As supply chain issues ease and model availability improves, opportunities to secure new vehicles have increased globally. Many consumers may be shopping for their first car, while others have a car and are looking for an upgrade or replacement. When in-market, how different are the motivations and influences for these distinct audiences?

As the auto ownership landscape evolves and consumer preferences shift, understanding the nuances between how car owners consider brands and models compared to how consumers shop for their first cars remains valuable insights for auto marketers.

Kantar gives marketers a unique opportunity to unravel the motivators, influencers and detractors behind the decisions consumers make. In new research, Kantar's Profiles division released insights across the auto category, including how in-market consumers are researching and considering new cars.

Generational Differentiation

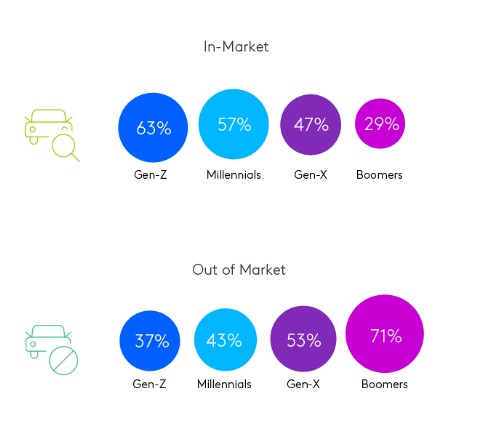

Recent research indicates that younger consumers are more likely to be in-market for a new car. 63% of those currently seeking a new car (either owners or non-owners) are Gen-Z, compared to 29% falling within the Baby Boomer generation. Boomers are more likely to be content with their current car (61%) where 35% of Gen Z don’t currently own a car at all. This contrast highlights the need for targeted advertising strategies that resonate with the unique preferences and values of these two distinct demographics.

Application: Understanding the demographics of in-market consumers means you can market the most relevant messages to your audiences.

Buying Timelines

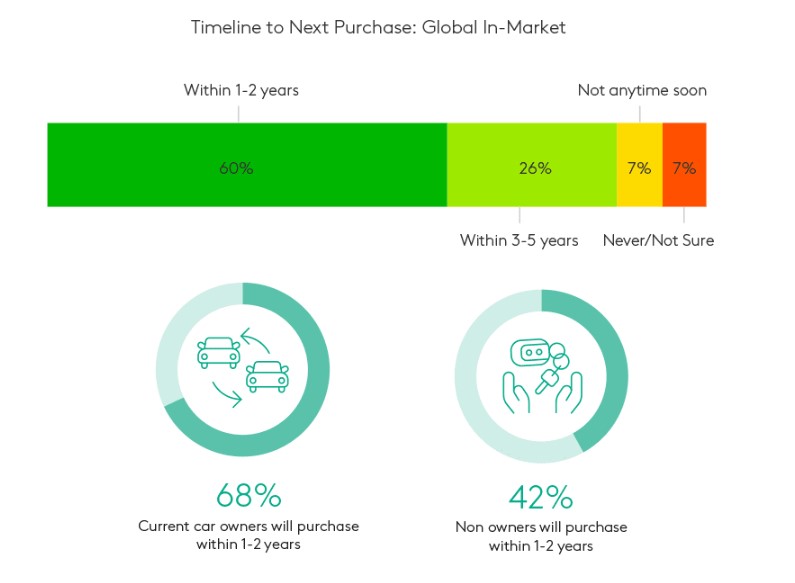

Shoppers take many steps before making a purchase decision for a big-ticket item like a new car, and the timing seems to vary quite widely depending on car ownership. Kantar's research reveals that a significant 68% of current car owners who are in the market plan to make a purchase within 1 to 2 years. Conversely, only 42% of non-owners share this same urgency. Understanding these timelines is invaluable for advertisers, enabling them to tailor their messaging and promotions to align with the varying purchase readiness of these two consumer groups.

Application: Marketing receptivity may be higher for consumers at various points in their shopping lifecycle. Using research to understand how your targets stack up can be the make or break to an efficient marketing strategy.

Fueling the Future

The environmental consciousness of consumers is reshaping the automotive landscape across the globe. Kantar's research uncovered a divide in the preferences of current car owners and non-owners who are considering a purchase. 59% of car owners expressed an interest in hybrid or electric vehicles in their next purchase, compared to only 41% among consumers shopping for their first car. In the full report, results indicate that price remains a significant barrier for hybrid and EV, and the leap from not having a car to full EV may be too large for many.

Application: As more car manufacturers add hybrid and EV models to their lineups, a deep understanding of the consumers who are primed to break away from gas-powered vehicles is vital in any organization.

Information Sources: From Dealerships to Social Circles

Kantar data indicates that existing car owners are more likely to turn to traditional sources, with a predilection for information from car dealerships. On the other hand, non-owners place a premium on the experiences of friends and family when making their decisions.

Application: Knowing where your consumers are seeking out information helps define the appropriate balance of a diversified media channel strategy. In this case, a blend of dealership-focused campaigns and social-centric narratives can speak to in-market consumers in varying stages.

Get more answers

For more findings from this study, access the complete Community Report: Connecting with the Automotive Community. Read about how consumer sentiments surrounding electric vehicle auto-pilot technology, sustainability and how global consumers are approaching the changing automotive market.

About this study

This research was conducted online among more than 10,000 respondents across ten global markets: US, UK, France, Germany, India, Singapore, Mexico, UAE, Mainland China and Brazil between 3-17 October, 2023. All interviews were conducted as online self-completion and collected based on controlled quotas evenly distributed between generations and gender by country. Respondents were sourced from the Kantar Profiles Audience Network