One of the sectors that has been hit hardest by the COVID-19 pandemic is travel, which has seen unprecedented declines since this spring. Complicating matters, there has been a resurgence in the virus over the summer, prompting some states to close again, including key travel destinations like Florida and California. And although such developments almost certainly diminish the chance of a quick recovery for the travel industry, Kantar data on consumer travel attitudes and behavior offers brands some positive indicators moving forward.

Online travel activity is rising

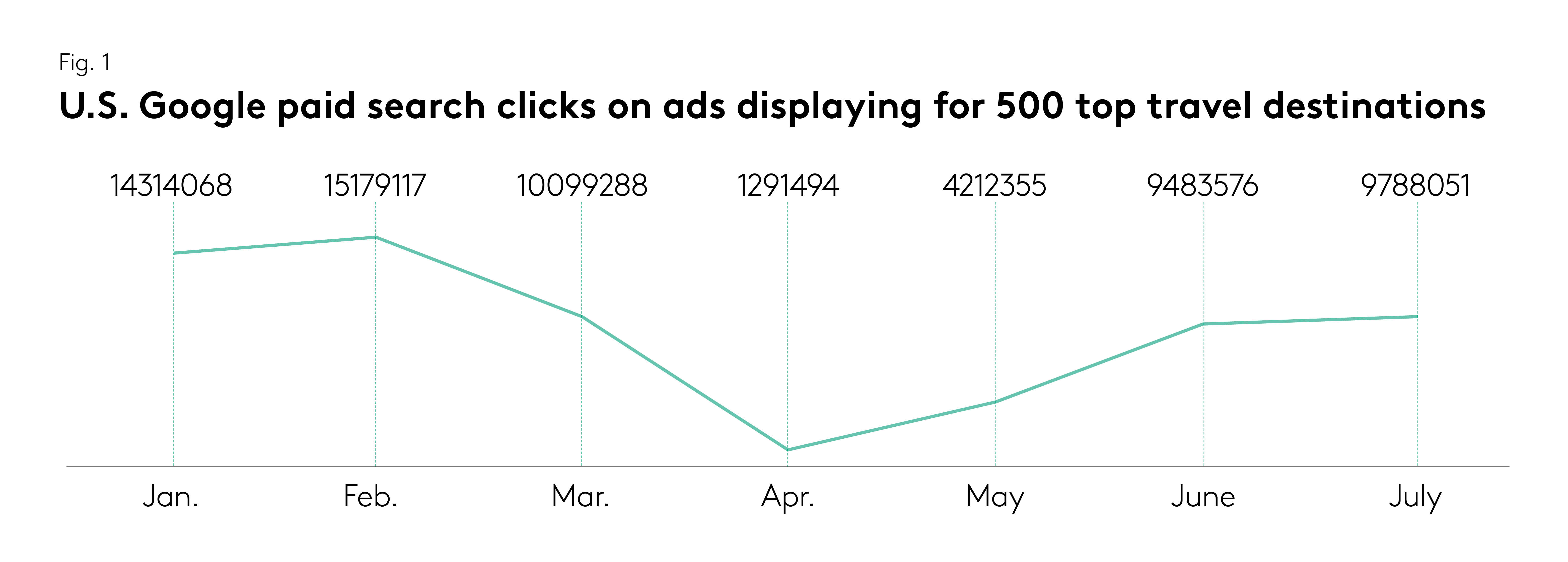

Consumer clicks on paid search travel ads have skyrocketed since bottoming out in April—a strong indication that increasing numbers of U.S. consumers are actively making travel plans. In our analysis of consumer activity on 500 top travel destination keywords, Kantar found that travel clicks shot up more than 800% from April through July, jumping 24% last month even amid the widespread resurgence of the virus.

Travel planners less concerned with Coronavirus?

Consumers currently making travel plans may not be especially concerned about coronavirus. Despite its current status as the world ‘epicenter’ of the pandemic, Florida was the top travel destination by paid search clicks from July 1-27, garnering 21.5% of total clicks on ads displaying for the 500 travel destination keywords. The next most popular destination was another virus hot spot, Las Vegas, which gained 15% of total clicks.

Profile of today’s traveler

So who are these intrepid would-be travelers? An ongoing Kantar study of U.S. consumer attitudes and behavior during the pandemic sheds some light.

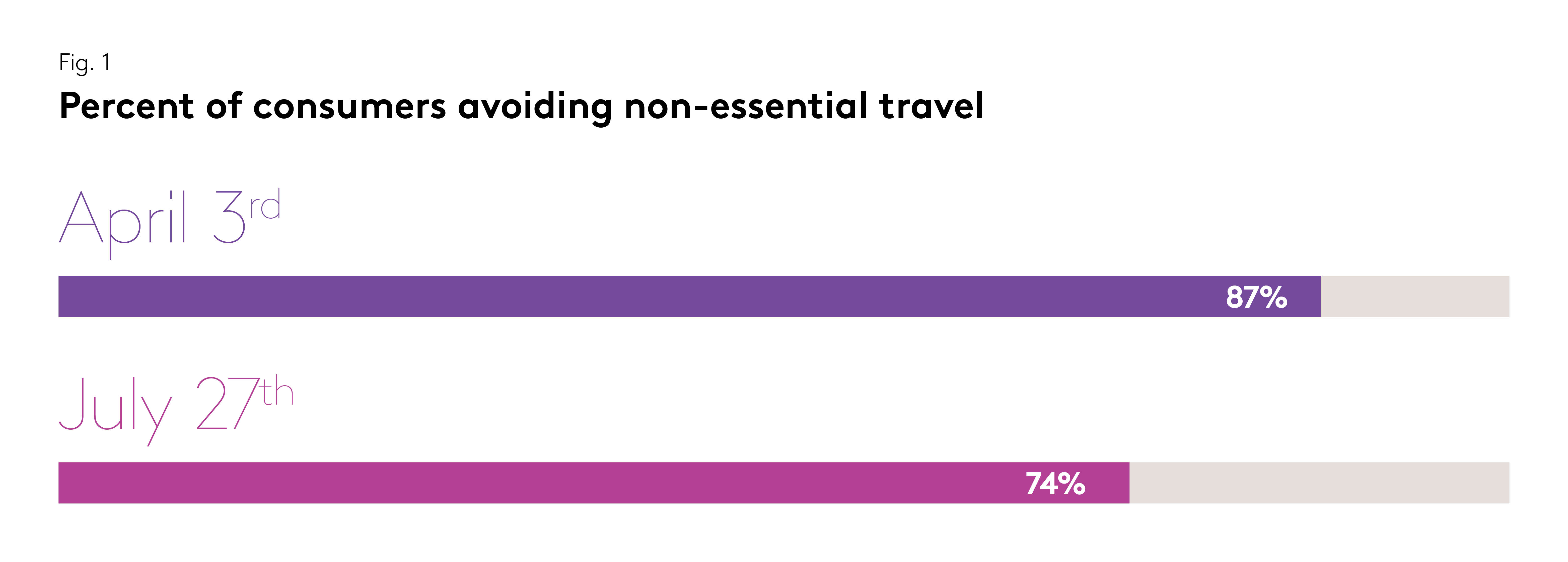

Across all groups, avoidance of non-essential travel is softening, though still fairly pervasive; in the week of July 27, 74% of consumers reported they are more likely to avoid non-essential travel compared to 87% the week of April 3.

Of those who are willing to engage in non-essential travel, they are more likely to be younger, male, have a lower household income, and, perhaps surprisingly, live in a household with children.

The most eager group to travel is not younger adults, however, but 45- to 54-year old men, 33% of whom expressed a willingness to travel “as soon as possible” compared to 19% of the general population.

Look beyond recovery

Travel companies need to engage willing travelers now to drive immediate revenue. Understanding which consumer segments to target is an important step. However, travel providers must also look to the future, beyond short-term recovery, to develop their brand for leadership into the next normal.

Customer experience is key. Consumers know that multiple airlines and cruise lines share the same respective destinations, and there are usually a multitude of hotels in any given location. To stand out and build brand loyalty, travel companies must deliver a superior customer experience that both caters to consumers’ needs and exceeds their expectations.

Listening to consumers

Understanding consumers’ changing attitudes, needs and behavior, as well as the underlying market trends that are shaping them is vital. Moreover, travel companies must also have an in-depth grasp of their customer relationships throughout the customer journey, which will enable them to better position their brand, excel in the moments that matter most to their customers, and invest in the right areas.

Ultimately, looking beyond the recovery and listening to consumers will enable travel brands to both drive growth in the short term and capture a larger share of what may be a reduced pie for some time to come.