It's no secret that the American Medical Association isn't a huge fan of direct-to-consumer pharmaceutical advertising. But that hasn’t stopped pharma marketers from continuing to invest in promoting their brands. Indeed, pharma is currently the 7th largest ad category in the U.S. as ranked by total spending which reached $6.4 billion last year – a growth of 64% since 2012.

Pharma budgets are growing

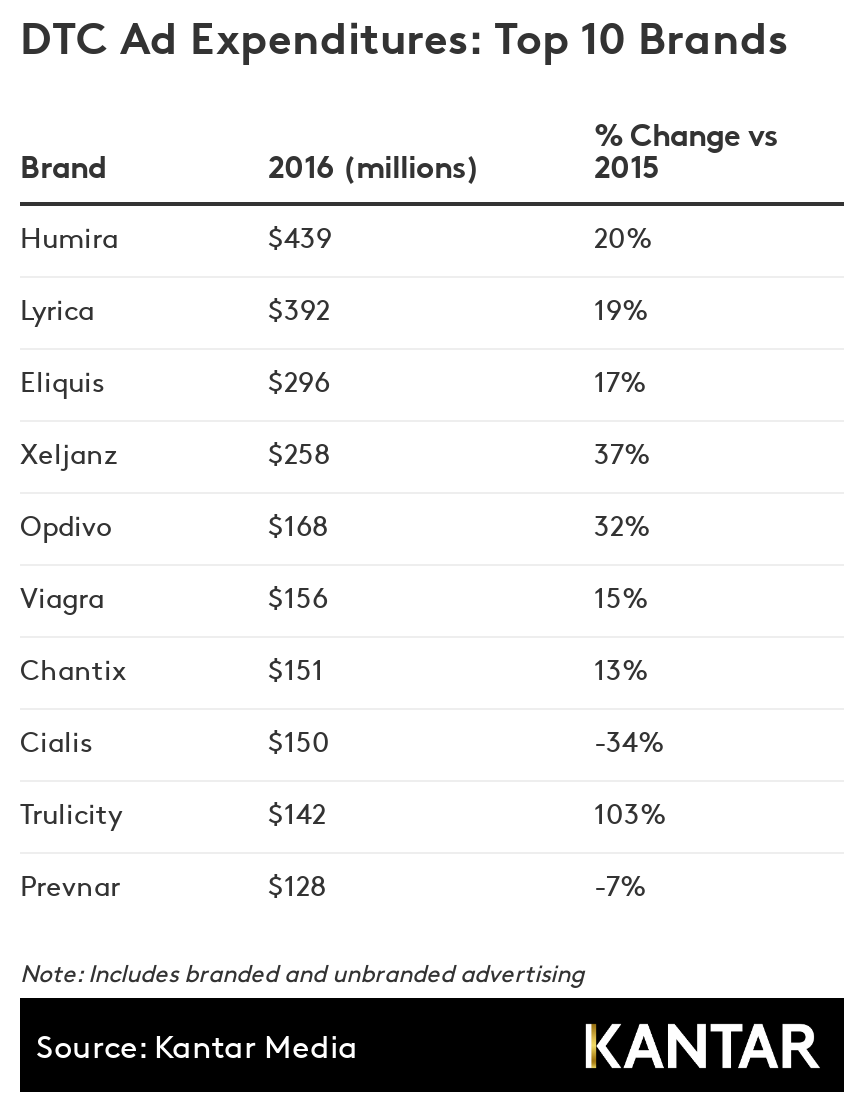

This surge in category expenditures reflects larger budgets from a multitude of drug manufacturers. The number of brands spending at least $50 million annually, as well as the number of brands spending over $100 million, have both more than doubled since 2012. Looking at the top 10 prescription drug brands ranked by 2016 ad investments, eight had double-digit growth rates year-over-year and all of them spent over $100 million.

New RX approvals fuel spend

Another catalyst for category growth has been well-funded marketing launches for new Rx approvals. During the past several years stepped-up R&D by major pharma companies has filled the product pipeline with new drug treatments, many of which have promising sales potential and have been commensurately supported by DTC advertising.

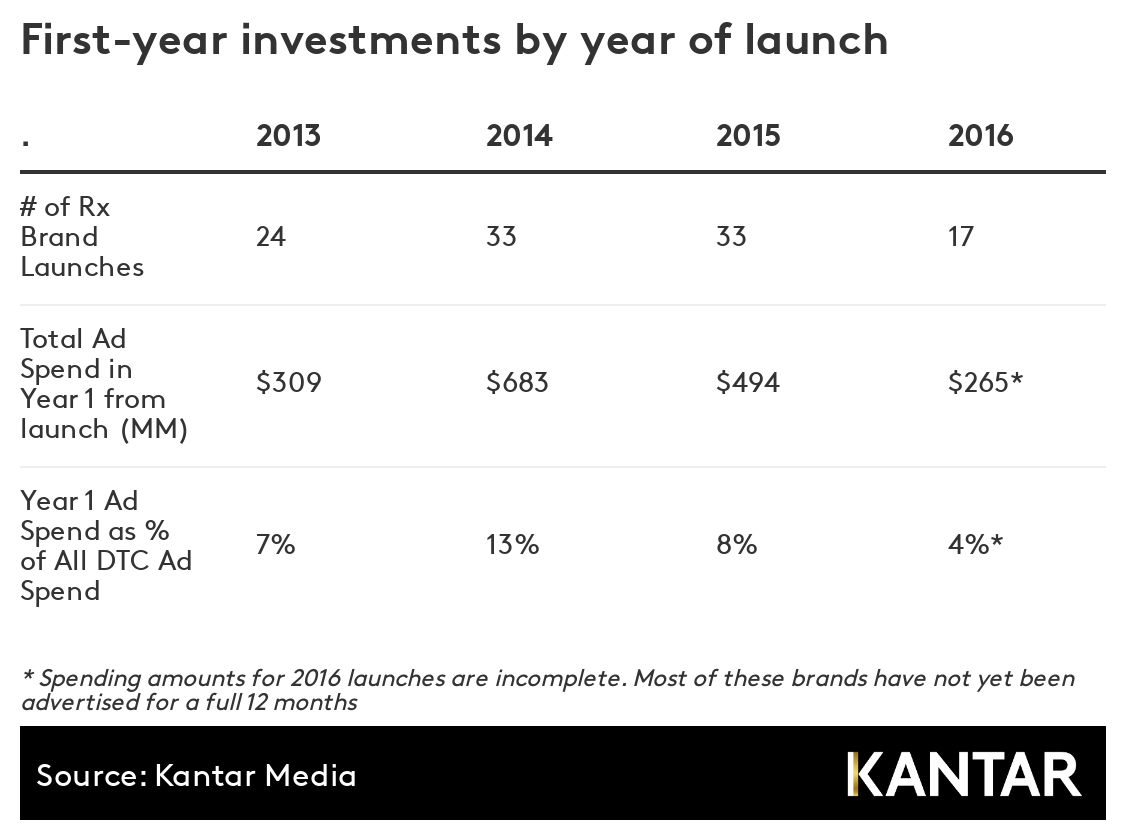

Using our comprehensive ad monitoring database we pinpointed the start date of advertising for every new Rx introduction since 2013 and tabulated expenditures over their first 12 months. The first-year investments made by newcomers have accounted for as much as 13% of total category spending.

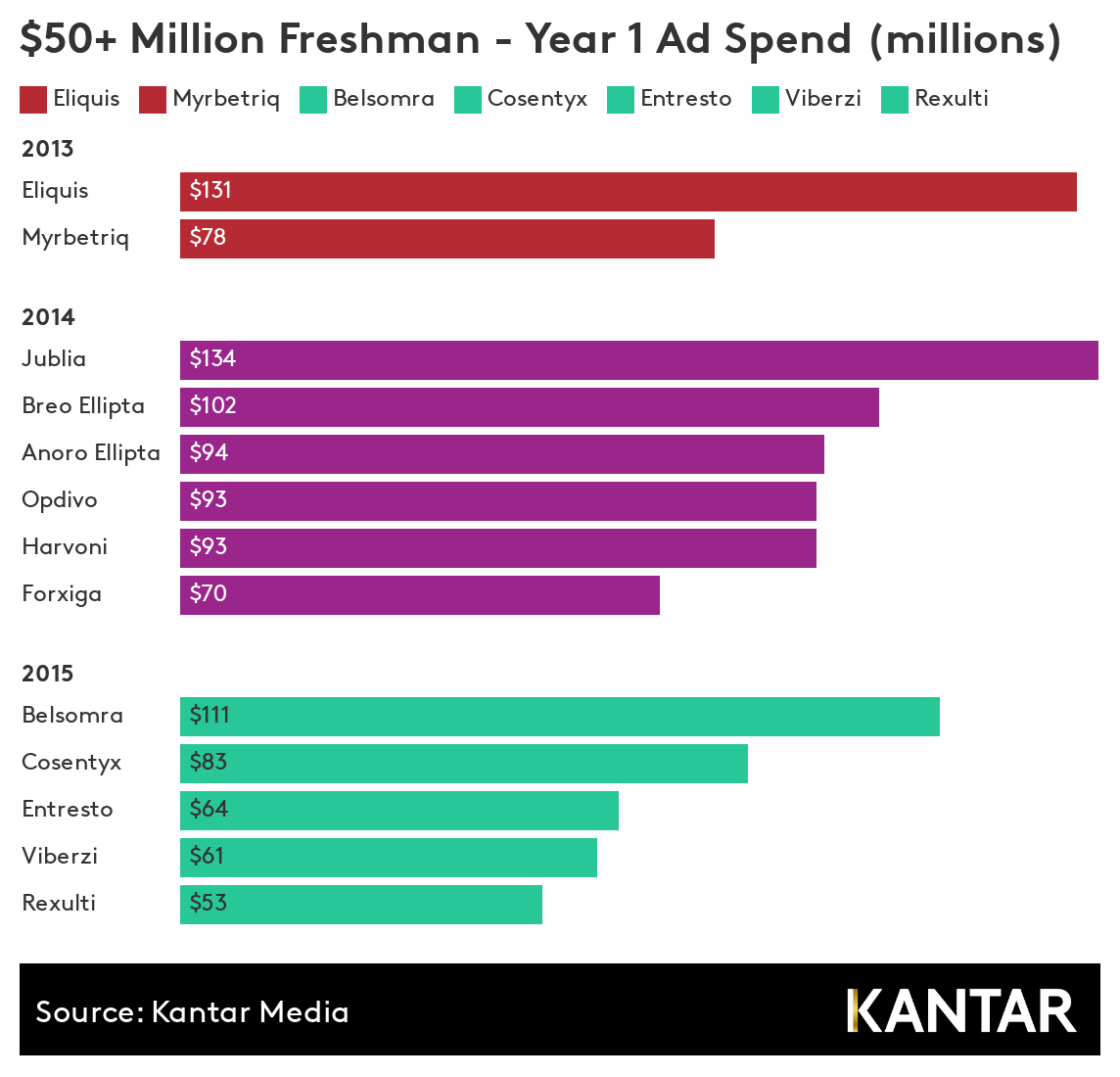

Looking back at the freshmen classes of 2013 thru 2015, the chart below details brands which spent $50 million or more on advertising in their first year from launch. New introductions during 2016 are still accruing their first-year spend but four brands are pacing to exceed the $50 million threshold – Bridion, Kybella, Taltz and Xiidra.

Despite their big ad budgets, some of these drugs are targeted at very narrow consumer groups. For example, when Opdivo was launched in 2014 its FDA approval was for a lung cancer condition with a patient population of fewer than 200,000 people. Yet the sales revenue potential for the drug (aided by a six-figure price per patient) justified an estimated $93 million of ad spending during its first year. This was based in part on the expectation of imminent approvals for additional indications that would enlarge the patient pool.

Can ad spend growth be maintained?

As the past few years have demonstrated, a diverse and well-stocked pipeline of new prescription drug treatments coming onto the market has a cascading impact on DTC advertising expenditures. Incremental spending is generated from new product launches which in turn can prompt competitors to raise their investments in defense of market share. More competition also provides an impetus for brands to sustain these higher spending levels over time.

There are a number of business issues that could affect future marketing budgets. For example:

- The pace of marketing launches is difficult to forecast because it takes several years for a pharma company to complete the cycle of research, development, clinical trials and FDA approval.

- The rising cost of prescription drugs is a public policy issue and might lead to actions that impact the revenue stream which funds consumer marketing budgets.

- Changes to the drug insurance marketplace could affect consumer demand and use of prescription medications.

Taking all of these factors into account, it remains to be seen whether or not the growth of DTC advertising that we’ve experienced from 2012-2016 can be sustained.