Kantar’s tracking of US consumers since the start of the pandemic has consistently shown they are highly concerned about its impact on their financial situation, with 63% of consumers indicating high concern about their monthly income. Households with children, as well as Hispanic, Asian and African Americans, all indicate a considerably higher level of concern compared to the general population.

Given such a high degree of worry over finances, it is not surprising to find financial planning is spiking; 63% of consumers say they are more proactive in their planning since the pandemic, an increase of 18 percentage points since the week of March 15.

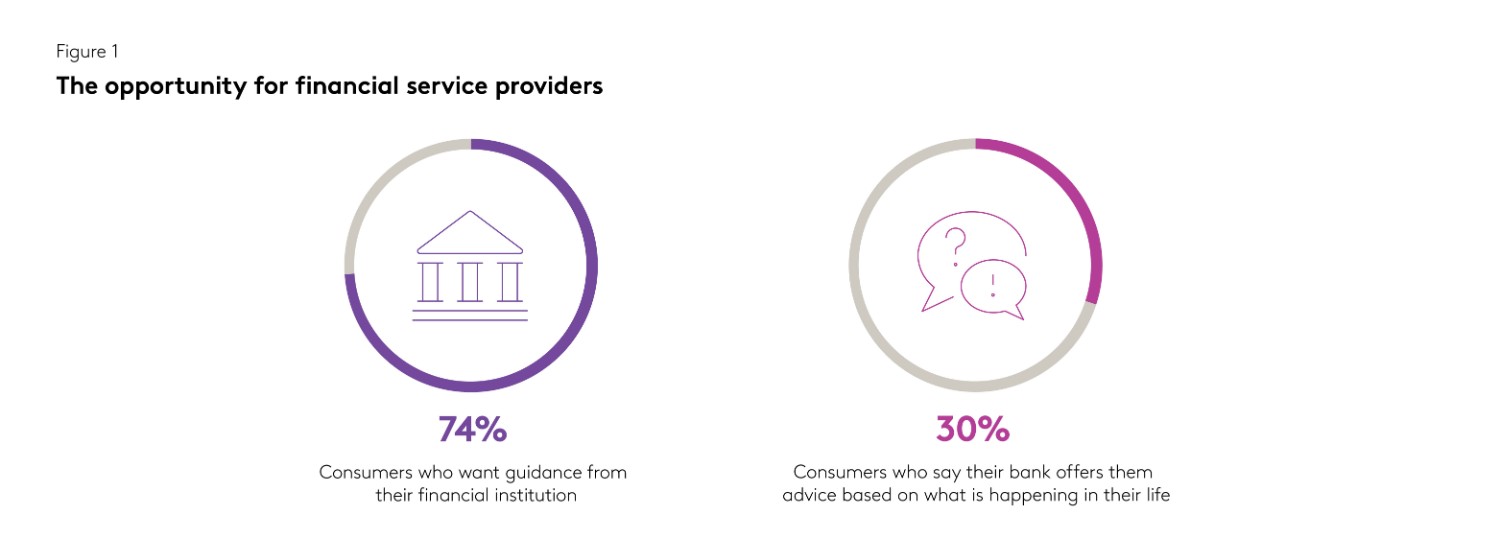

What’s more, consumers are looking for help. Consumers feel their financial institution should talk to them about how they can help them adjust to the new realities of everyday life since the pandemic began. However, so far financial institutions seem to be falling short.

The impact on brands

The financial industry has faced crises before, but the COVID-19 pandemic is different. It presents a profound opportunity for financial services providers to meet the new needs of consumers, the majority of whom are worried about their future and desire guidance from their financial institutions.

Offering more holistic services matched to the current market reality is critical. On-point creative messaging and reimagined customer experiences, including seamless digital options, are two of the strongest levers at financial brands’ disposal.

Proactively offering consumers financial guidance will be just as vital. The spike in reported financial planning suggests consumers may need advice on a variety of matters, including refinancing, getting lines of credit, taking out home equity loans, deciding whether to take money out of retirement funds, and more.

Current providers who are meeting these needs, and communicating in an honest, clear and empathetic manner, will be more likely to emerge from the crisis stronger, having forged deeper customer relationships and enhanced their brand in the minds of consumers.

The opposite is also true. Financial services providers who do not rise to occasion risk not only losing customers to rivals who are better adapting to the new marketplace but also risk doing long-term damage to their brand.

Learn more

Contact Kantar today for more information on these findings and to learn how we can help you better understand your consumers during this unprecedented time and build lasting customer relationships.