Worldpanel’s new study reveals how COVID-19 pandemic lockdowns and the related work from home culture shift have transformed the beauty market. The data shows a striking decrease in the weekly use of cosmetics in every market, with weekly usage down an average of 28% compared with pre-pandemic levels and down 31% compared with five years ago, as women choose simpler routines. The study also identifies that more shoppers are opting for fewer, higher quality usage occasions. The increase in premium beauty product usage along with a surge in demand for natural beauty products, which moved from, on average, 18% of sales in 2017 to 24% of sales in 2021, helped the market recover to pre-pandemic levels of revenue.

‘On Trend: The evolving beauty consumer’ analyzed the purchase habits of more than 300,000 individual and households in 20 countries and women’s daily usage habits across seven major economies to understand the impact of two years of coronavirus lockdowns, shifting priorities, and the continuation of the work from home culture. The study also reveals an increasing demand for premium beauty products during the pandemic, an increase of 6%* for Face & Makeup categories. Hair care and body care product categories have been the standout categories, achieving growth in both years of the pandemic.

Transformed beauty regimens

The study shows a global trend towards fewer usage occasions, particularly apparent amongst European beauty consumers. Face and lip occasions have significantly decreased year-on-year, and there has been an increased focus on eye makeup, which may be a consequence of face mask wearing during the pandemic:

- The focus is now on fewer, long-lasting beauty products that can be applied quickly.

-

Consumers are wearing makeup less frequently compared to pre-pandemic period.

The Haircare Market

Through the pandemic period, the percentage of women choosing to wear their hair longer grew from, on average, 58% of women in 2017 to 62% in 2021. Simultaneously, women chose to wash their hair less frequently, down almost 10% over five years to 2.8 times per week on average. Illustrating the premiumization trend, despite falling usage, hair conditioners and treatments grew in sales value, generating 5% growth in 2020 (vs 2019), and 7% growth in 2021 (vs 2020).

The premiumization trend has been spearheaded by requirements for specific haircare solutions to help promote growth. Products targeting specific hair conditions including hair loss and dandruff have grown 5X faster than the overall shampoo market rate with 10%* growth in 2021, while the total shampoo market grew just 2%*.

The shift to environmental consciousness

Natural and vegan cosmetics continue to grow in popularity as the world becomes more conscious of ingredients and sustainability in the beauty products they buy:

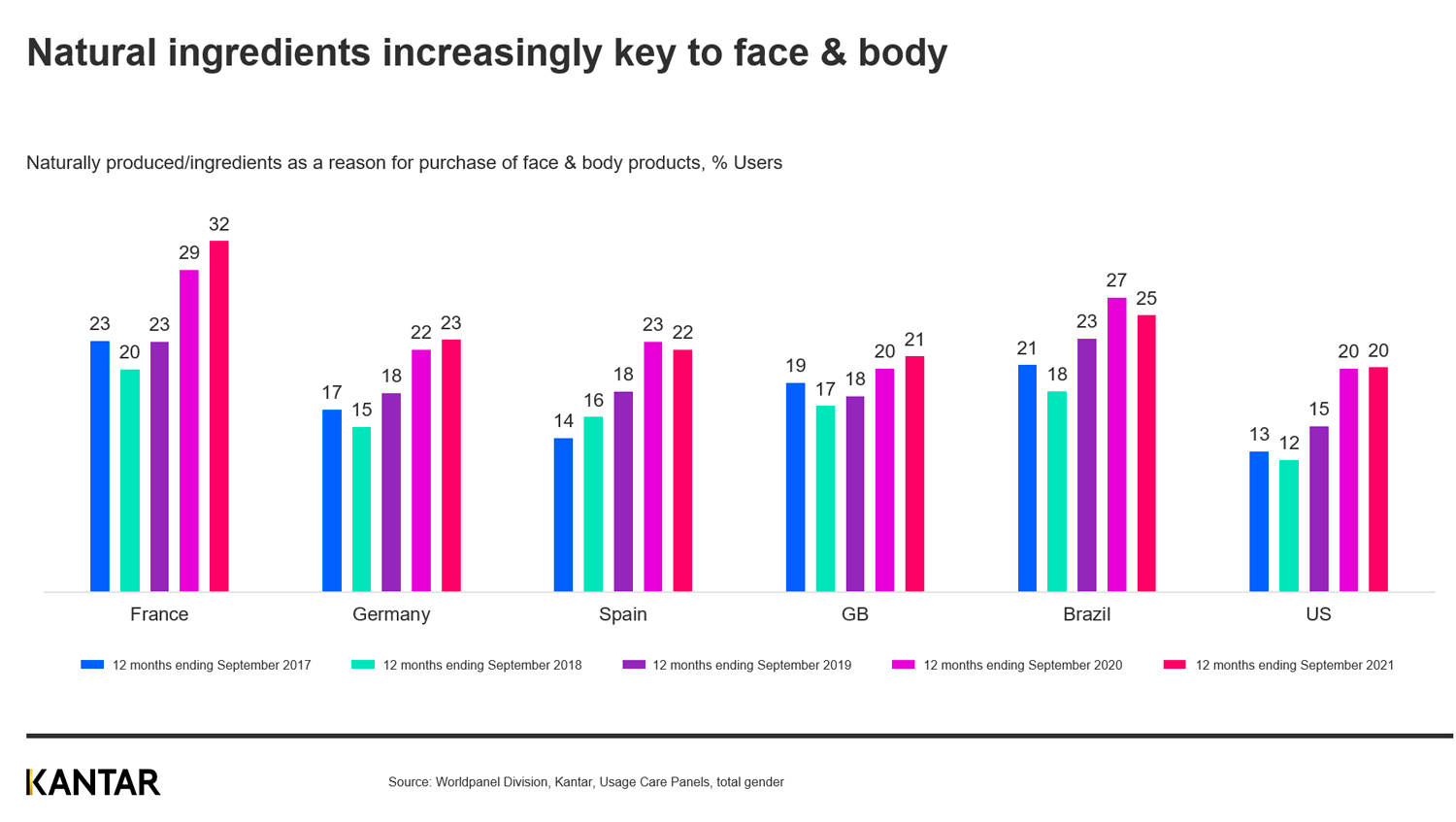

- Consumers purchasing naturally produced ingredients in face and body products grew from, on average, 18% of sales in 2017 to 24% of sales in 2021. The largest increase is in France, where the shift was from 23% of consumers in 2019 to 32% in 2021.

- Environmentally conscious consumers are also willing to pay extra for sustainable and natural products, as mirrored in the Who Cares, Who Does study. Eco-active households spend more than the average household on beauty products, with French Eco-Active households spending 5% more on beauty products per shopping trip.

The study underlines an opportunity for beauty brands to understand the lifestyle changes triggered by the pandemic, and therefore the evolution in needs in consumers’ lives. Though consumers are seeking simpler routines and a ‘natural’ look, this does not mean they will suddenly move away from the category. Consumers will binge on various products that respond to their changing demands. In the skin care category, ‘sustainability’, ‘natural’, ‘derma’ are some of the many routes to ‘premiumize’ globally. With growing number of females wearing hair long, treatments represent a growth opportunity, together with functional shampoos like anti-hair-loss and anti-dandruff. Make-up will continue to be challenged for some time. Convenience is now key; long-lasting products will enjoy success. In the economically challenging times, it’s not that consumer won’t spend, but rather they will spend more wisely, making the most out of their spending power, whether that be to make their life simpler, to address their values or to binge on their aspiration.”

Watch the webinar and access the report here.