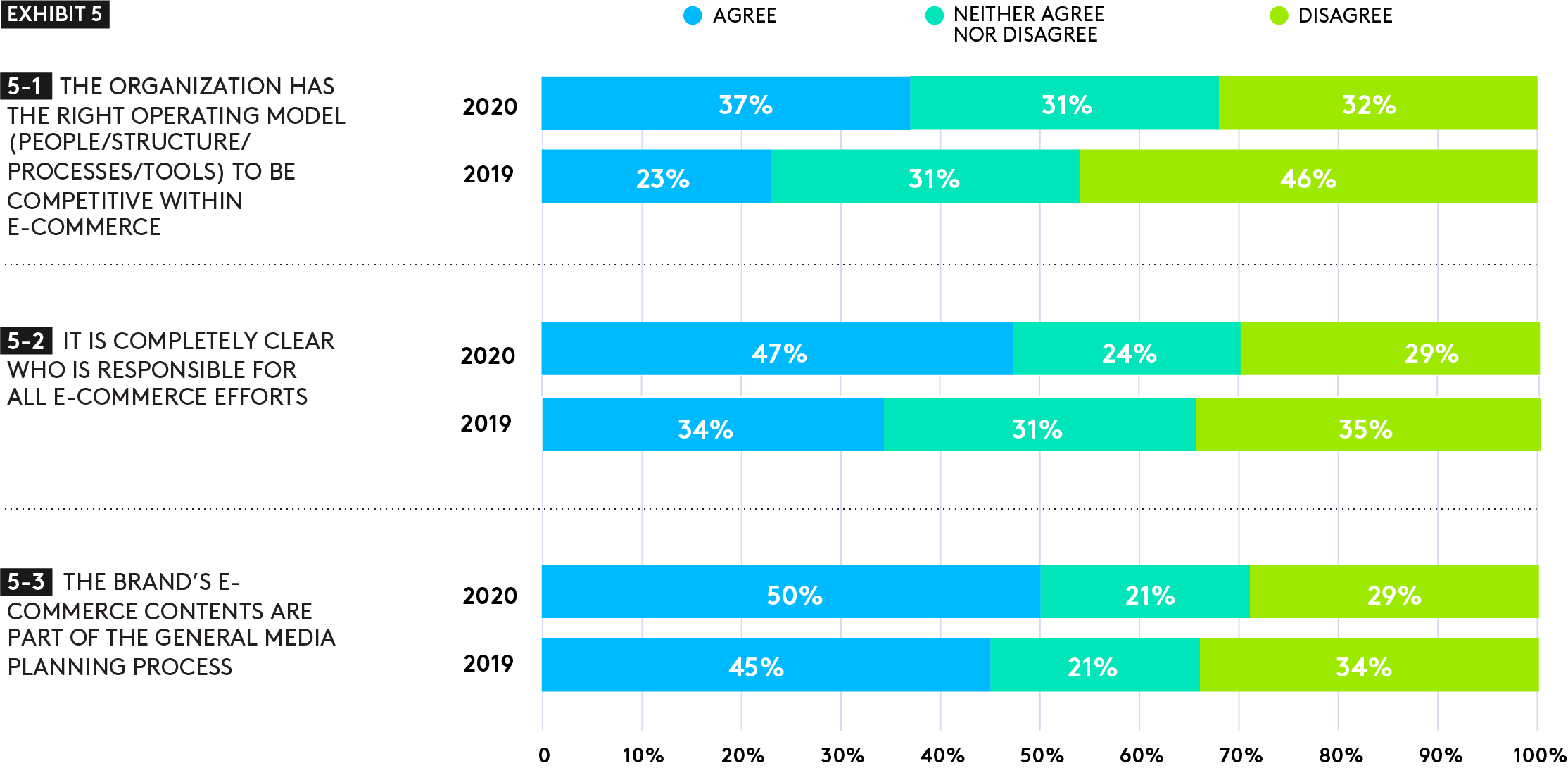

If the surveyed organizations’ leadership have made ecommerce a priority, created clear, measurable goals, and developed a channel strategy, then structure should naturally follow strategy. This is important as it enables organizational alignment to deliver sustainable performance. However, only 37% of all respondents agree that their organization has the correct operating model (people/structure/processes/ tools) to be competitive within ecommerce. This may be a clear increase from 2019 (see exhibit 5-1), but it nevertheless means there are huge gains to be had by better setting up the proper model for ecommerce.

Lack of clarity on responsibility

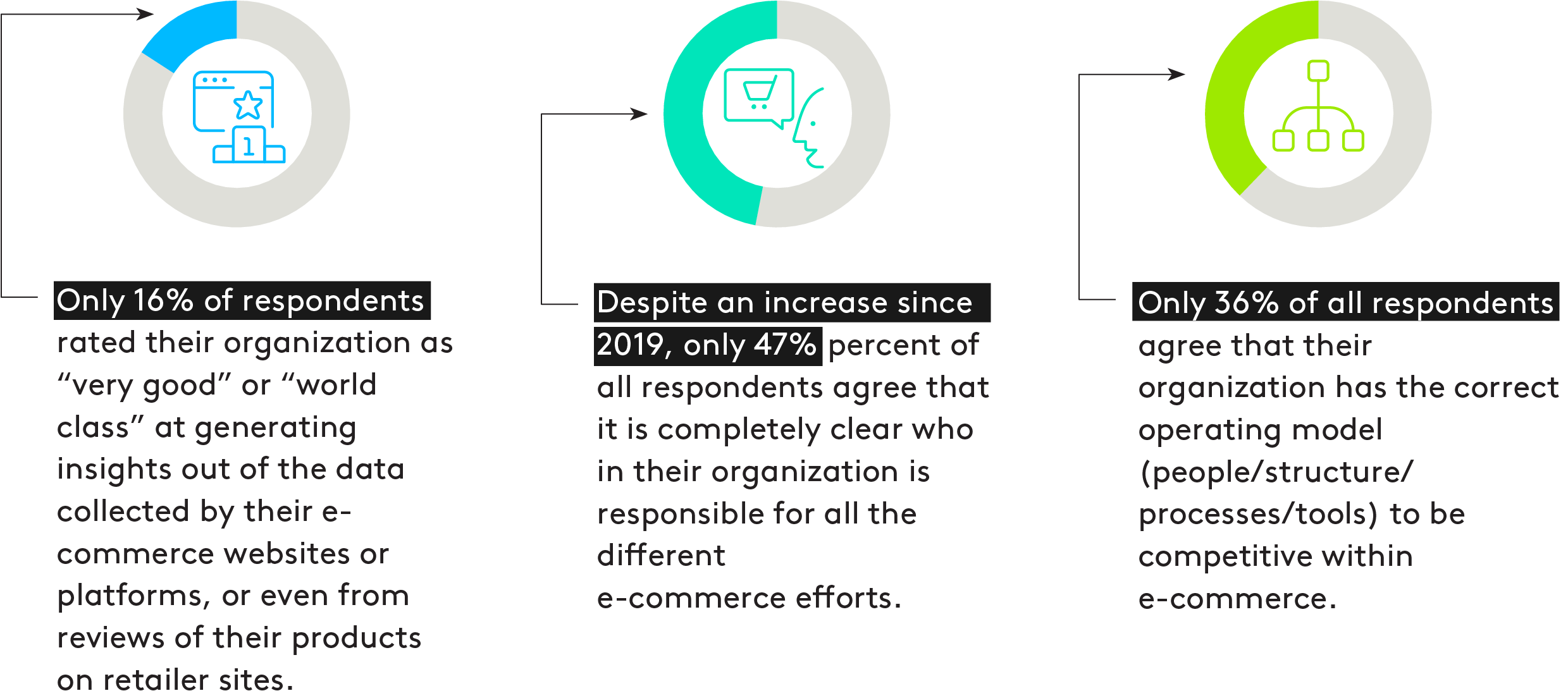

Sustainable performance can only be achieved if there is clear accountability for delivering on the strategy. Without this, there is risk that operationalizing the strategy fails quickly and stymies fruitful collaboration between departments, such as sales and marketing. Organizations have done a relatively decent job of assigning clear responsibilities regarding ecommerce. But despite an increase since 2019, only 47% percent of all respondents agree that it is completely clear who in their organization is responsible for all the different ecommerce efforts (see exhibit 5-2).

Insufficient integration with media planning

In order to leverage ecommerce as both a brand-building and sales touchpoint, ecommerce activities and media planning should be well-aligned. This ensures that all efforts work together to increase revenue and grow the brand. Unfortunately, this is far from a given in many organizations; only half of all respondents indicate that their brand’s e-commerce content is part of their general media planning process (see exhibit 5-3).

Failing to leverage ecommerce to generate consumer insights

While the focus for most organizations is to drive sales, ecommerce is still being underleveraged as a tool for generating insights and for brand-building activities. Only 16% of respondents rated their organization as “very good” or “world class” at generating insights out of the data collected by their ecommerce platforms, or even from reviews of their products on retailer sites. Leveraging this data (in conjunction with other sources of insight) could help inform better messaging, superior user experience, product prioritization, and drive new pathways for innovation as well as other use cases.

What next?

From an organizational design perspective, two key questions must be answered. The first: Where should ecommerce sit within the organization? This should be in sync with the role of ecommerce within the organization’s omnichannel strategy. Secondly, once the structure is set, how do we efficiently organize our processes, people and tools, and critically, ensure functions such as marketing and sales take a far more integrated approach?

Organizational change is no small initiative and we by no means intend to underestimate the effort that it entails. However, this disruption highlights the need for structure to follow strategy in order to effectively act against the organization’s priorities and find new growth opportunities. Those that are able to do this, consequently building in learning loops to create a virtuous cycle of organizational learning, will emerge as the winners, building resilient brands in the face of ongoing and future disruptions.