As auto marketers develop their strategies to engage with consumers, an understanding of the cultural nuances across markets is valuable in determining the globalization, regionalization or localization of campaigns. A factor like price or cost savings may be a top priority in one market, while another market values driving features most when evaluating car models to purchase.

Kantar recently released its latest Community Report: Connecting with the Automotive Community, which maps out the ways consumers across multiple countries are navigating a new automotive market. As supply chain issues ease, and buying a new car is back on the table for many, consumers across the globe are researching and considering multiple brands for purchase. This research, across more than 10,000 global consumers, uncovered some significant differences in the desires, values, behaviors, and motivations based on their country of origin.

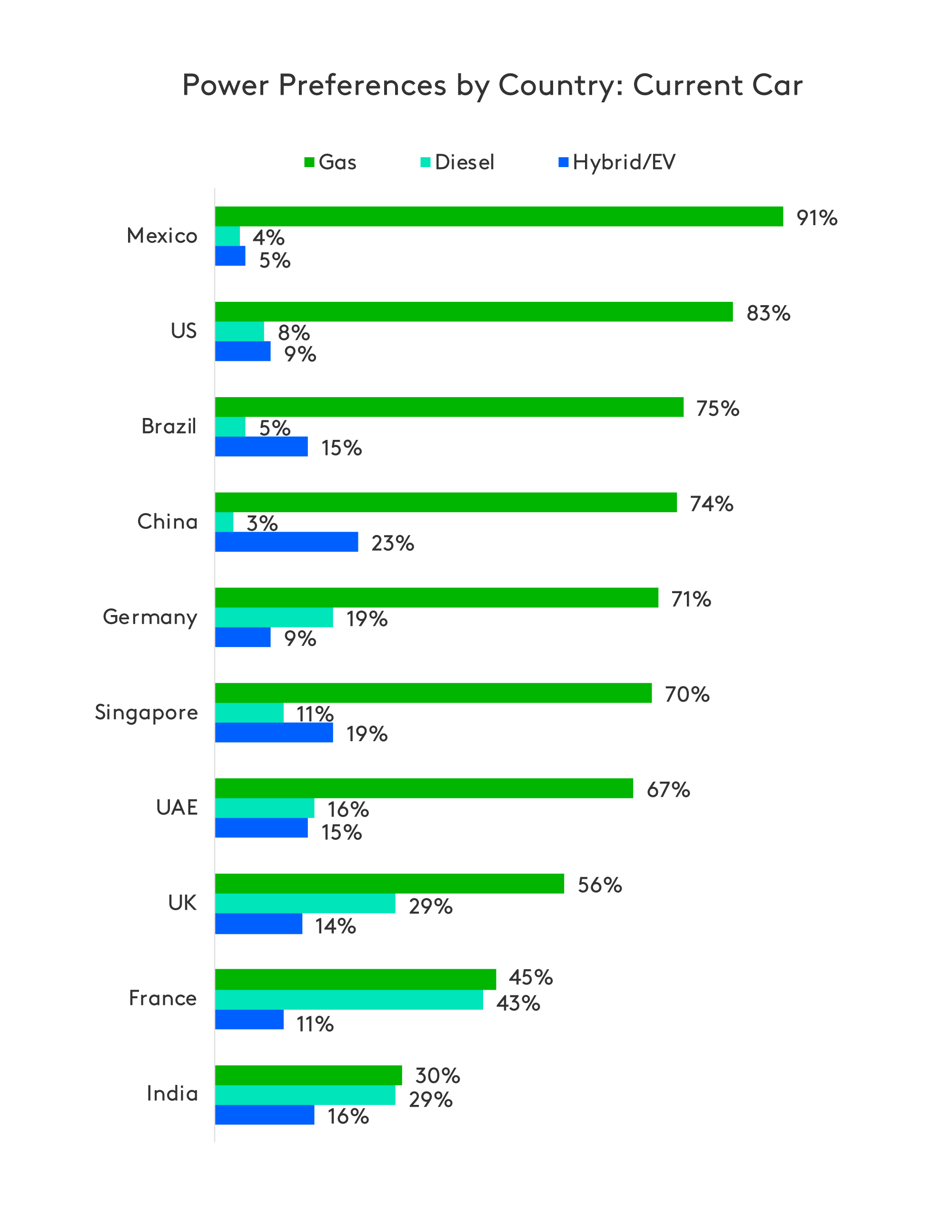

Power Preferences

One clear area of differentiation is consumer preference in how cars are powered. In the United States, 83% reported driving gas-powered cars, and in Mexico, it's an overwhelming 91%. In contrast, India and France show a preference for diesel, likely due to regional availability. In China, 23% of consumers own hybrid or full electric vehicles (EVs), signaling a growing appetite for sustainable mobility solutions in Asian markets.

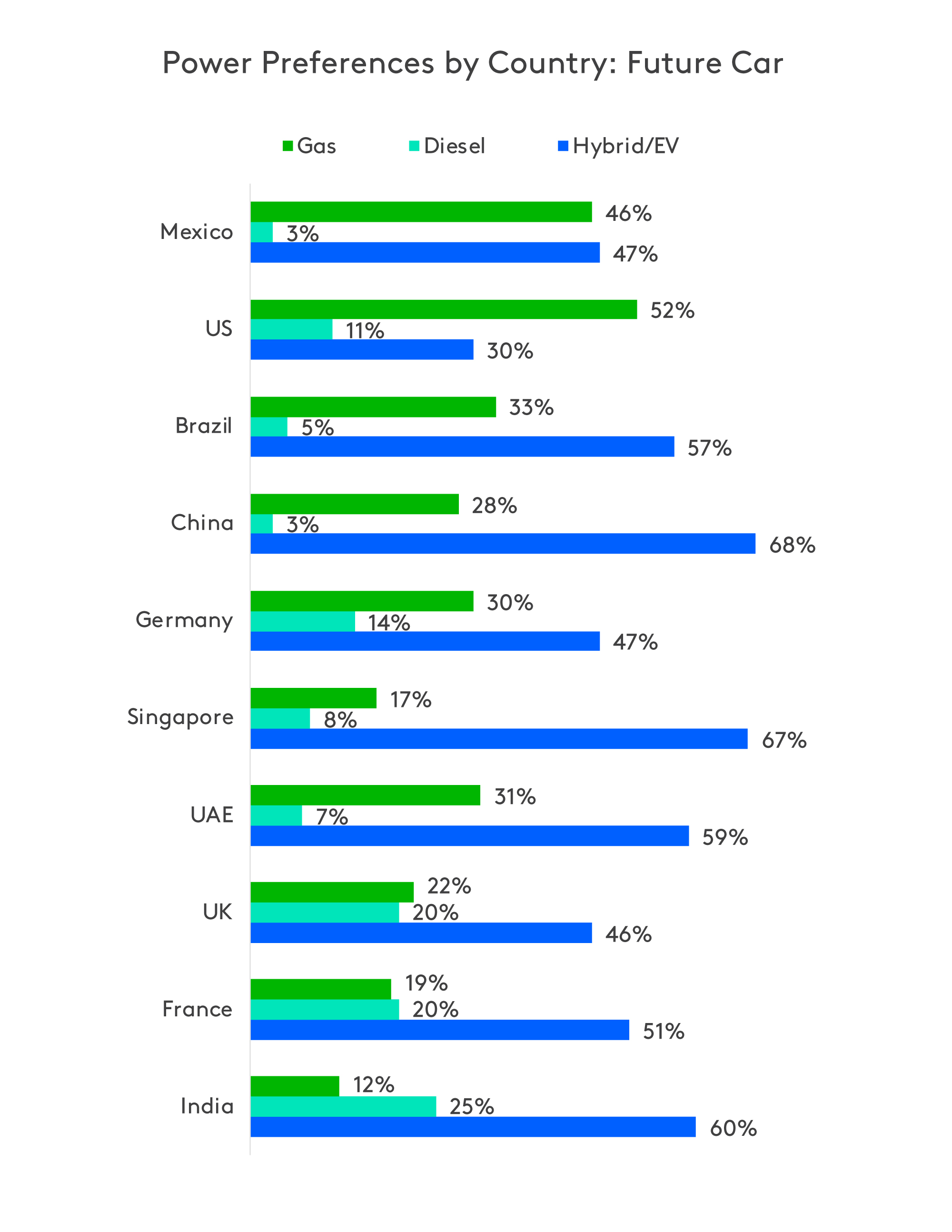

Fueling the Future: Next-Gen Preferences

These power preferences by market also influence future car purchase decisions. While there is a significant shift across all markets in their aspirations toward owning hybrid or EV, in the Americas, gas-powered vehicle preferences remain dominant. 52% of US consumers and 46% in Mexico report a desire to purchase a gas-powered vehicle for their next car. In contrast, in-market consumers in Asia-Pacific (68% in China, 67% in Singapore) report leaning towards hybrid or electric vehicles. Europe is also witnessing a surge in interest, with 51% in France, 47% in Germany, and 46% in the UK expressing a desire for hybrid or EV for their next vehicle.

Ownership Dynamics

The ways consumers choose to own their vehicles also differs significantly worldwide. In the UK, car leases are more common than in other markets, with 11% of consumers opting for this flexible arrangement. China, however, boasts a 93% preference for owning a new vehicle, where owners in Germany and the UK leaned towards pre-owned vehicles, at 46% and 45%, respectively. In the US, only 35% of consumers opt for used or pre-owned cars and 51% own new.

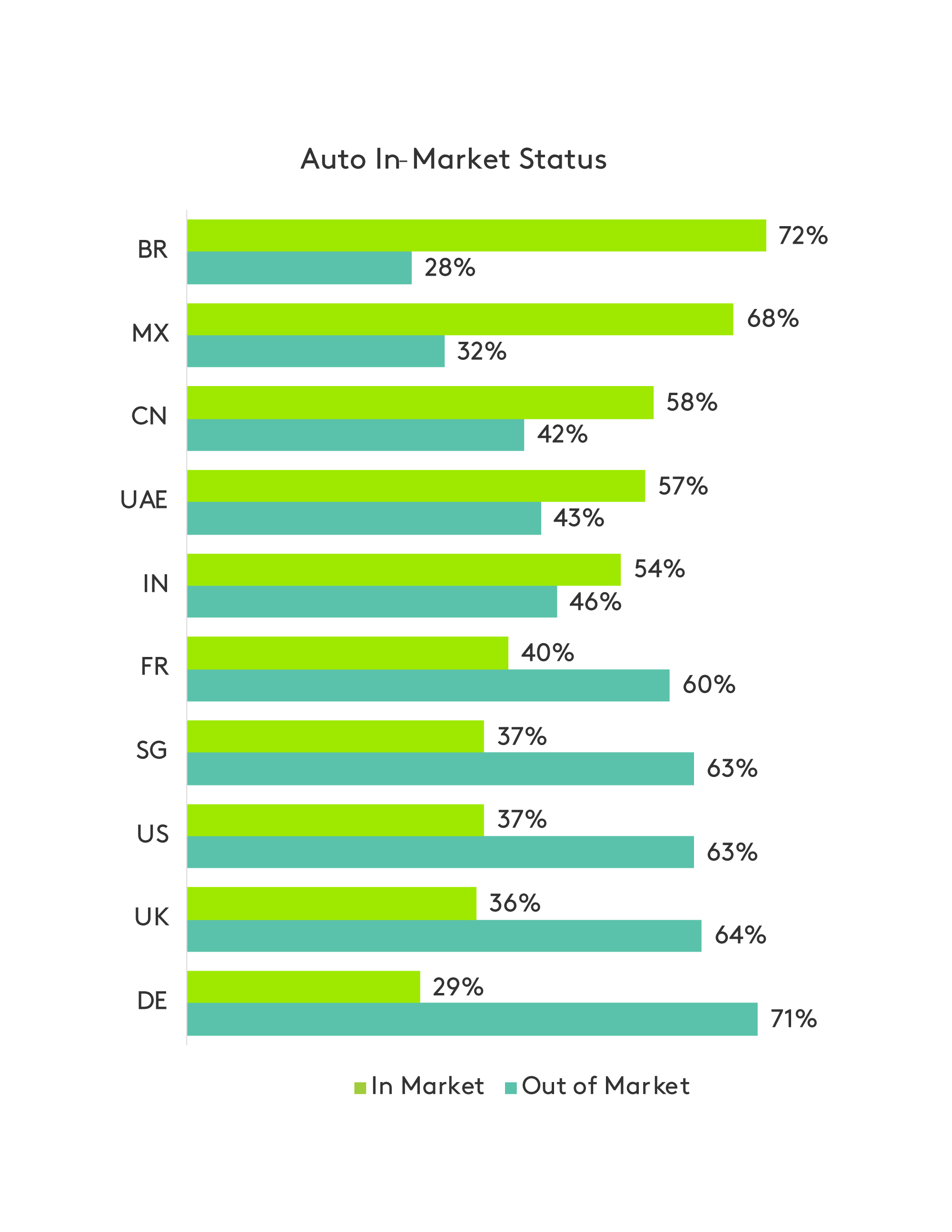

Satisfaction and Aspiration

Consumer sentiments regarding their current vehicles also vary globally. In the US (60%) and across Europe (56% average across France, Germany and the UK), car owners are generally happy with their current cars and have no plans to replace them. Factoring in first-time buyers, 72% of consumers in Brazil aspire to replace their current vehicles, and 68% in Mexico. Understanding differences like these underscores the potential impact of appropriately targeted messaging specific to market trends.

Auto Attributes that Drive Decisions

Car attributes that weigh most heavily on consumer purchasing decisions were also found to vary widely by market. In the US and Europe, cost and reliability were ranked as the top two most important factors. However, in China, driving performance and fuel cost savings are more highly valued when considering their next auto purchase. Ultimately, adapting marketing strategies to cultural differences requires a thoughtful approach that goes beyond just messaging translations and swapping imagery. Cultural preferences and behaviors such as driving habits, environmental concerns and other choices can significantly impact consumer purchasing decisions – and should factor in to the development of any marketing strategy.

Get more answers

For more findings from this study, access the complete Connecting with the Automotive Community report. Read about how consumer sentiments surrounding electric vehicle auto-pilot technology, sustainability and how in-market consumers are approaching the changing automotive market.

About this study

This research was conducted online among more than 10,000 respondents across ten global markets: US, UK, France, Germany, India, Singapore, Mexico, UAE, Mainland China and Brazil between 3-17 October, 2023. All interviews were conducted as online self-completion and collected based on controlled quotas evenly distributed between generations and gender by country. Respondents were sourced from the Kantar Profiles Audience Network.