At the beginning of the COVID-19 pandemic, our local supermarket only had own-brand pasta sauce in stock. We bought some, ate it with pasta and, while I couldn’t really tell the difference, my wife insisted I never buy that brand again. We were able to purchase our favorite brand on our next purchase, and we continue to do so.

“Repeat purchase” (as in the pasta sauce example) comes from consumers who will seek your brand out; they like it and will continue to buy it.

On the other hand, “advertising retention” is when potential customers remember past advertising, and buy the brand when they are in the market to do so.

“Repeat purchase” and “advertising retention” play a crucial part in understanding the long-term effects of advertising.

We know advertising drives sales in both the short and long term. While short-term sales are relatively easy to measure, quantifying long-term sales is trickier. There are numerous reasons for this: advertising memory can last for years, for example, so an ad could be leading to sales for decades after your campaign finished. But a big problem is not including brand equity as part of your analysis. Of course, the relationship between brand equity and sales is complex.

We have seen from work we’ve done at Kantar that brand equity metrics are a great surrogate for understanding and quantifying long-term sales driven by advertising.

We have seen four scenarios emerge in this association between brand equity and sales:

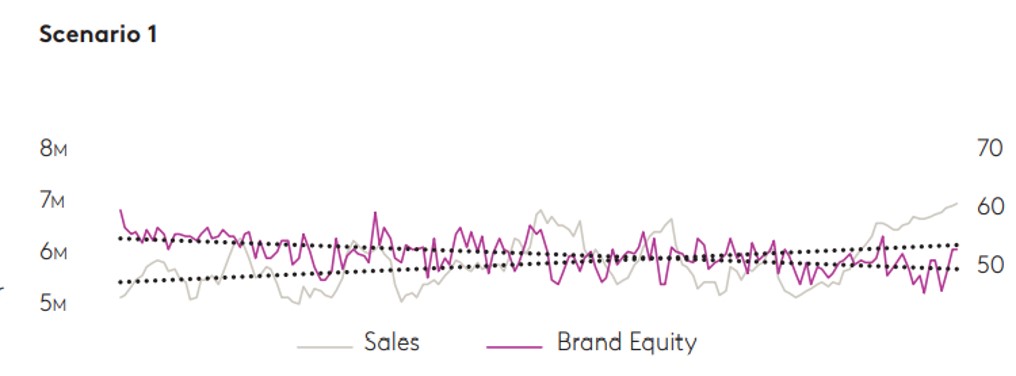

- Scenario 1: When sales are increasing, and brand equity is declining

- Scenario 2: When sales are decreasing, and brand equity is increasing or flat

- Scenario 3: When both sales and equity are increasing

- Scenario 4: When both sales and equity are declining

While 3 and 4 are more common (and will be covered in subsequent articles), in this article I am going to look at Scenario 1: when sales are increasing, and brand equity is declining. This occurs more often than you might think, and it’s a phenomenon we’ve seen more recently.

Two possible reasons for this are:

1. Your brand is in a growing category

Brands could see an increase in sales as the category itself grows. They are “riding the wave”. The hard seltzer category in the US is a great example of this: it has grown in double digits since 2018 and it continues to do. Almost all brands in the category have seen a growth in sales, but only a few have seen a positive affinity towards their brands, and some even show a decline when it comes to key brand attributes. Category growth provides weaker brands a tremendous opportunity to develop brand-building communication to generate long-term sales.

2. Your brand is trying to drive short-term sales via sales activation

Sales activation or promotional activity will no doubt increase sales in the short term but could have a damaging effect on your brand equity. Sales activation in itself is not a bad thing: it could be a great way to recruit new buyers, as long as it’s not done too frequently. Promotional tactics often tend to appeal to existing buyers, who now enjoy the benefit of obtaining their regular brand at a lower price.

Case Study:

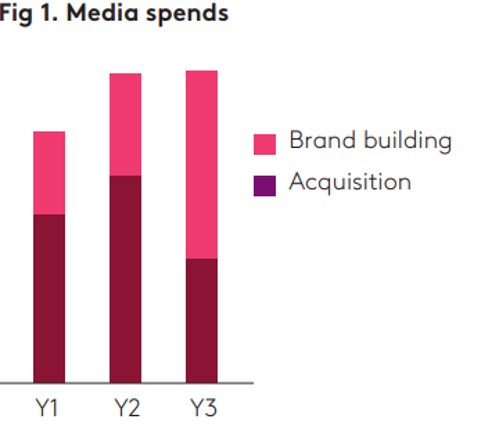

We recently did some work with a financial services provider who saw 22% growth in the opening of investment accounts. They were spending on brand building vs. acquisition-based advertising in the ratio of 1:3 (Fig.1, year 1). From the modelling work we conducted, we saw growth was mainly attributed to a higher interest rate being offered to prospects during the first six months after signing up, and the advertising to communicate that message.

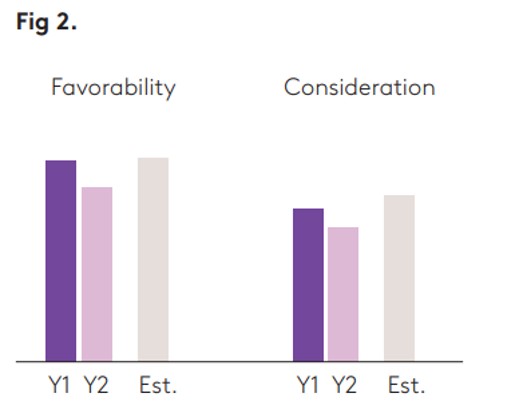

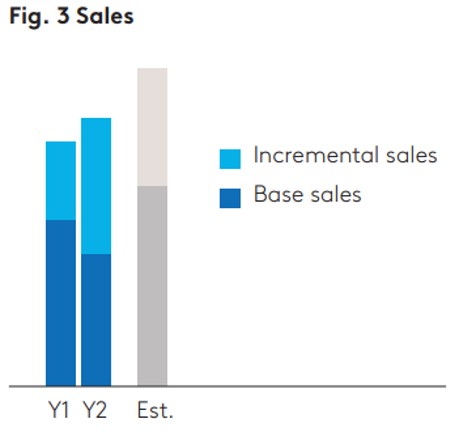

We saw two other things: there was a decline in brand favorability and consideration (Fig. 2) as well as a subsequent decline in their base sales (or sales that come from customers who are predisposed to buy from your brand) and a much higher short- term sales contribution compared to long term (75% in the short-term vs. 25% in the long-term in Fig. 3.)

This told us two things:

- It was unlikely the promotional offer was changing peoples’ perceptions of the brand

- They seemed to have actually been dissuading customers who would have come to them anyway.

As part of our broader recommendations we suggested they increase spend on brand-building activity by 70%, establishing a ratio of 2:1 in favor of brand building. This would, as we had simulated:

- Reverse the trend around brand equity metrics (3% points growth in consideration)

- Increase short-term sales by 15%

- Increase long-term sales by 60%

Marketers should be concerned if sales are increasing and brand equity is declining. The sales increase may give a false sense that all is well and may set the brand up for long-term failure. But this scenario does provide an opportunity for brands to drive long-term effects, knowing that long-term effects are generated differently to short-term effects… and that long-term activity tends to generate short-term effects, but the reverse may not always be true.

In the next article, we will focus on the scenario where sales are decreasing and brand equity is increasing or flat, offering reasons for why that could be happening, case examples, and possible ways to overcome this.